Budget 2024: The Competitive Advantage of Indigenous Ownership

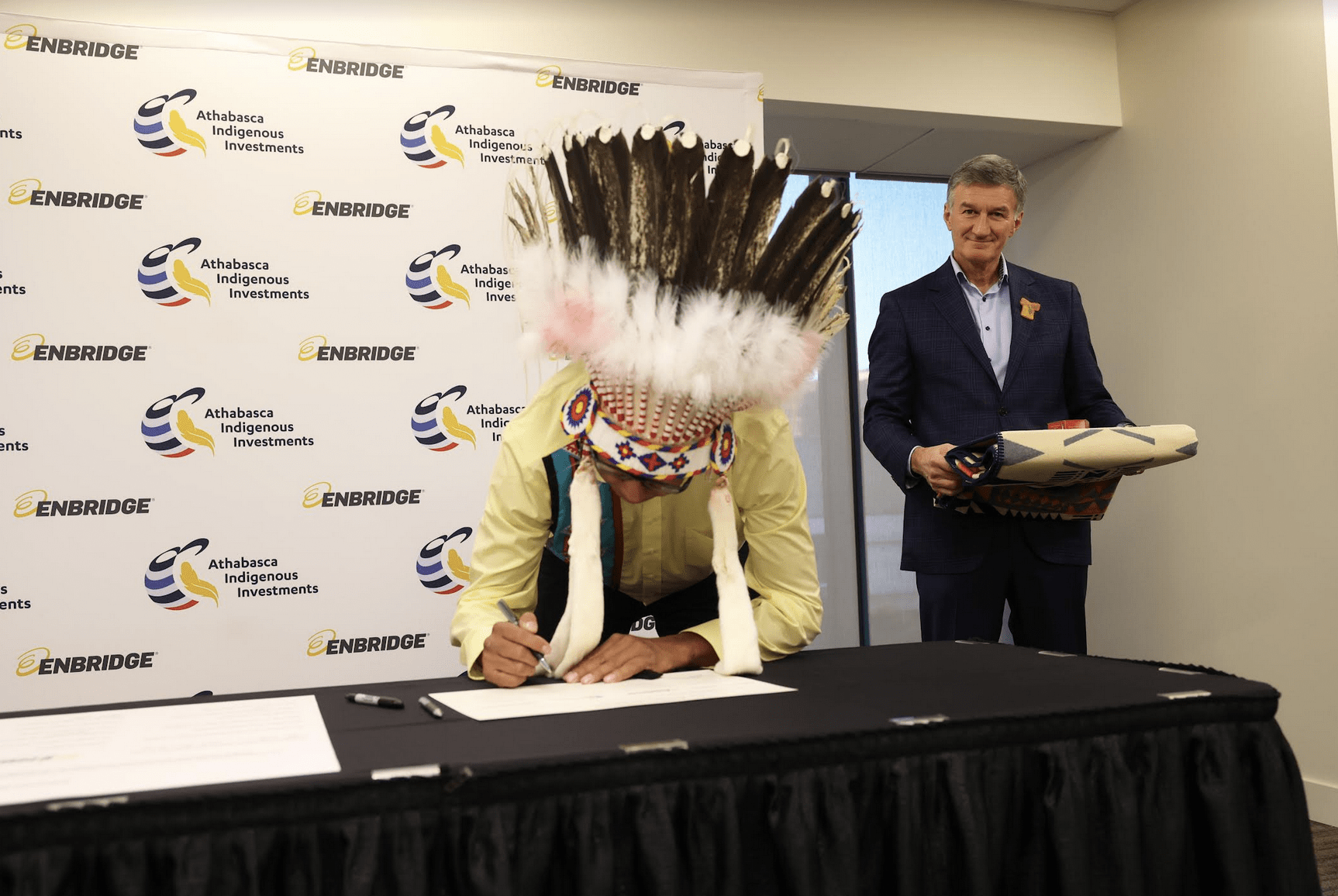

Chief Greg Desjarlais of Frog Lake First Nation signs historic equity partnership agreement with Enbridge on September 28, 2022

Chief Greg Desjarlais of Frog Lake First Nation signs historic equity partnership agreement with Enbridge on September 28, 2022

By Mark Podlasly, Shaun Fantauzzo and Michael Gullo

April 19, 2024

Many different perspectives have emerged about the federal budget tabled earlier this week, but everyone should agree that launching a national Indigenous Loan Guarantee Program is good news for the country. The untapped value of economic reconciliation is enormous.

