And in the End…

By Douglas Porter

December 22, 2023

Markets are ending 2023 on a distinctly upbeat note, with the economy having so far avoided recession, inflation retreating, and visions of rate cuts dancing in our heads. Chair Powell stoked the fires with last week’s mild remarks, but the economic data have been adding fuel as well. A wide variety of indicators this week suggested that U.S. growth is still chugging along, accompanied by some encouraging signs on inflation—even core inflation. As a result, equities are working on a seven-week winning streak, which has lifted the MSCI World Index 18% above end-22 levels (after a 17.4% drop last year). On the flip side, bond yields have cascaded lower in recent weeks, and in many cases falling below levels prevailing at the start of the year—the 10-year Treasury is now basically unchanged on net for 2023. Even venerable gold got into the act, ending with a flourish at a record high of around US$2070.

Gold, of course, was one of the gifts brought by the three Kings, along with frankincense and myrrh. We’re going to update that for 2023 (after all, does anyone even really know what myrrh is—other than what Google tells you?). Here are the three main gifts that financial markets were given this year by the economic backdrop:

1) Better-than-expected growth: While recession calls were rife at the start of 2023, the global economy held up, even if growth was a tad below average. The U.S. especially fared well, with the 4.9% jump in Q3 GDP the exclamation point. This week’s data showed a surprise bounce in November housing starts, a pick-up in homebuilder confidence, a slide in mortgage rates, a big upswing in consumer confidence, low jobless claims, a surge in durable orders, and sturdy income trends. While growth has clearly cooled from the surprising Q3 spurt, we see it holding around 1% or better in Q4 and on average in 2024. Not bad.

Canada’s economy clearly struggled more heavily with the fierce rate hikes of the past two years, but still managed to eke out some growth for all of 2023. GDP was flat in October for the third month in a row, but may just keep its head above the waterline in Q4, with the flash estimate for November pointing to a 0.1% gain. Consumer spending is holding up a bit better than anticipated, as retail sales were a sturdy +0.7% in October (and up a hefty 1.4% in volume terms). A snap-back in auto sales on replenished supplies has added support. Of course, all of Canada’s spending numbers need to be viewed through the lens of raging 3.2% y/y population growth, the fastest since the late 1950s.

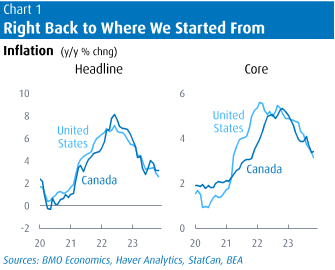

2) Lower inflation: Both the U.S. and Canada produced their key inflation readings for November this week, and there was a certain symmetry in the results (Chart 1). A mild 0.1% rise in the core PCE deflator sliced the annual rate to 3.2%, the lowest since early 2021 (when inflation was merely a twinkle in the Fed’s eye), and down almost 2 points from a year ago. Even better, the 3- and 6-month trends are 2.2% and (just!) 1.9%, respectively. Forget all the subtleties of supercore et al: the Fed’s traditional measure of core has been a snick below target for the past six months. The headline PCE deflator is also a tame 2.6% y/y, and just 2.0% in the past six months. That’s good.

Canada’s main measures are mostly tracking the U.S. trend; a bit higher than the PCE, but a bit lower than the U.S. CPI, at least on core. True, the headline result this week disappointed consensus by holding steady at 3.1% y/y (exactly matching the latest U.S. CPI result). But that’s still way down from 6.8% a year ago, and even underlying inflation has shown solid improvement. True, median prices were steady at 3.4% y/y in November, but again that’s down nearly 2 points from a year ago. And, the short-term trends are a bit better still, with the 3-month pace at 2.3%, and the 6-month at 3.2%.

Looking further afield, even the U.K. posted much milder-than-expected inflation last month. Britain had been the real trouble spot earlier this year on that front, but CPI cooled to a 3.9% y/y clip in November, after starting 2023 in the double digits. Core also relented, but it’s still an issue at 5.1%. The Euro Area confirmed its big pullback in November inflation at 2.4% (and core at 3.6%), while Japan also saw a moderation to 2.8% last month (and 2.5% for core). We will reiterate that Team Transitory can in no way declare victory, since a) it took a monumental hike in interest rates to tame inflation, and b) even with the recent decent results, overall inflation has still been very high—to pick but one example, Euro Area prices have risen 18% in the past three years alone; they didn’t rise that much in the prior 13 years combined.

3) The prospect of lower rates: The calming of headline and core inflation, and some retreat in inflation expectations, are setting the stage for central banks to ease up on restrictive policies. With inflation fading, positive real rates are becoming ever-more positive, and the need for policy rates of 5% or more lessens. And, while growth has held up, it is slowing or buckling in some cases (Britain, the Euro Area, Canada). A bevy of Fed speakers in the past week attempted to curb the enthusiasm for rate cuts, but markets are still circling the March meeting as a very real possibility for the first move. We lean later, but will allow that the latest inflation results have been surprisingly good, and Chair Powell was surprisingly accommodative at his press conference.

The Bank of Canada is still taking a more hawkish line, but Governor Macklem and the deliberations from this month’s meeting both pretty clearly suggested that the Bank is done. Thus, it truly is just a matter of time before rate cuts commence. With growth essentially stalling, the jobless rate backing up steadily, and clear (if erratic) progress on the inflation front, the market is looking for spring rate relief in Canada as well. Not to dampen the seasonal spirit, but we continue to believe that the Bank will err on the side of caution, and keep rates on hold longer than the market expects. After all, the last thing policymakers want to do is underestimate the economy and, thus underlying inflation pressures, and have to painfully reverse course in 2024. Still we officially look for the Bank to cut a step ahead of the Fed, mostly due to a softer domestic economic backdrop.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.