Assessing Canada’s Policy Responses to Trump’s Tariffs

Shutterstock

Shutterstock

By Emaad Samsoodeen and Kevin Page

April 14, 2025

The principal ballot box question for the 2025 federal election is which party leader is best positioned to address Donald Trump’s trade war and threats to Canadian sovereignty. The conflict with the Trump administration has the potential to be a turning point for the Canadian economy. Forecasters are suggesting we brace for an economic recession. Whether or not this happens, one question remains: how do we ensure Canada is more resilient to trade shocks and political threats?

Three policy responses have gained traction during the election campaign: the dismantling of interprovincial trade barriers, the diversification of trade partners, and moving forward on industry strategies, especially for critical minerals. If acted upon wisely, these could usher in an era of economic prosperity. The fear caused by the Trump tariffs could thus be seen as an opportunity to spur long-overdue reform.

Caveat emptor for the electorate; if modern history is a guide, any government promise risks delay and underperforming execution and outcomes.

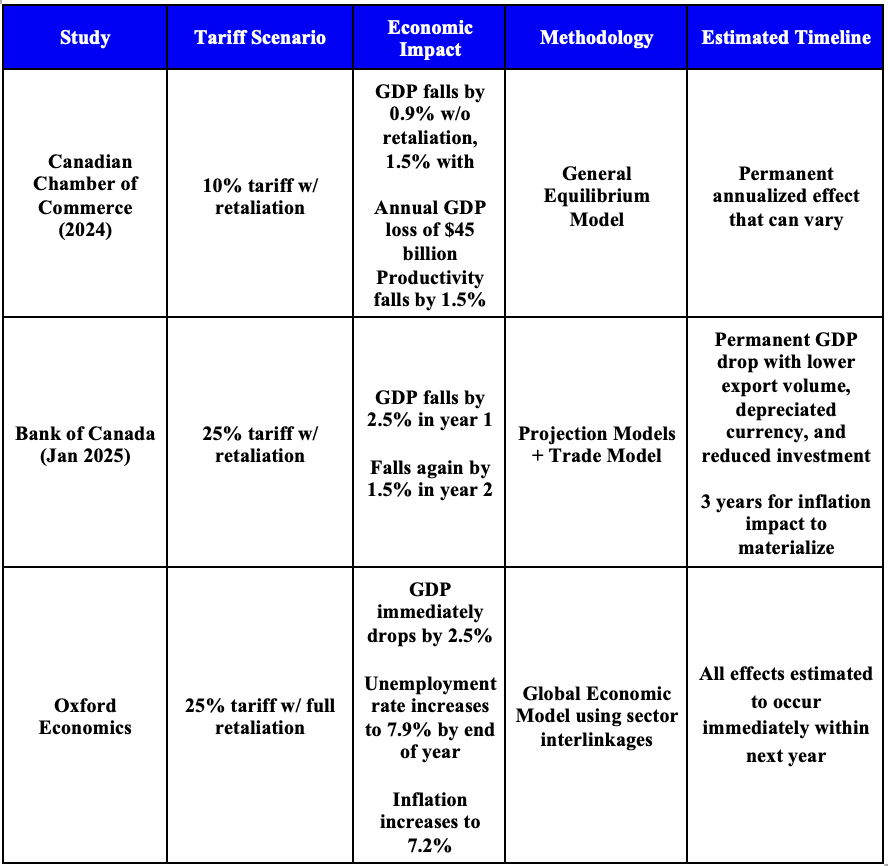

What are the best guesses for the negative economic impacts that the next Canadian government could face because of the ongoing trade war? The table below highlights three recent studies.

Forecasters expect the tariffs to yield an immediate shock negatively impacting export volume, import capacity (strains on supply chains), investment, employment, inflation and the exchange rate. With pre-tariff outlooks assuming real GDP growth of about 1.5 to 2 percent, a 2.5 per cent expected loss would imply a modest recession in 2025.

Could a heated trade war involving the two largest economies (US and China) result in a larger-than-expected (equity and financial) market impact and loss of consumer and business confidence? Yes. The stakes are high.

Could a protracted trade conflict result in lower productivity and standards of living? Yes. Brace for impact.

Interprovincial Trade

To what extent can strengthening east-west (interprovincial) trade help make up anticipated economic losses from less north-south trade? Do the timelines coincide?

Canada’s interprovincial trade barriers — including differences in shipping regulations, credential recognition, and local procurement biases — have long been seen as a burden on the economy. The barriers persist for reasons such as geography, sectoral lobbying, and in Quebec’s case, cultural preservation. Prime Minister Mark Carney met with provinical premiers in March 21st on reducing barriers to interprovincial trade, with the group agreeing to accelerate the process in the face of Trump’s tariffs.

Despite previous efforts such as the Canadian Free Trade Agreement (2017), hundreds of barriers remain, particularly in the sectors of services, energy, and transportation.

A 2019 International Monetary Fund (IMF) study estimated that these trade barriers “impose the equivalent of a 6.9% tariff on goods” – about twice the average import duty for Canada on US goods before the recent trade conflict.

The Table below highlights selected studies on the economic impacts of abolishing interprovincial barriers.

These studies, widely cited by political leaders and policymakers, indicate that the potential positive impacts of eliminating interprovincial trade barriers are significantly larger than the impacts of a time-limited (fingers-crossed) US trade conflict. This is good policy news. What is different are the timelines. Studies on the dismantling of interprovincial trade barriers suggest it will take many years to reap the full benefits. The Trump trade shock hits hard and fast.

