Budget 2024 Preview: Policymaking in a Slow/No Growth Economy

Chrystia Freeland tabling the 2023 Fall Economic Statement on November 21/Adam Scotti photo

Chrystia Freeland tabling the 2023 Fall Economic Statement on November 21/Adam Scotti photo

Hunter Vanderlaan and Kevin Page

February 28, 2024

Policymakers and politicians face a dilemma in 2024. We are in a slow/no growth economy with relatively high inflation. Downside economic risks are significant. Policy credibility, institutional trust and political support are on the line.

Deputy Prime Minister and Finance Minister Chrystia Freeland must find a fiscally responsible path for Budget 2024 that supports disinflation and a soft landing (no recession) while maintaining the government’s progressive policy agenda.

The finance minister does not hold all the economic cards. The game- changer role rests with the governor of the Bank of Canada, Tiff Macklem. The longer the delay to lower policy interest rates, the greater the risk of a recession.

Robert Frost wrote, “The best way out is always through”. The hardship ahead for 2024 is baked in the cake. The restoration of economic fundamentals (prices, interest rates, housing, balance sheets) is the way out. As Prime Minister Harper learned the hard way in 2015, it is always better to face an election with a growing economy.

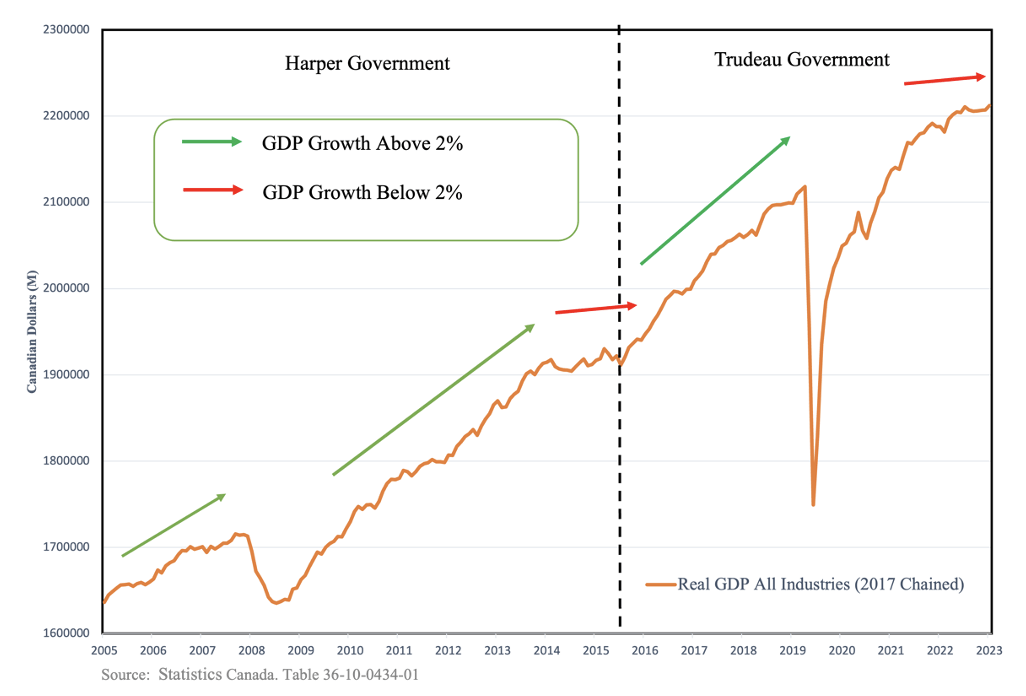

Chart 1 Real Gross Domestic Product (GDP) and Political Timeframes

The economy is weak. The weakness is cyclical. High interest rates are used to slow the economy to reduce inflationary pressures. Productivity, immigration, and income disparity are longer term challenges. A lack of focus on structural issues is the opportunity cost of restoring economic fundamentals in the short-term.

In the third quarter of 2023, population growth (up 3.0 percent) far exceeded economic output growth (0.5 percent). Unemployment is increasing – up by almost 200,000 in 2023. The unemployment rate has risen from 5 to 5.8 percent. Expect the rate to break through 6.5 percent by summer.

