Budget 2023: An Ironic GST Rebate and a Happy NDP

L. Ian MacDonald

March 28, 2023

It’s historically ironic that Ottawa implementing the Cost of Living Relief Act in Budget 2023 is being called the “GST rebate”.

That’s because the cost of food was exempted from the GST when it took effect at the beginning of 1991. But that was not before a huge fight in the caucus of the Conservative government of the day, and it was Brian Mulroney who always said: “You can’t lead without the caucus.”

When the GST bill was first introduced by then-Finance Minister Michael Wilson in 1989, food was going to be included, and the consumption tax was going to be 9 percent. That’s what set off the revolt in the Tory caucus, and Mulroney heard them loud and clear. In the end, the GST was adopted at 7 percent, with food excluded, except for snack foods, soft drinks and spirits.

The PM’s department, the Privy Council Office, worked closely with Mulroney’s office on the GST. And one of the senior advisers to PCO Clerk Paul Tellier was Michael Sabia. When I first met him in the Clerk’s third floor corridor of what was then called the Langevin Building on Wellington Street, someone introduced him as the guy who did the work on the GST.

“Do you know how much trouble you’ve made for us?” I asked.

And now, after decades as a senior executive at CN Rail, Bell and Quebec’s pension plan, Sabia is back as deputy minister of Finance. At 69, he’s not doing it for pensionable time, and as a long time executive in the private sector, he doesn’t need the money, either. He’s doing it out of a continuing sense of service to country. As such, he’s Finance Minister Chrystia Freeland’s closest adviser in her department and one of the authors of the GST rebate, as the Liberals have themselves dubbed it. What goes around comes around.

Liberal caucus members, who’ve been getting an earful from voters on the food price spikes piggybacking on the inflationary cycle of the last year, are only too happy to call it the GST rebate.

So is NDP Leader Jagmeet Singh, who got his trade-off with Prime Minister Justin Trudeau for the confidence and supply agreement of a year ago, in which the Dippers agreed to prop up the Libs until the 2025 election in return for consumer benefits in budgets.

“That’s something we’re going to use our power on,” Singh said several weeks back. “The agreement gives us the leverage to push for things like that.”

Subsidies for youth and seniors on dental care costs was another thing on Singh’s budget shopping list. And he got that, too. The government is investing $7 billion in dental subsidies over the five-year fiscal framework to 2027-28.

As for the Conservatives, their pre-budget mantra, recited by Opposition Leader Pierre Poilievre and every Tory who intervened in the House in Question Period on Monday, was: “No new taxes.”

The new Tory slogan is lifted from George H.W. Bush’s acceptance speech as the Republican Party’s nominee for President of the United States in 1988, when he famously declared: “Read my lips—no new taxes.”

