A Political Economy Perspective on Policy, Numbers and Risks

Kevin Page with Alex Eikre and Zhihan Li

Deputy Prime Minister and Finance Minister Chrystia Freeland tabled Budget 2023 in the House of Commons on March 28. With due regard to high inflation and interest rates and gloomy prospects for economic growth in 2023, Freeland tabled a fiscally modest budget focused on affordability, health and energy transition. Post-budget reaction has been mixed, and mixed is good enough in the current political environment.

Given geopolitical uncertainty and downside economic risks on the short-term horizon, the government needs to be prepared for policy adjustments before the ink dries on the Budget 2023 implementation act.

The central strategic challenge for Budget 2023 was finding balance. Not the usual budgetary balance – but economic, political and policy balance. Finding strategic balance means compromise. It is said that compromise promotes harmony (but not happiness). Harmony is important in politics.

As quotations through history – from “When the people go hungry, governments topple,” to “It’s the economy, stupid” — attest, economics affects politics. Today, high inflation and interest rates are straining household balance sheets. Budgetary deficits need to be restrained to support monetary policy efforts to lower inflation and inflationary expectations. The global energy transition has started. Canada cannot afford to lose competitive ground in the investment drive to cleaner economies.

And, politics affects the economy. The government needed to address pressure from the provinces and territories to strengthen health care in the wake of the global pandemic. Health care is a top policy priority for Canadians. To remain in power, the Liberal government needed to address priorities shared with the NDP.

Freeland set four priorities for this Budget. Four benchmarks to measure its success:

- Targeted inflation relief for the Canadians who need it most.

- New money for public health care, including dental care.

- Investments to build Canada’s clean economy.

- A responsible fiscal plan.

By this scorecard, Freeland gets a passing grade.

The priorities were crafted to balance economic and political interests. They received general support.

For vulnerable people grappling with affordability challenges, there is a one-time increase in the goods and services tax (GST) credit ($2.5 billion); enhanced student financial assistance ($700 million); additional resources for housing for First Nations ($1.9 billion) and a range of “make-life-easier” measures (e.g., junk fees, predatory lending, credit card transaction fees, common chargers for devices, automatic tax filing). The make-life-easier measures were a creative and popular addition to the budget.

The biggest spending outlays in Budget 2023 go to health ($23.4 billion) and dental care ($7.3 billion). The increased health care spending largely goes to a top- up of the Canada Health Transfer. There is a range of complementary initiatives (e.g., mental health, reproductive care, opioids, personal support, rural care, data). Increased funding for dental care is an expansion on the Budget 2022 initiative and will provide dental coverage for uninsured Canadians with annual family income of less than $90,000. Health Canada is tasked with the difficult challenge of implementation by the end of 2023.

The part of the budget that likely received the most policy focus to-date were three new tax credits to support energy transition investments starting in 2024 – clean electricity ($7.4 billion), clean technology manufacturing ($4.5 billion); and clean hydrogen ($5.6 billion). These new initiatives were complemented with a range of smaller spending increases to support workers, transportation, sector adjustment, and research. Significant funds remain available for energy transition in the years ahead through the Canada Growth Fund ($15 billion) and Canada Infrastructure Bank ($20 billion).

About $9 billion over the next five years was allocated to a number of initiatives to support reconciliation, inclusion and a healthy environment.