In the current environment, the Canadian economy is significantly underperforming the US. The IMF world economic outlook has real GDP up by 2.5 percent in 2023 and 2.1 percent in 2024 in the US versus 1.1 and 1.4 percent in Canada. Why the difference in the short-term outlook? Canada has much higher outstanding debt at the household level. High interest rates are biting hard. The US is running a large (stimulative) budgetary deficit at about 6 percent of GDP in 2024 compared to about 1.3 percent in Canada. If Canada was running a budgetary deficit at about $175 billion (6 percent of GDP) we would have higher growth.

High interest rates are driving record-high carry costs on mortgages in Canada. Mortgage debt servicing costs hit 8.3 percent (interest cost divided by disposable income) – a full 2 percentage points higher than a peak prior to the 2008 financial crisis. Inflation rates have come down (from 8.1 percent in June, 2022 to 3.4 percent in January, 2024) but cumulative increases in prices (up almost 16 percent since the start of COVID) are biting into household balance sheets. Inflation expectations are falling but too slowly for the Bank of Canada to initiate declines in policy interest rates.

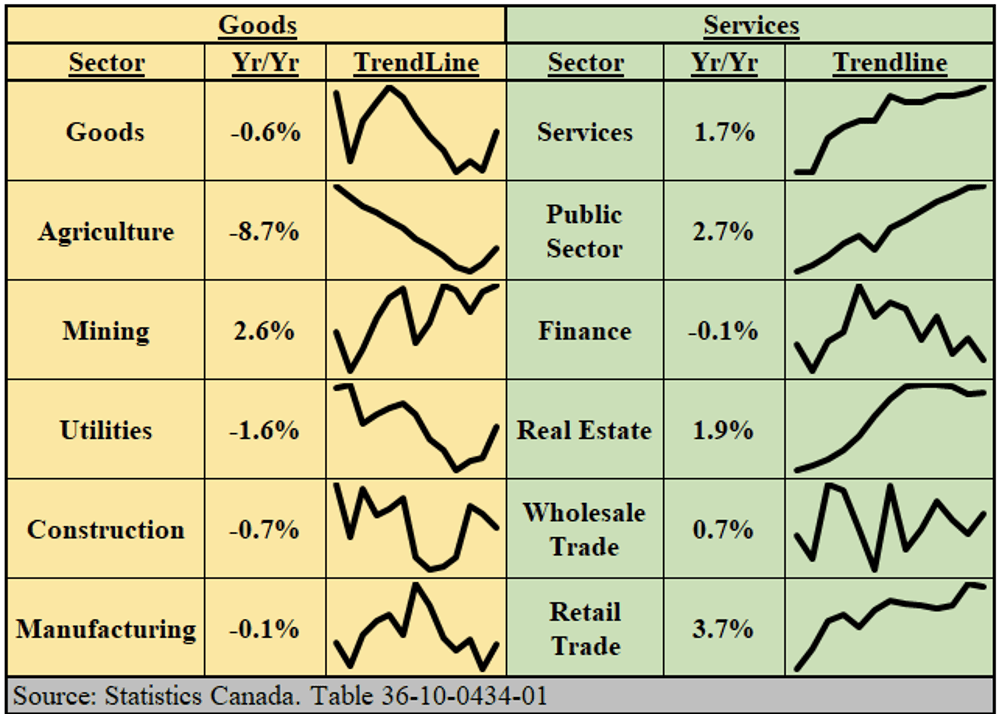

Chart 2 Mapping the Growth Slowdown

Notes: November 2023 data. Trendlines highlight profile of goods and service industry (level) output over the past year. Select industry groups under goods and service categories.

The economic slowdown is widespread across different industries (Chart 2). On a year-over-year basis, output in the goods sector is down 0.6 percent. Growth in construction and manufacturing has hit a wall. The service sector has seen year-over-year growth cut in half in 2023 from 3.4 percent in January to 1.7% in November.

