ChatGDP… and Jobs

Douglas Porter

February 3, 2023

So, about that recession… Making a mockery of all the downbeat forecasts for 2023, the U.S. job market came flying out of the chute to start the year with a powerhouse 517,000 payroll advance in January. Adding to the mix, the companion household survey reported a towering 894,000 employment rise, which helped clip the jobless rate to a fresh 54-year low of 3.4%. The participation rate rose to match its pandemic-era high of 62.4%, and aggregate hours worked jumped 1.2% in the month—a strong gain. While the closely-watched average hourly earnings met expectations at up 0.3% m/m, revisions to earlier months left them a tad high at 4.4% y/y, offering no succor.

The surprisingly strong jobs report echoed earlier indications that the labour market was holding up much better than almost anyone expected. For example, initial jobless claims continue to grind down to unusually low levels, dipping to 183,000 last week. As well, job openings defied consensus with a pop higher in December to back above 11 million—with the latest dip in unemployment, there are again almost two openings for every person officially reported as jobless. If that wasn’t enough, auto sales also chipped in with their best month in nearly two years in January, while the ISM services report snapped back to a solid 55.2.

The big caveat here is that, while no doubt an impressive set of figures, January can be a very odd month for economic data since it is so heavily influenced by the weather. And, generally speaking, it was an unusually mild month (aside from biblical rain in California), which likely gave a small bump to activity in general. And the bounce in auto sales and the services ISM followed a particularly weak December. Meantime, the factory ISM disappointed last month with a soft 47.4; which, while short of recession terrain, points to a contraction in manufacturing. Consumer confidence softened anew in January, home prices continue to fade, and layoff notices are soaring. Still, pulling all the diverse strands together suggests that while underlying growth may be slowing, the economy is still pretty far from an outright downturn just yet.

Where does this leave the Fed, after this week’s by-the-book 25 bp rate hike to 4.50%-to-4.75%? Chair Powell’s remarks to these ears weren’t especially notable, but he chose not to forcefully push back at a rallying market and didn’t directly address the possibility of a pause. And, thus, markets seized on some of his mildly dovish comments (“disinflation starting”, and the “extent” of further hikes), and completely ignored his hawkish remarks. Our takeaway was a very clear commitment to a “couple” more hikes, and—combined with robust January economic results—have prompted us to put back in a 25 bp hike at the May meeting, after the universally assumed 25 bp hike at the next meeting in March. Thus, we are in sync with the Fed’s view that the terminal rate will be 5.00%-to-5.25% and look for rates to stay there for the remainder of 2023.

The jobs shock prompted most markets to reverse course after a broad-based rally right up until Friday. The end result was a relatively small net move, with equities slightly higher on balance for the week and yields only a touch higher as well. From a big picture lens, the 10-year Treasury yield is toggling around the 3.5% mark, just a touch shy of the 50-day moving average (closer to 3.6%) and now more than 100 bps south of the fed funds target. And, after spending much of the week on the defensive, the U.S. dollar bounced back after the blow-out jobs data and ended somewhat firmer.

The Canadian dollar ended slightly weaker, albeit still holding around its firmest level of the past four months at just under 75 cents (or $1.339). Even in the face of the Fed potentially hiking two more times and taking short-term U.S. rates more than 60 bps above the BoC’s target, the loonie is absorbing the coming rate divergence with aplomb. And that’s with oil prices sagging further this week, and natural gas prices plunging to their lowest level in more than two years.

The fact is that all of the commodity currencies never really benefitted from the spike in resource prices last year, and are also not getting side-swiped by the pullback now. Instead, the U.S. dollar is driving the currency bus, and the big picture is that the greenback is gradually losing altitude. In part, that’s because even with the resilient U.S. economy, the end of Fed rate hikes are coming into view.

The fact is that all of the commodity currencies never really benefitted from the spike in resource prices last year, and are also not getting side-swiped by the pullback now. Instead, the U.S. dollar is driving the currency bus, and the big picture is that the greenback is gradually losing altitude. In part, that’s because even with the resilient U.S. economy, the end of Fed rate hikes are coming into view.

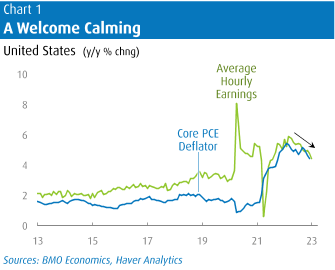

Perhaps the best news of all this week is that even as employment is still rolling, the job market strength is not translating into surging wages—arguably the opposite (Chart 1)—and underlying inflation is calming. While remaining alert to the risk that core services inflation will be persistent, even we must allow that wage and price trends have been surprisingly mild of late, notwithstanding a resilient economy. One really could not ask for a more favourable mix in recent months—and the theme was neatly captured in the payroll report: fading inflation trends amid a surprisingly sturdy growth backdrop. The pressing question looking ahead is whether this was a one-month fluke in a traditionally quirky month, or an accurate portrayal of a highly unusual economic cycle. While the reality is likely a little bit of both, it’s almost certainly the case that growth can’t maintain January’s hot pace and activity will lose considerable lustre in coming months.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.