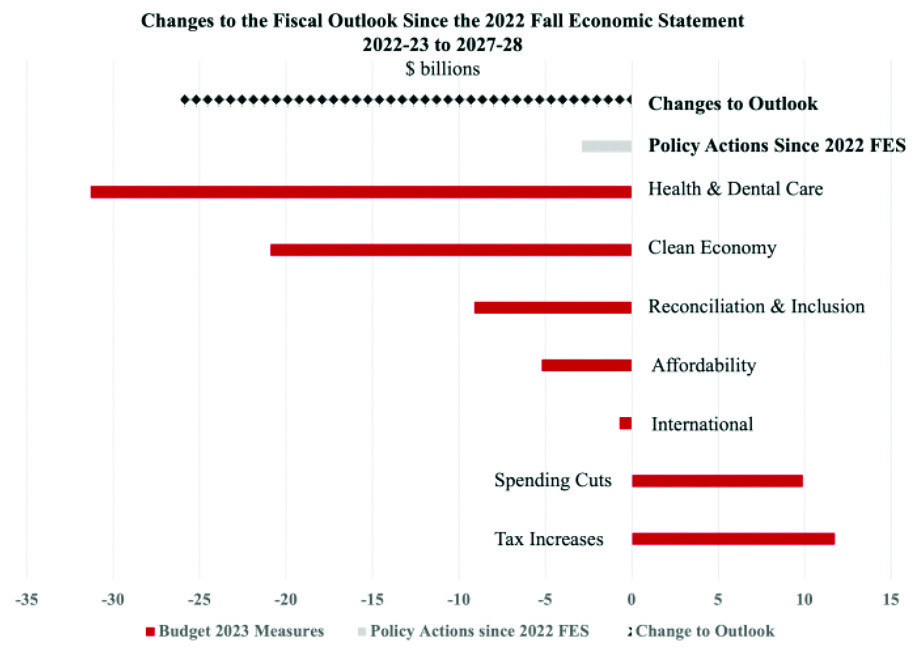

To offset the fiscal impact of the new spending and tax credit initiatives, the government plans to restrain program spending by $12.8 billion on a net basis over the next five years ($21.8 billion including the Budget 2022 commitments). It represents about $6 billion of annual restraint on a base of operation spending of about $130 billion. Additional tax revenues total $11.6 billion over the next five years come from measures to ensure that minimum level taxes are paid by wealthier people and global corporations and a measure to tax dividends differently as received by financial institutions.

The political reaction to Budget 2023 was mixed. The NDP took political credit for measures related to dental care, increase to the GST credit and provisions related to labour requirements on the new clean electricity tax credit. The Conservatives refused to support the budget because of deficit spending. The Bloc Québécois refused to support the budget because it did not further increase health care spending. The Green Party supported some measures (i.e., affordability, First Nations) but argued the budget did not go far enough on many fronts, including the environment, health and support for disabled people.

The political reaction to Budget 2023 was mixed. The NDP took political credit for measures related to dental care, increase to the GST credit and provisions related to labour requirements on the new clean electricity tax credit.

The Budget 2023 medium-term deficit and debt track is modestly higher than the 2022 Fall Economic Statement. The economic outlook is weaker in 2023 and short-term interest rates are higher. Growth in real gross domestic product (GDP) falls from 3.4 percent in 2022 to just 0.3 percent in 2023. Weaker growth means less revenues. There is about $43 billion in net new spending across the priority areas after planned savings in spending and increases in revenues.

