Budget 2024: The Cost of Fairness

Finance Minister Chrystia Freeland tables the 2024 budget on April 16/Adam Scotti

Finance Minister Chrystia Freeland tables the 2024 budget on April 16/Adam Scotti

By Kevin Page with Yasmine Hadid and Hunter Vanderlaan

April 17, 2024

Deputy Prime Minister and Finance Minister Chrystia Freeland tabled Budget 2024 on April 16. Faced with a weak economy, many difficult policy changes, and limited fiscal room, Freeland chose action. This year’s budget theme has shifted from “Growing the Middle Class” to “Fairness for Every Generation”. Fairness implies bigger government. The budget is big. There are multiple priorities and more than 200 (line item) measures. It is a tax-and-spend budget. Fiscal targets are met.

How do you expand the size of government, address multiple priorities and hold to short-and-medium fiscal planning targets? The jigsaw puzzle has three pieces.

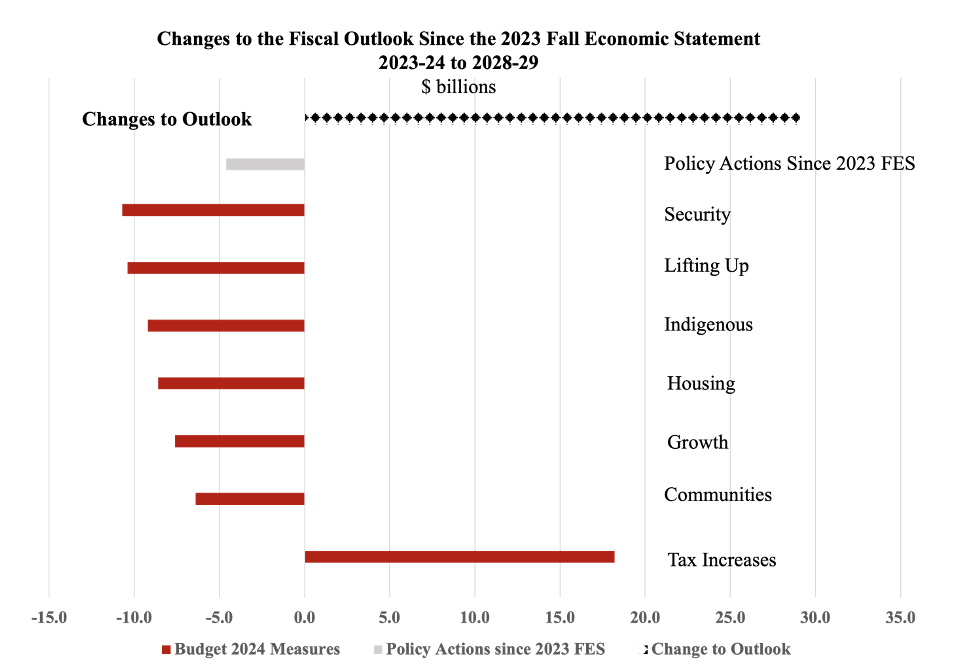

One is the economic outlook. The outlook is weak – a soft-landing scenario – but less weak than assumed in the 2023 Fall Economic Statement. This generates about $29 billion in additional fiscal room over the six-year planning period (Chart below).

Two, a significant tax change to the inclusion rate on capital gains for individuals and corporations. This generates about $18 billion in additional revenue starting in 2024-25.

Three, more than $50 billion in new spending measures over 6 priorities, including measures announced in the lead-up to the budget.

Were the stakes high for the government to meet its fiscal targets? Yes. Will the stakes remain high in Budget 2025? Yes.

Fiscal credibility and trust are on the line. Canadian deficit and debt numbers are elevated in a post-COVID environment. Fiscal consolidation is necessary to replenish fiscal room in anticipation of a future economic shock. Increasing the use of deficit financing in a high price environment with the Bank of Canada using a high policy interest rate to lower inflation pressures would be justifiably criticized.

