2023 Fall Economic Statement: Outrunning the Hard Rain

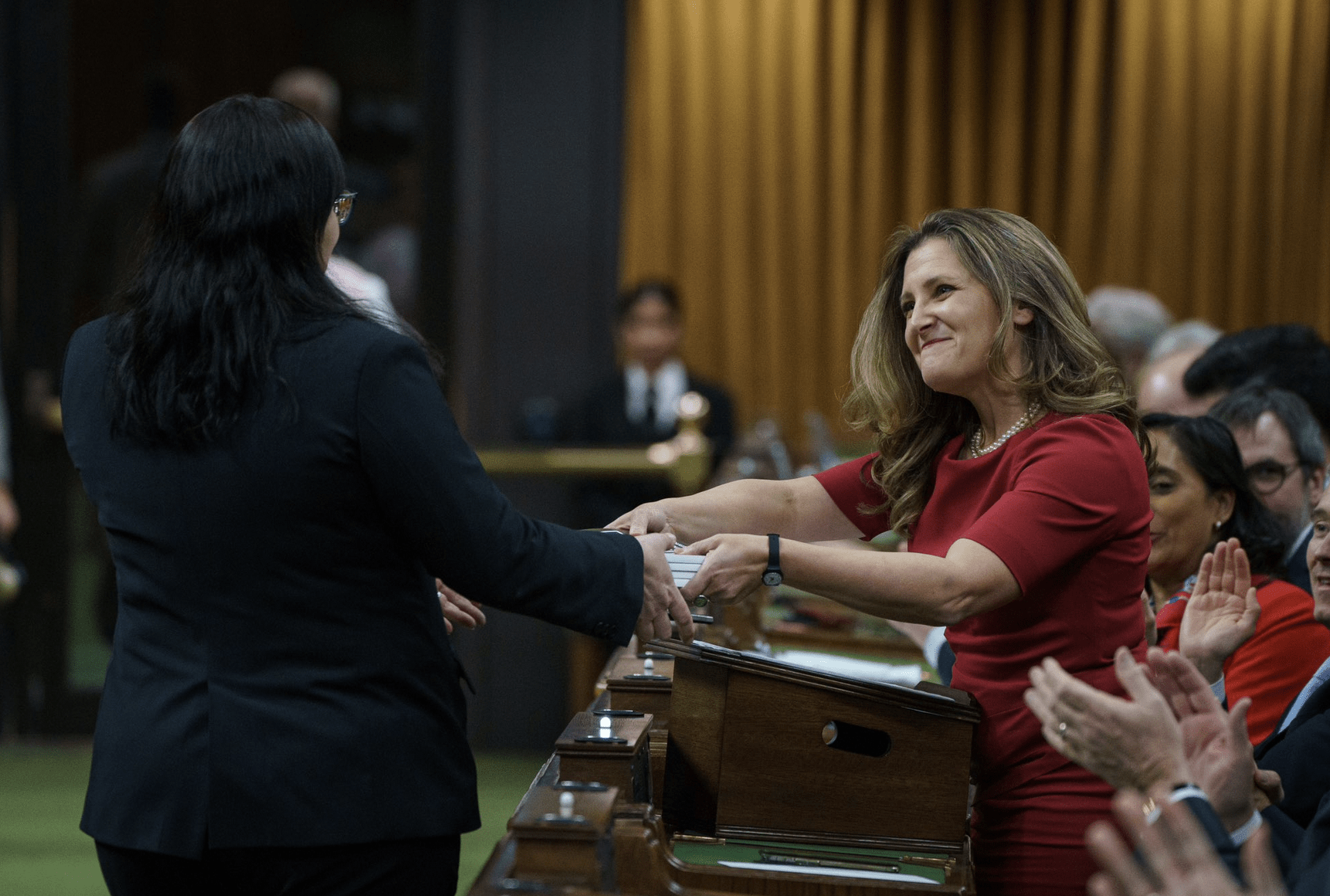

Chrystia Freeland tabling the 2023 Fall Economic Statement on November 21/Adam Scotti photo

Chrystia Freeland tabling the 2023 Fall Economic Statement on November 21/Adam Scotti photo

By Kevin Page

November 21, 2023

Deputy Prime Minister and Finance Minister Chrystia Freeland tabled the 2023 Fall Economic Statement in Parliament on November 21st. Contrary to some catchy characterizations, it is most definitely an economic statement, not a mini budget. There are few new announcements of fiscal significance. Times are tough. The economy is not growing and unemployment is rising. Expect more of the same in 2024. Freeland is also telling Parliament and Canadians that the government is doing a lot to address affordability and housing supply shortages, even if it feels like they are falling short.

But the fiscal plan is caught between a rock and a hard place.