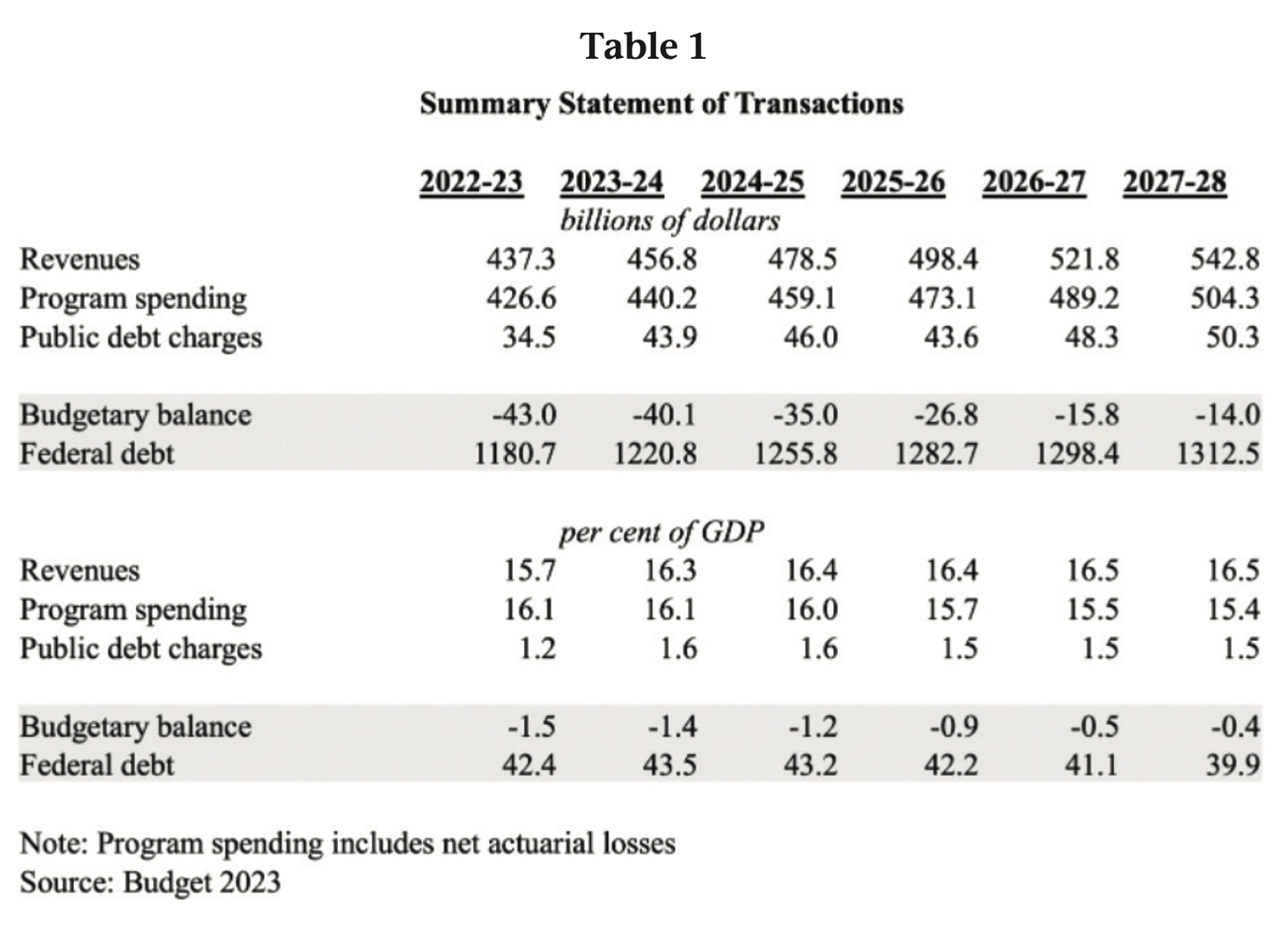

Table 1 indicates that the projected budgetary deficit falls modestly in the years ahead. It hovers in the $40 billion range, which is about 1.5 percent of GDP. This is a modest deficit compared to the deficit incurred during COVID ($328 billion, 14.9 percent of GDP in 2020-21) and modest compared to deficits projected in the US and UK (5 to 6 percent range of GDP). The debt-to-GDP ratio rises modestly in 2023-24 reflecting the slowdown in economic growth and new measures and then falls over the medium-term. A declining debt-to-GDP ratio is the government’s fiscal rule.

Table 1 indicates that the projected budgetary deficit falls modestly in the years ahead. It hovers in the $40 billion range, which is about 1.5 percent of GDP. This is a modest deficit compared to the deficit incurred during COVID ($328 billion, 14.9 percent of GDP in 2020-21) and modest compared to deficits projected in the US and UK (5 to 6 percent range of GDP). The debt-to-GDP ratio rises modestly in 2023-24 reflecting the slowdown in economic growth and new measures and then falls over the medium-term. A declining debt-to-GDP ratio is the government’s fiscal rule.

Over the long-term horizon, both Finance and the Parliamentary Budget Office analysis indicate that the current federal fiscal structure is fiscally sustainable – debt will not increase relative to GDP in the face of aging demographics.

Freeland’s claim that Budget 2023 is fiscally responsible is based on the relatively low deficit and debt numbers compared to other OECD countries. This is true.

One could go further and make the assertion that Budget 2023 is fiscally responsible because it holds the line on the deficit in a high inflation and slowing economy environment. Over the long-term horizon, both Finance and the Parliamentary Budget Office analysis indicate that the current federal fiscal structure is fiscally sustainable – debt will not increase relative to GDP in the face of aging demographics.