The logic is straightforward: harmonized rules cut compliance costs, which increase efficiency, and hence boost productivity. Benefits would proceed to ripple in a cycle of increased spending and job creation.

However, the case isn’t 100% airtight. There are economists who do not believe that the destruction of interprovincial barriers is the cure-all some think it is, let alone an ample response to the looming economic malaise caused by the tariffs.

Marc Lee, an economist for the Canadian Centre of Policy Alternatives (CCPA) notes that interprovincial trade has grown by 44% over the past 18 years despite the barriers. Lee argues that many barriers exist for legitimate reasons such as geography or public policy and that abolishing them won’t guarantee reduced prices. He argues that less than 7% of Canada’s GDP is in sectors affected by these barriers. He criticizes the anti-barrier boosters for oversimplified assumptions that won’t translate in a real-world application.

While the dissenting opinion is not firmly against the abolition of certain burdensome regulations, it cautions against an extreme deregulation scenario while suggesting that the desired effects of such deregulation may be overrated.

Trevor Tombe, another well-known economist from the University of Calgary, has responded to these refutations calling for more rigorous counter-research and cautioning policymakers not to focus solely on high-end estimates.

In reality, some east-west trade friction is inevitable and will continue. Quebec’s French language laws will always mean differences in communication regulations. Geographic barriers exist. Structural adjustments (e.g., investments in infrastructure) will carry costs. Canada’s business environment must support adaptation.

Critical Minerals

Industrial strategies, particularly for critical minerals, have gained urgency as a means for Canada to seek economic independence from the US.

Canada’s 2022 Critical Minerals Strategy sets forth five objectives: economic growth, global security, inclusive communities, climate action, and Indigenous reconciliation. It focuses on 34 key minerals, including lithium, uranium, cobalt, and potash; all of which are essential for electric vehicles (EVs), clean energy, and high-tech manufacturing.

Strategy projections:

- GDP growth of $15–59 billion by 2030, $24 billion from EV industry alone

- 79,000–333,000 jobs created, 81,000 jobs from EV industry alone

- At least $11 billion in annual government revenue

- Global demand for critical minerals to grow sixfold by 2040

- Canadian mining industry to require at least 113,000 new workers by 2030

These numbers are based on input-output modeling and market trend forecasts. Unlike interprovincial trade, however, few external studies have scrutinized the assumptions behind these figures. More third-party analysis is needed.

While Canada has the resources capable to execute such a strategy, it also has the experiences of other countries to learn from. Australia released its Critical Minerals Strategy and coordinated it through partnerships with global tech firms and a strong focus on research and development (R&D). As a result, it attracts major investment and supply chain development while possessing one of the world’s strongest refining capacities.

Japan is another excellent example. In response to the 2010 China rare earths embargo (note, China is conducting a similar embargo on the US), Japan implemented a supply diversification strategy. They invested in various overseas mining projects, maintaining a strategic stockpile of critical minerals. As a result, Japan reduced dependence on China by half in spite of having few domestic resources.

Despite our vast potential and the established precedents that can guide us, skepticism of the Critical Minerals Strategy is not unwarranted. In November 2024, Canada’s Commissioner of the Environment and Sustainable Development tabled an Auditor General’s Report stating that more work is required on gathering information and analyzing the environmental effects of critical minerals resource development.

Indigenous groups have also voiced concern as more than 600 communities live within 100 km of a major mineral project.

In essence, the case for strengthening and moving forward on a critical minerals strategy is strong, but more work (analysis, consultation, plans) and financial resources are needed to increase prospects for success.

Trade Diversification

Trade diversification in Canada has been highlighted by all political leaders in the 2025 election campaign as a strategy to respond to Trump’s tariffs. About three quarters of Canadian exports go to the US.

China’s efforts to rebalance trade away from the US provide some possible lessons for Canadian policymakers.

The US imposed tariffs on Chinese goods in three waves between 2018 and 2019. The new tariffs increased the weighted average tariff rate by almost 16 percent. Despite the significant drop in exports to the US, China’s diversion strategy allowed for its total exports to remain stable.

While China was expected by some to endeavor to shift exports to other high-income countries, China instead predominantly diverted its exports to the global south. This enabled lower market penetration costs, and expansion into new product varieties. The strategy was to avoid more intense competition in higher-income markets. This allowed China to largely offset the $58 billion lost in the US market with a gain of $50 billion worth of exports to new markets.

Chinese export prices increased with ongoing efforts to quality upgrading. This could not have happened without new market access. It also provided China a foothold in certain markets for decades to come.

Canada can learn from the experience of other countries with trade diversification. Changing export destinations and developing enhanced trade with existing markets requires strategy, planning, negotiations, regulation alterations and infrastructure investments to handle new trading relationships and volumes. China made deliberate strategic efforts to rebalance its trade with the US after the 2018 tariffs.

Each of these responses to US tariffs and threats to Canadian sovereignty — reducing interprovincial trade barriers, implementing a critical minerals strategy and diversifying Canadian trade — has merit. Together, if delivered successfully, they can produce meaningful economic benefits for Canadians over the medium-to-long term. Over the short term, we will need Canadian governments to work together and set course. We will also need public fiscal supports for people and businesses get through hard times and adjust to an uncertain future.

Emaad Samsoodeen is an undergraduate economics student at the University of Ottawa. He will graduate in 2025.

Kevin Page is the President of the Institute of Fiscal Studies and Democracy at the University of Ottawa, former Parliamentary Budget Officer and a Contributing Writer for Policy Magazine.