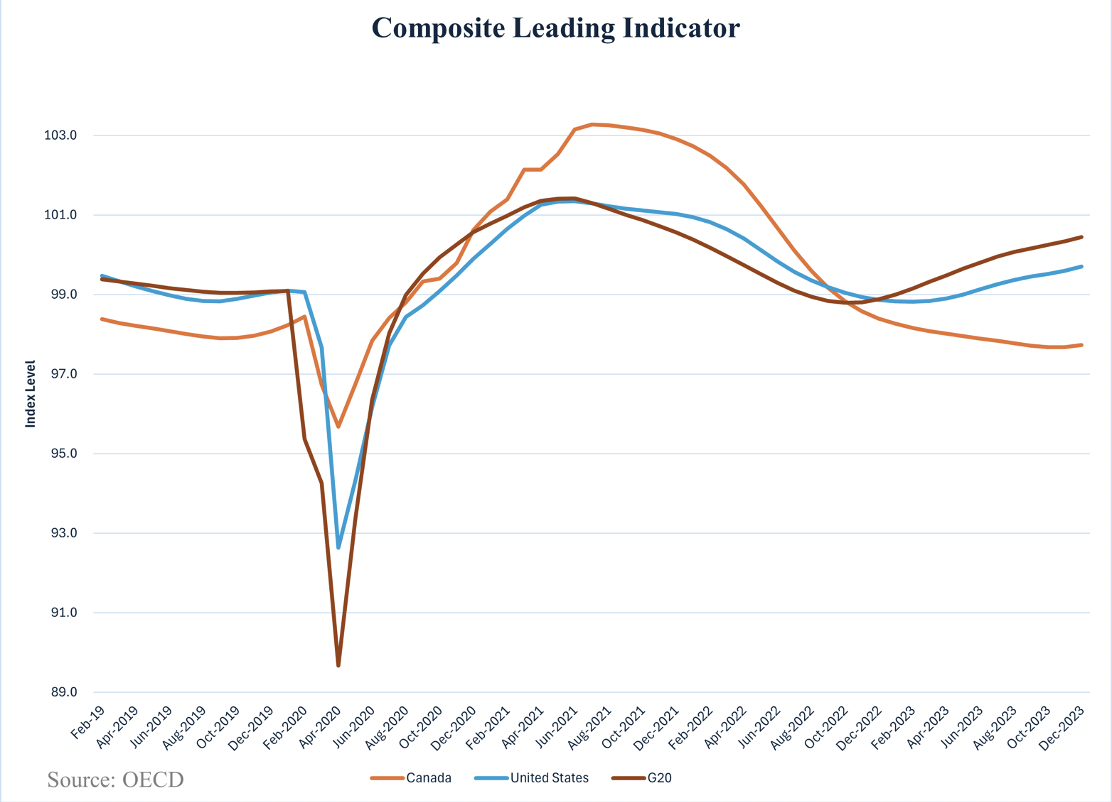

Composite leading indicators for Canada compiled by the OECD signal a weak economy over the next 6 to 9 months (Chart 2). These indicators cover a range of factors – money supply, interest rates, manufacturing and business confidence, inventories, and share prices. Recent reports from Finance and the Bank of Canada assume growth in the 0.5 to 1 percent range for real GDP. Canada’s outlook for 2024 is notably weaker than the US and the G20. High interest rates and significant debt will constrain consumption, investment and undermine confidence.

Chart 3 OECD Leading Indicators: G20, US and Canada

Notes: Composite leading indicator calculated by the OECD. Components include money supply (M1), manufacturing confidence, consumer confidence, interest rates, ratio of inventories to shipments; share prices (S&P/TSX)

The finance minister and governor of the Bank of Canada face a difficult policymaking balancing act in 2024. The best case scenario for the government is a soft landing that restores price stability. This will allow the Bank of Canada to significantly reduce policy interest rates which will boost growth prospects in 2025. A budget plan that puts the annual deficit on a downward trajectory as growth recovers will bolster fiscal credibility.

Whether it is likely or not, it is the economic scenario the government wants in the lead-up to the next federal election – the return of strong growth in 2025.

Kevin Page is the President of the Institute of Fiscal Studies and Democracy at the University of Ottawa, former Parliamentary Budget Officer and a Contributing Writer for Policy Magazine.

Hunter Vanderlaan is an undergraduate economics student at the University of Ottawa.