Canada must attract and incentivize more capital investment to meet the economic and energy challenges ahead. Leveraging Indigenous partnerships is one way to do this. Unlocking competitively priced capital to support Indigenous equity participation in the transformational projects we need for transitioning to a low-carbon economy will create ripple effects across the country. Indigenous ownership is becoming one of Canada’s biggest competitive advantages, and it has the potential to kickstart a new economic cycle that accelerates our energy transition.

Equally important, Indigenous ownership can help to ensure that rightsholders have a say in the commercial activities that impact their lands while receiving a fair share of the economic returns that reflects the risks they bear when consenting to major projects. This capital can be reinvested in new projects or initiatives that improve socioeconomic outcomes for Indigenous Peoples.

Canada’s structural challenges

Most Canadians are not aware of the barriers that prevent Indigenous participation in the economy. Issues such as the Indian Act legally barring First Nation individuals and band governments from pledging reserve-based assets as collateral to lenders, the cumulative impacts of historical developments that have eroded Indigenous rights, remoteness, and a lack of internal resources needed to advance economic opportunities in a meaningful way have had, and continue to have, significant macroeconomic implications for Canada. A greater effort on the part of governments and industry to tackle these barriers is win-win.

Even though Canada is blessed with abundant natural resources, this is no guarantee that the country will be an attractive choice for investors. Capital will flow to jurisdictions that can provide clarity and certainty. Today, investors have many different options when it comes to deploying their capital and maximizing their returns, and Canada must compete with other jurisdictions around the world. Indigenous partnerships will be a big part of what attracts capital into Canada.

Canada’s capital attraction challenge requires deep consideration by policymakers. Interest rates will likely remain stubbornly high for longer than previously expected, while the global economy adjusts to structural challenges, including fractured trade relationships, emerging geopolitical risks, and technological barriers to decarbonizing the global economy by 2050.

We are hardly immune to these challenges. In a speech by Carolyn Rogersdelivered exactly three weeks before the federal budget, the Senior Deputy Governor of the Bank of Canada said that “Canadian investment levels are lower than they were a decade ago” and called Canada’s productivity problem a “break the glass” emergency. The long-term picture is also bleak with the OECD projecting that Canada will rank dead last amongst advanced economies in real GDP per capita growth out until 2060.

It is naive to underestimate Canada’s capital investment challenge. The energy transition alone will require more than $2 trillion in investment between now and 2050. Some projections show that 5-7 gigawatts of incremental grid capacity are needed every year for the next 25 years—akin to adding a new Bruce Nuclear or Roberta-Bourassa generating station every 12 months. The challenge is enormous.

A market analysis recently conducted by the First Nations Major Projects Coalition (FNMPC) revealed that roughly $525 billion in capital investment in energy and mining projects is expected over the next 10 years. These major projects will be built, operated, and decommissioned on Indigenous lands, and so Indigenous ownership is a no-brainer. Equity is an incredible tool for aligning interests, incorporating Indigenous values, and ensuring that projects move forward in a good way and on time, but Indigenous equity investment requires access to capital.

Canada has everything it takes to be a leader in producing and exporting energy to global markets. Indeed, leaning into the country’s natural resource endowment can ease short- and medium-term energy security challenges for our allies and reduce global reliance on higher-emitting sources of power. Canada’s greatest opportunity lies in its unique ability to assist countries in their pursuit of cleaner energy and technologies. Our natural resources could support the global energy transition. S&P Global estimates that if just 20% of Asia’s coal-fired power plants were converted to natural gas, global emissions would be reduced by more than Canada’s annual emissions. Indigenous partnership is integral to this story.

What can a national Indigenous Loan Guarantee Program achieve?

Using loan guarantees to support Indigenous ownership is not a new concept. In Alberta and Ontario, their programs have unlocked approximately $2 billion in Indigenous equity participation opportunities in the last 15 years and created sustainable, long-term revenue streams for Indigenous partners. These programs have more than proven their concept. And to date, there have been no defaults and therefore no material fiscal impacts in those provinces.