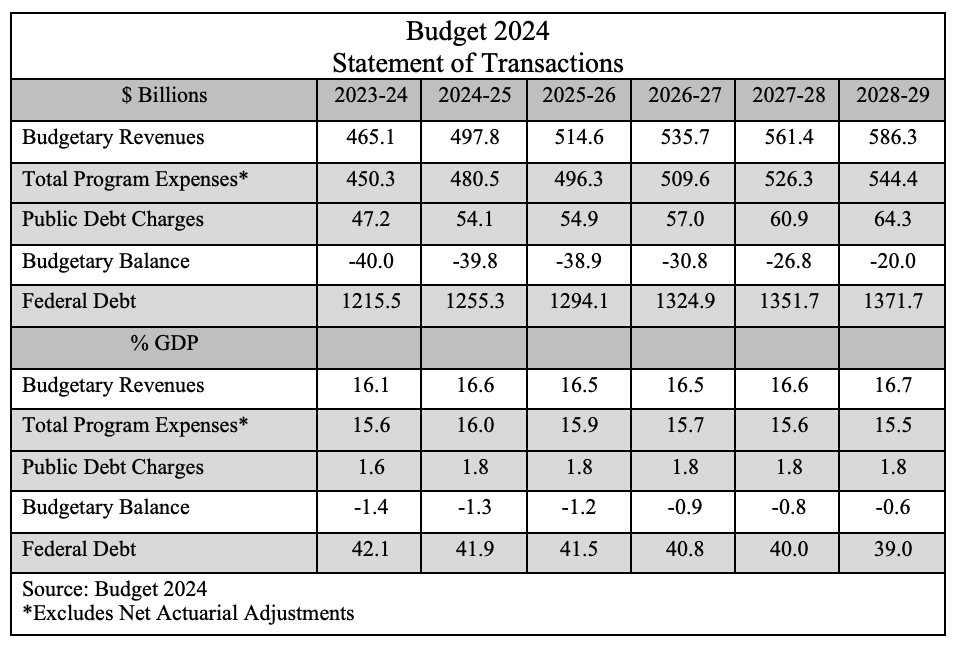

The government is claiming that the planning framework is consistent with its fiscal objectives – holding the deficit to $40 billion in 2023-24; lowering the debt- to-GDP ratio over the medium term; budgetary deficits below 1 percent in 2026-27 and beyond (table below). One challenge the government will face is that there are no explicit reserves on these targets. Changes to the outlook can easily throw the targets off-track because of the higher spending in the budget.

Is this a good time for a classic tax-and-spend budget? There are legitimate yes and no arguments from a macroeconomic perspective.

Yes. The economy is weak. The difference between a soft and hard landing may be government support through modest counter-cyclical measures and some help from a stronger US economy that continues to boost exports. A $40 billion budgetary deficit is modest relative to the weak economy and international comparisons. Taxing wealthy Canadians and corporations and redistributing to less-wealthy Canadians can support consumption and stabilize the economy.

No. Raising capital gains taxes in a weak economy with poor investment can exacerbate, not help, Canada’s productivity challenges. Canada needs investment. The proposed tax increases and the signal by the government to tax and spend can undermine business confidence.

The government had a policy choice in deciding how to generate additional fiscal room to allocate to Budget 2024 priorities. It chose to increase taxes. It decided not to reduce existing spending through spending reviews and re-allocate funds from poor-performing operating and transfer spending. When the Liberals came to power in 2015, program spending as a percentage of GDP was 13.2 percent. In 2024-25, program spending is expected to be 16.0 percent. In a $3 trillion economy, each percentage point is worth $30 billion annually. The growth in spending and ongoing performance issues (e.g., pay system, procurement) necessitate a greater focus on spending review.

What is the cost of fairness for every generation? Does Budget 2024 help tilt the federal spending structure toward something that is fairer?

Increasing fairness for every generation is a laudable aspiration. In the budget speech, Freeland anchors the concept of fairness around the promise of Canada as a place where you can do as well and preferably better than your parents. Canadians want this for their children and grandchildren. Like the previous budget theme – growing the middle class – fairness for every generation will remain undefined and unmeasurable. The cost of fairness will not be known.

Increasing fairness could be achieved by growing the economy (creating opportunities for younger generations) and/or by redistributing income and wealth. We do not want one without the other. Canadians should want the public (federal-provincial-municipal) and private sectors to be good dance partners. We need a collaborative strategy and plan that can drive confidence and investment. No strategy; no accountability.

The $50 billion plus of new spending over the planning framework in Budget 2024 is about more than generational fairness. The largest increase for spending in a policy priority area is for the military (about $11 billion over the planning period). In a dangerous and uncertain world, Canada’s defence spending has fallen well below NATO targets. The Budget 2024 spending allocation brings the country’s defence spending closer to NATO’s 2% of GDP benchmark.

Canada’s demographic profile is getting older. All generations can see it in the budget tables. Spending on elderly benefits – one program – will rise by $30 billion annually to $100 billion in 2028-29. This increase dwarfs spending on younger generations across an array of programs, including recent enrichments for child benefits and child care.

Budget 2024 does tilt spending towards younger generations – housing supply and affordability, child care, students, affordability frustrations (e.g. banking, air travel, communications), Indigenous child and family well-being, research and development. There are also initiatives to support clean and safer communities with broader generational implications. Tilting or realigning spending will be an ongoing process. It will be easier to do if we can grow the economy.

Kevin Page is the President of the Institute of Fiscal Studies and Democracy at the University of Ottawa, former Parliamentary Budget Officer and a Contributing Writer for Policy Magazine.

Yasmine Hadid and Hunter Vanderlaan are undergraduate economics students at the University of Ottawa.