Did We Say Rate Cuts?

By Douglas Porter

April 19, 2024

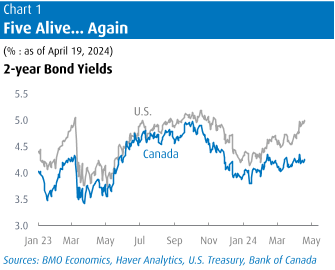

Fed rate cut expectations continue to melt in the face of an amazingly resilient U.S. economy and highly uncooperative inflation. This week’s blow was landed by the consumer, with retail sales handily topping expectations in March, and now up a sturdy 4% from year-ago levels. Following hard on the heels of yet another disappointing CPI report, and an earlier solid jobs gain, the run of robust data has the hawks squawking and the doves retreating. Chair Powell allowed in Tuesday remarks that it will take “longer than expected” to gain confidence that inflation is in a good place. NY Fed President Williams went one step further and said—out loud—that it’s “possible” that rates may even need to go higher, but to be clear, that’s not his base case. Hardly soothed by that caveat, the sell-off in Treasuries resumed, with two-year yields flirting with 5% and 10s now up 80 bps since the start of 2024 to just over 4.6%.

Initially, equities had bravely looked past this year’s steady rise in bond yields and fading Fed expectations. After all, solid economic growth had supported earnings, and everyone knew the Fed would be eventually easing. But whispers of whether rates actually are restrictive enough to quell the economy and inflation have moved from the fringe to the mainstream in recent days. And stocks are accordingly buckling. After peaking in the last trading day of March on a 10% Q1 advance, the S&P 500 is nearing a 5% pullback on three consecutive weekly losses. The Nasdaq was a tad slower to catch on, hitting a record high just last Thursday, but has since got the message, swiftly dropping more than 6%.

It’s not just monetary policy that is coming under the microscope amid sticky inflation. Fiscal policy has been no help in the inflation battle, with the deficit remaining enormous at $1.7 trillion over the past 12 months. And oil prices have been a major thorn this year, rising over 20% (from $70 to above $86) before backing off this week to around $83. Gasoline prices have tagged along, jumping more than 30% since January at the wholesale level, also before ebbing a bit this week. Overall, energy prices have gone from being very helpful in the inflation fight last year, to being at best a neutral party.

The fundamental issue is that growth just isn’t weak enough to truly undercut inflation pressures. Yes, the unemployment rate has nudged up a bit from the low, but remarkably stable jobless claims give no sign of serious stress. Consumer confidence is low, but that’s simply not translating into soft spending. And exports have managed to overcome a strong dollar due to better-than-expected external growth—we now see the global economy holding up with a decent 3.2% advance this year, matching the 2023 outcome. Next week’s first estimate on U.S. Q1 GDP is expected to show 2.0% a.r. growth: a cooling, but not weak. In turn, the core PCE on Friday is projected to rise 0.3% (a tenth below CPI), only trimming the yearly rate a tick to 2.7% (core CPI is 3.8%).

While Canadian growth and inflation are both notably chillier than recent U.S. trends, domestic yields have been lifted by the gravitational pull of Treasuries. Even with a third consecutive friendly CPI this week, GoC yields still pushed higher, with 10-years at their highest level in five months at almost 3.75%. With most major measures of inflation now tucked just below 3%, and short-term trends even softer, and the jobless rate above 6% and rising, the domestic case for rate cuts is strong. Unfortunately, the U.S. case is crumbling, leaving Governor Macklem to reassure that the BoC can carve its own path. True, in theory, but the Canadian dollar looms as a reality check. Markets are leaning to a bit more easing this year from the Bank (2-to-3 cuts; we’re at 3) than the Fed (1-to-2 cuts, we’re clinging to 2), but are only willing to price in one step beyond for the Bank.

The loonie actually firmed slightly this week, despite a mild CPI, hawkish Fedspeak, and a dip in oil prices. We won’t give credit to this week’s spending-heavy federal budget, although the tax bite wasn’t quite as bad as many feared, prompting some relief. And, in the sometimes twisted logic of the market, easier fiscal policy initially tends to strengthen a currency, all else equal. Macklem noted last week that the BoC’s forecast for real government spending had been notched up half a point due to the provincial budgets (to 2.75% this year), and the federal effort will pile on. The Governor suggested prior to the budget that such spending was “not making it any easier to get inflation down to our 2% target”. Nevertheless, we continue to look for the Bank to lead the way, with a June cut still a live possibility. Now, if the U.S. could produce just one decent inflation report—and put rate hike whispers back to bed—we’d be all set.

There’s a certain symmetry to Canada’s federal budget landing on the same week as the start of the NHL playoffs. Fresh starts, new plans, things get serious and all that. The analogy can be stretched a bit further, as the budget specifically used the Leafs winning a first-round playoff series (yes, seriously) to discuss one policy measure. And we will assert that pulling for the Toronto Maple Leafs is a bit like pulling for the Canadian economy—a seemingly endless source of frustration. Think of the parallels:

- Both have a long, storied history with wonderful past successes, but haven’t been a champion for a while, and now disappoint often;

- Both have plenty of natural advantages, are wealthy, are still very good, but are just not living up to their full potential;

- In the bygone days, both were battling with the alpha dog (Canadiens, USA) for the top, but have steadily dropped down the competitiveness ladder, as new emerging players have moved to the fore;

- Both spend far too much on questionable priorities, and are locked into some highly expensive contractual obligations, leaving little room to manoeuvre;

- Both have seen their statistics inflated in recent years;

- Neither seem to invest enough in the future (trading draft picks, low R&D);

- Both are challenged by high taxes, obsessed with housing, and both enjoy golf a bit too much;

- And for both, hope springs eternal. Go Leafs!

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.