Traditionally, when governments face economic slowdowns, ministers of Finance will allow the deficit to grow. A loosening of the belt is considered prudent (P.S., many observers do not think the Liberal government has a belt in its wardrobe). A weaker economy means fewer- than-expected revenues and more spending for employment insurance. Conceptually, fiscal restraint in a slowing economy can make things worse. We want governments to stabilize unstable economies. Times are changing. Hell, times are already worse. Call it inflation and the need to lower high interest rates before a soft landing for the economy gets hard.

The government has found a new commitment to hold the line on budgetary deficits over the short-term horizon. This should make the job of the Bank of Canada to lower the inflation rate back towards 2 percent easier, not harder. This increases the likelihood of lower interest rates in the future. Monetary policy is tight. The brakes are on. High interest rates (policy interest rates at 5 percent with the CPI inflation rate at 3.1 percent) and slower money supply growth have put consumption and investment into the skid zone. Now is not the time to deficit finance short-term consumption or longer term new social programs like single payer universal pharmacare. Canadians are paying a high price to lower inflation.

Economic statements are about strategy and numbers. Sometimes they are aligned, sometimes not.

Freeland says the government has an economic plan. Grow the green economy. Make social investments. The minister says “our plan is working”. Parliament, experts and the media will debate this conclusion. The economic outlook has real GDP growing 1.1 percent in 2023 and 0.4 percent in 2024. This is a very weak outlook for a rapidly growing population. It is a hard sell for the plan.

The Economic Statement highlights $50 billion in previously announced multi-year commitments to increase housing supply, including $4 billion for the Housing Accelerator Fund; $25 billion in low-cost financing for new rental homes; $4 billion for a Rapid Housing Initiative and almost $7 billion for First Nations. Make no mistake, this is an enormous commitment.

Debt has a way of catching up. To use the diet metaphor; a moment on the fiscal lips, a lifetime on the economic hips.

The Statement adds to the tally with new spending to support cooperative housing, apartment construction and the removal of GST for new rental housing (previously announced). There are also non-fiscal commitments regarding a mortgage charter, labour mobility, repurposing federal lands, and helping international students. When times are tight, progress can be made without opening wallets.

The first Catch 22? Notwithstanding significant commitments on housing, real (after inflation) residential investment is down. It is hard to go against the market. High interest rates and high prices are hurting supply and demand. Housing supply in a growing population is a long-term problem even after we correct market fundamentals. Housing is going to be a big platform issue in the next election.

The government is arguing that it has practically emptied the bank account (my words) to make life more affordable for Canadians. The list of initiatives is very long: tax cuts; early learning and child care; enhancements for seniors; increases to the GST credit; grocery rebate; quarterly Canada Workers Benefit increases; help for students and renters; a new dental benefit. The Statement adds to the fiscal cost with new incentives for the purchase of heat pumps.

The second Catch 22? Notwithstanding significant fiscal commitments, household balance sheets (net savings) have deteriorated for Canadians in the lower four quintiles of income distribution. Again, it is hard to go against the market. Higher food and energy prices, largely set in the global marketplace, have squeezed hard. Mortgage interest costs are the new significant driver hurting affordability. The prime minister’s approval ratings have sunk as prices have risen. The same is true for political leaders of other G7 countries.

The Economic Statement projects a budgetary deficit of $40 billion — the same number as in Budget 2023. A number worth noting. It is up modestly from $35 billion for 2022-23 which came in lower-than- projected thanks largely to higher-than-anticipated income tax revenues. By most accounts, it is a modest deficit equivalent to about 1.4 percent of GDP. That’s much smaller than deficits recorded in other G7 countries and very much in line with deficits recorded by the Conservative government in the years following the 2008 global financial crisis.

But the outlook is tarnishing the government’s narrative around its own fiscal rule – a declining debt-to-GDP ratio. Weak economic outlooks do this. The debt-to-GDP ratio rises from 42.4 percent in 2022 to 43.5 percent in 2023-24 and then is projected to fall to about 39 percent before the end of the decade. These are debt ratios that are much elevated relative to pre-COVID times (around 30 percent). It was very expensive to backstop the Canadian economy when COVID hit and a vaccine was being developed. The government got more favourable polling ratings in 2020-21. Less so now.

Higher debt and higher interest rates mean higher debt charges. Public debt charges will rise from $35 billion in 2022-23 to $46.5 billion in 2023-24. They are projected to rise to more than $60 billion by the end of the decade. The annual increment in debt charges is close to what the government currently spends on national defence. Debt has a way of catching up. To use the diet metaphor; a moment on the fiscal lips, a lifetime on the economic hips.

Freeland wrote the foreword for the Fall Economic Statement. It is a tough statement from a strategy-and-numbers perspective. It reminds me of the famous Bob Dylan song A Hard Rain’s A-Gonna Fall. In the song, the narrator will not get broken by bleak outlook. “Canada is not and has never been broken,” Freeland says in the foreword. What will the afterword say in the years ahead? Maybe we will get a better idea in Budget 2024.

Kevin Page is the President of the Institute of Fiscal Studies and Democracy at the University of Ottawa, former Parliamentary Budget Officer and a Contributing Writer for Policy Magazine.