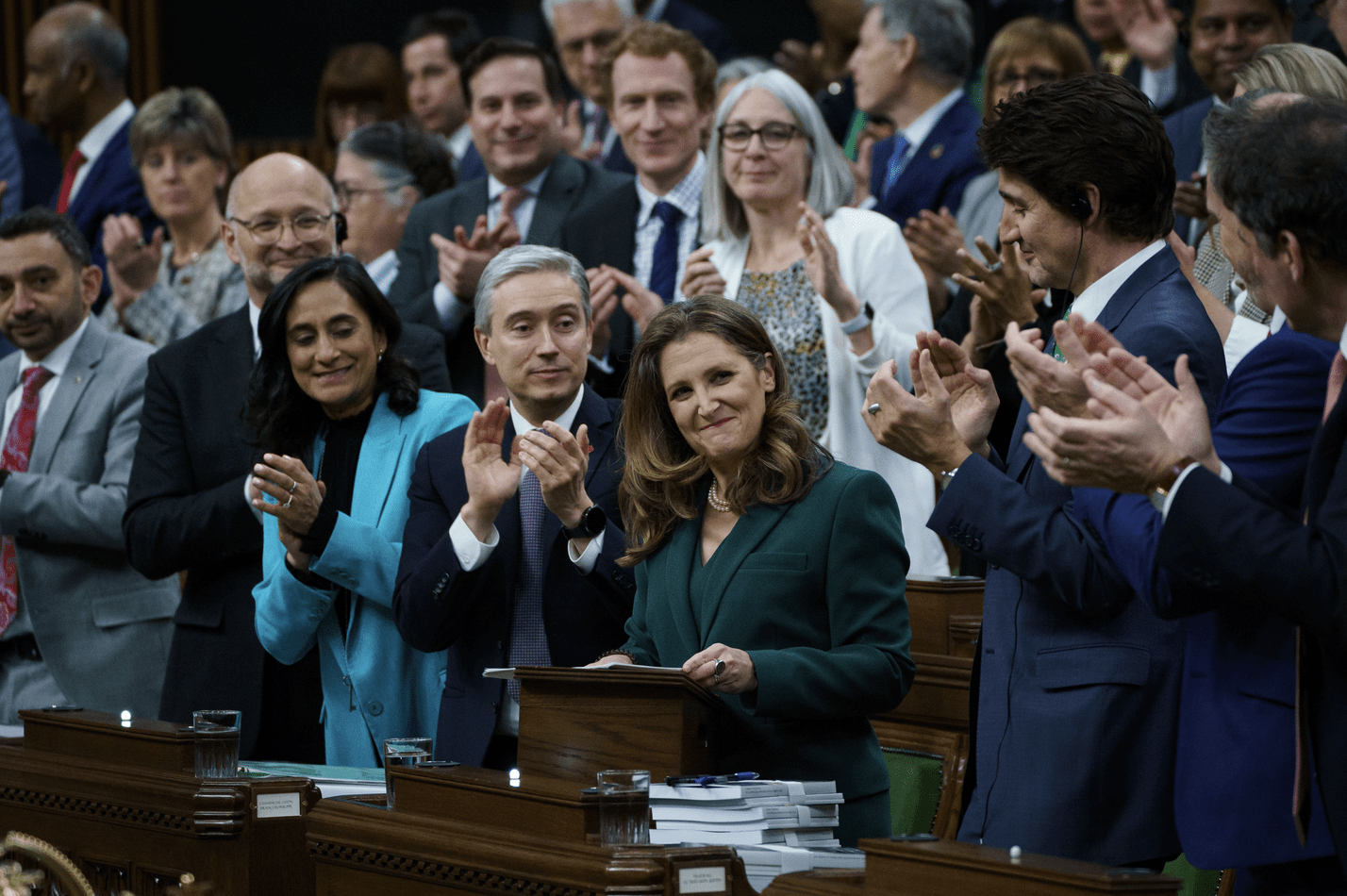

As for Freeland, her budget speech was commendably short, only about 20 minutes long. Her distributed reading copy consisted of only five pages. She styled the GST rebate as the “Grocery Rebate” which will “help make up for higher prices at the checkout counter—without adding fuel to the fire of inflation.”

She began with a boast of Canada’s recovery from “the COVID recession” and noted that there “are 830,000 more Canadians working today than when COVID first hit” in 2020, and that Canada has “recovered 126 percent of the jobs that were lost in those first months—compared to just 114 percent in the United States.”

Freeland told a pre-speech news conference, ‘I have never been more optimistic about the future of our country than I am today.’

In terms of program spending, Freeland confirmed a “$198 billion investment in public health care that the Prime Minister announced last month.” That’s over 10 years, and most of it is pre-committed transfers to the provinces and territories with Trudeau’s top-up of nearly $7 billion in new money.

As for dental care, she declared that by the end of 2023, Ottawa “will begin rolling out” a plan “for what will eventually be up to nine million uninsured Canadians.

“That will mean that no Canadian, ever again, will need to choose between taking care of their teeth and paying the bills at the end of the month.”

She then moved on to the clean-energy transition, and putting Canada on the road to net-zero emissions by 2035, describing it as “the most significant economic transformation since the Industrial Revolution, our friends and partners around the world—chief among them, the United States—are investing heavily to build clean economies and the net-zero industries of tomorrow.”

Freeland added: “We are going to make Canada a reliable supplier of clean energy to the world, and, from critical minerals to electric vehicles, we are going to ensure that Canadian workers mine, and process, and build, and sell, the goods and resources that our allies need.” When it comes to minerals, lithium and so on, Canada has an abundance of what America and the world need for EVs. We also have no shortage of farmland for wind and solar clean electricity panels. All in, a senior Finance official said a current commitment of $20 billion for clean electrification will double to $40 billion during the current five-year fiscal framework.

Overall, in the department of no news is good news, Freeland noted that “Canada maintains the lowest deficit and the lowest debt-to-GDP ratio in the G7.” Which is to say a current deficit of around $40 billion, and a declining debt-to-GDP ratio of 40 percent.

She added: “We are reducing government spending by more than $15 billion—while taking great care not to reduce the services and support that Canadians rely on.”

Overall, she told a pre-speech news conference at the media centre in the Westin hotel, “I have never been more optimistic about the future of our country than I am today.”

Some commentators have already characterized this budget as one based on the hope that the many “events, dear boy” external factors that impact Canada’s fiscal reality — illegal wars, global inflation, bank runs — will recede before a more election-adjacent Budget 2024. That may place a premium on optimism.

L. Ian MacDonald is Editor and Publisher of Policy Magazine.