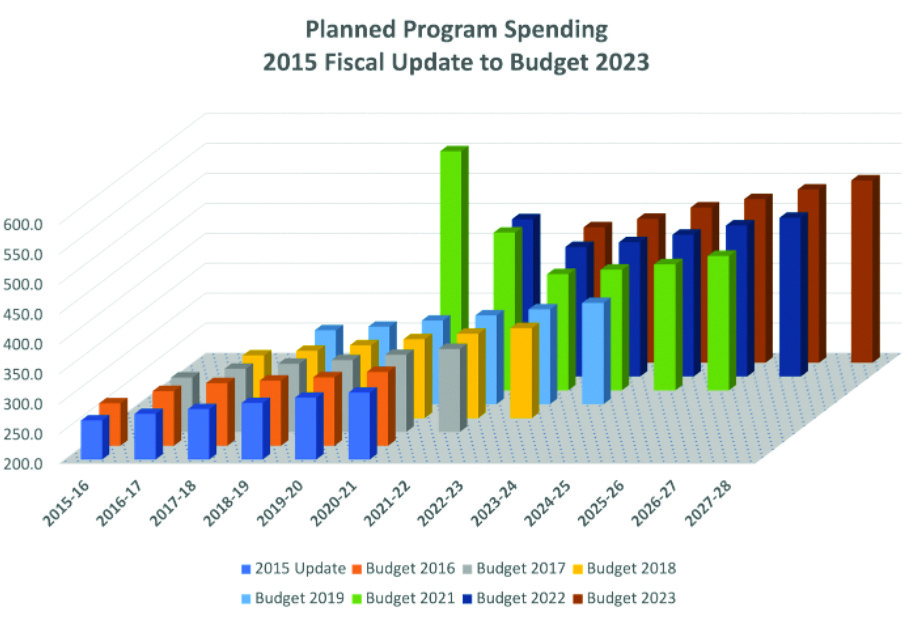

The critique and concern about fiscal responsibility and the Liberal government is their penchant for deficit spending. Chart 2 illustrates the consistent increases in program spending from budget to budget.

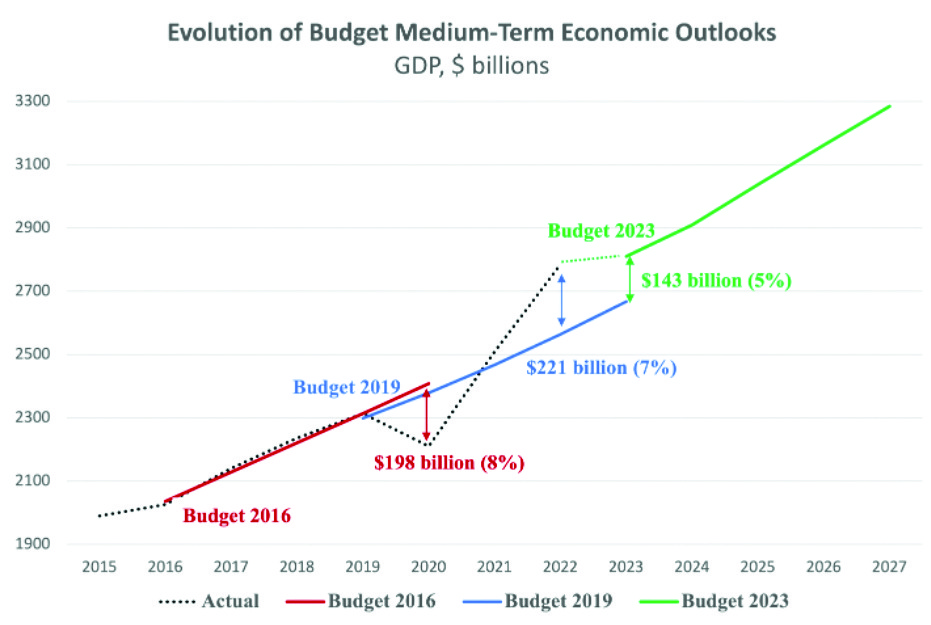

Chart 3 illustrates that the stronger-than-anticipated economic recovery from COVID created a fiscal dividend for the federal government. More GDP in the outlook means more revenue.

Notwithstanding prospects for a growth slowdown in 2023 due largely to monetary policy tightening (i.e., higher policy rates; restrained growth in money supply), the government has the opportunity to strengthen its fiscal planning framework. Fiscal buffers (or reserves) could be imbedded in the fiscal plan to help ensure a declining deficit track. Targets could be added to direct program spending to help reinforce the commitment to spending review.

The addition of buffers and targets would be good politics and economics for a Liberal government headed into an election within the next two years. It could help silence the critics on fiscal responsibility and strengthen our standing with bond rating agencies. It would make the younger generation of Canadians feel more confident that governments of their time will have the necessary fiscal room to help households and businesses face global shocks.

Kevin Page is the President of the Institute of Fiscal Studies and Democracy at the University of Ottawa, former Parliamentary Budget Officer and a Contributing Writer for Policy Magazine.

Alex Eikre and Zhihan Li are undergraduate economics students at the University of Ottawa.