Inspired by these successes and motivated by the growth of Indigenous ownership opportunities emerging across the country, the Government of Canada has committed to launching a $5 billion program modelled on the programs in Alberta and Ontario. Recently, the Government of British Columbia committed to doing do same by announcing its new $1 billion First Nations Equity Financing Framework, which will deploy loan guarantees as its main tool.

With Canada and British Columbia in the mix, as well as the Canada Infrastructure Bank’s Indigenous Equity Initiative, there is now more than $10 billion in loans and loan guarantee support for Indigenous equity participation on the table or on the way across the country. While this figure is lower than the $50 billion equity opportunity that FNMPC projects for Canada, this collective commitment is building significant momentum.

A loan guarantee works by helping reduce interest rates and shorten amortization periods for Indigenous equity partners. In a typical project finance structure, project revenues are used to repay lenders. Equity investment in major natural resource projects is risky and expensive and it is not uncommon for Indigenous equity partners to borrow most, or all, the money required to finance their equity investments, which often translates into lower returns due to higher interest rates. In many cases, the returns are so low that equity investment is not commercially viable.

Loan guarantees can help to reverse this outcome—the additional security provided by a government loan guarantee encourages lenders to soften terms and results in more meaningful returns to Indigenous equity investors sooner in a project’s lifecycle. Estimates derived by FNMPC and others show that the impact of loan guarantees ranges from 1.5% to 5%. The financial impact can be hundreds of millions over the lifetime of the equity investment. Furthermore, developing additional deal precedents in the market will help lead to innovation.

If deployed strategically, the Indigenous Loan Guarantee Program can be used to develop the projects that create a competitive advantage for Canada on the world stage and generate the strong returns needed to fuel the country’s economic growth. Our view is that the commercial success in the natural resource sector holds a lot of promise for Canada’s economic prospects and positions the country as a premier destination for capital markets. For this very reason, announcing that the program would be open to all types of natural resource projects was welcomed. It will be important to leverage all aspects of the natural resource sector, from oil and gas, critical minerals, and renewable electricity to enabling infrastructure and export capacity. Prioritizing Indigenous self-determination in this respect is a good choice.

Thankfully, Indigenous partnerships in the natural resource sector are accelerating across the country. It is clear to industry that these partnerships can help to unlock mutually beneficial economic opportunities. And it is encouraging that governments in Canada are following suit. Indigenous equity participation is on the rise and examples abound, from the Tu-Deh-Kah Geothermal Project led by the Fort Nelson First Nation in British Columbia and the Athabasca equity pipeline partnership among 23 First Nations and Métis Communities with Enbridge in Alberta to the Hydro One 50-50 First Nation equity opportunity in the Chatham-to-Lakeshore transmission line in Ontario and Miawpukek First Nation’s wind-to-hydrogen opportunities in Newfoundland. These and other examples underscore how equity arrangements with Indigenous partners can help to drive investor confidence, move projects forward, and advance economic reconciliation.

Timely next steps will be important

Now that the Government of Canada accepts the value proposition associated with Indigenous ownership, it needs to move with a sense of urgency to equip the Canada Development Investment Corporation with the support it requires to create a new subsidiary that will administer the program in concert with Natural Resources Canada. Natural Resources Canada will also play a critical role in managing program intake and providing capacity support to Indigenous applicants (e.g., to conduct financial due diligence).

The Government of Canada’s ambition should be underpinned by an unwavering commitment to generate economic prosperity for all Canadians by making Canada a top destination for international capital seeking transformational projects. This includes ensuring that free, prior, and informed Indigenous consent is the standard for project development. Capital naturally seeks low-risk, high-reward investment opportunities. Positioning Indigenous people as co-investors and co-proponents provides greater assurance that consent for a project has been granted, which will help to de-risk Canadian natural resource projects.

This week’s announcement in the federal budget holds immense potential and foreshadows what can be accomplished when Indigenous Peoples, governments, and the private sector work together. A future in which Indigenous Peoples continue to be viewed and treated as stakeholders instead of strategic partners is not acceptable. The cost of doing more of the same is too high.

Mark Podlasly is Chief Sustainability Officer with the First Nations Major Projects Coalition.

Shaun Fantauzzo is Vice President of Policy with the First Nations Major Projects Coalition.

Michael Gullo is Vice President of Policy with the Business Council of Canada.