Economy Beware: Interest Rates Are Going Up Until Inflation Comes Down

SkyNews

SkyNews

Kevin Page

June 1, 2022

The governor of the Bank of Canada, Tiff Macklem, has announced the third rate hike in four months. The interest rate tightening cycle is maturing quickly. The policy rate (the overnight lending rate to banks that is used as a benchmark for household and business lending rates) now stands at 1.5 percent — up 50 basis points since April 13; up 100 basis points since March 2; up 125 basis points since January 26. It is a steep climb. There is a lot more climbing to do. Economy beware.

Horace, the Roman poet who lived during the time of Augustus (before the birth of Christ) said “Remember when life’s path is steep, to keep your mind even.” In the face of steep increases in interest rates, an even mind is right to ask: “Why?”, “What next?” and “How does this interest rate cycle end?”

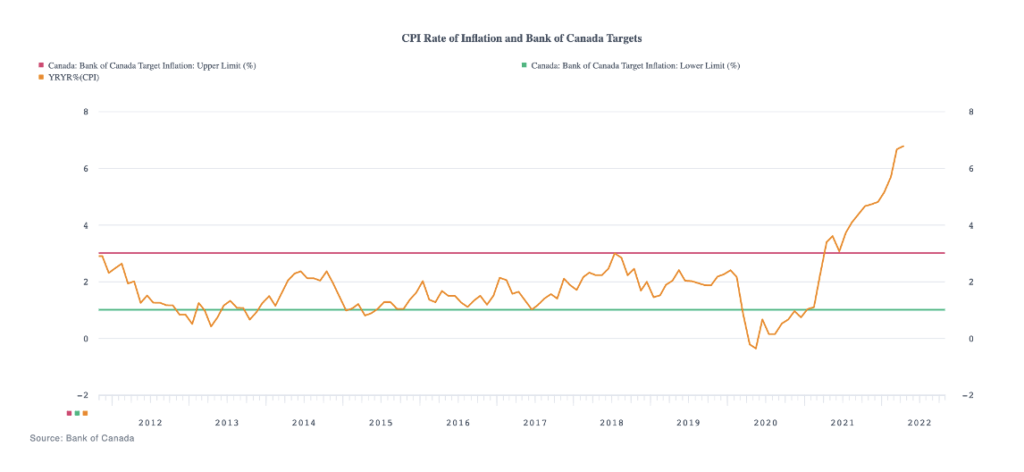

Why? Rising inflation is the problem. The consumer price index is up 6.8 percent on a year-over-year basis. It is more than twice the upper end of the Bank of Canada target range of 1 to 3 percent.It is a good bet that this inflation rate will increase in the months ahead. We have seen strong monthly increases in 2022, particularly since the start of Russia’s invasion of Ukraine on February 24. There are significant price pressures at the industry and commodity level that are yet to pass through. This is a global issue. Contrary to the initial assessment of Fed Chair Jerome Powell in 2021, it is not transitory.

At this juncture, there are three notable factors driving high and rising rates of inflation.

Two large supply shocks stemming from the COVID public health crisis and the Russia-Ukraine war. COVID-related supply restrictions continue in large economies, including China. The latest global surge in oil, metals and grain prices can be tied to the repercussions of war. These supply shocks are enduring.

On a different note, inflation is being pulled upwards by a stronger-than-expected rebound of demand in the economy, in Canada and elsewhere. In 2020, facing significant uncertainty about the human impacts from the virus (both in spread and fatalities), policymakers boosted household and business balance sheets. As social restrictions lifted, the economy surged forward. Higher demand means higher prices as supply struggles to keep up. We saw this with the prices of goods in the early phase of the pandemic. We are seeing it now with services.

What next? We should all mark the dates of Bank of Canada interest rate announcements in our calendars for the remainder of 2022 – July 13, September 7, October 26, and December 7.

It is possible, perhaps likely, we could see four more policy rate increases this year, including another possible 50-basis point (large) hike in July. The Bank of Canada says the normalized policy interest rate is in the 2 to 3 percent range. That is an interest rate consistent with a stable rate of inflation in the 2 percent range and an economy growing at its potential. With tight labour markets and a rate of inflation well above target, a 3 percent policy rate could be too low to bend future inflation rates downward. This suggests we could be less than halfway in the interest rate hiking cycle. Indeed, on Thursday, Deputy Bank of Canada Governor Paul Beaudry warned that the “We may need to raise the policy rate to the top end or above the neutral range to bring demand and supply into balance and keep inflation expectations well anchored.”

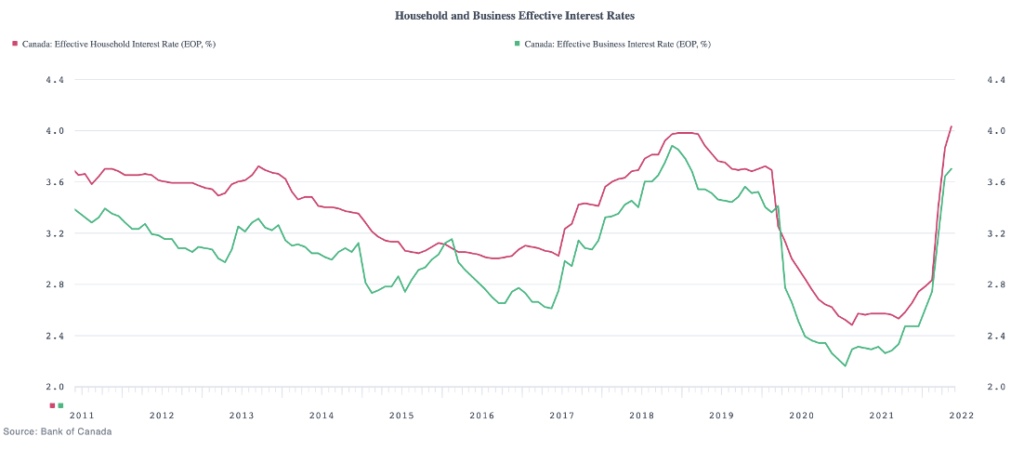

For consumers and businesses, expect commercial banks to at least move in tandem with the increases in the central bank policy rate. These rate increases are sudden and steep. They are also risky from a policymaker perspective — trying to navigate a soft landing for the economy while focusing on reducing inflation.

How does the rising interest rate cycle end? It ends when inflation rates are trending towards the 2 to 3 percent range. Are risks of a recession rising over the next two years? Yes. Is a recession a probability? Getting closer.

As the Bank of Canada contemplates the future path for policy interest rates, they will focus on a number of variables, including economic growth and household and business balance sheets.

Recent data from Statistics Canada on economic output indicate a recovery in full swing. Output levels in both the goods and services economy are trending upward. The output gap is closing quickly relative to pre-COVID projections. Labour market indicators including the employment rate (percentage of population employed) and the unemployment rate are stronger than before the crisis. The trend line in the level of output will give the Bank of Canada a read on the demand pressure on prices and the resiliency of the economy to withstand higher interest rates.

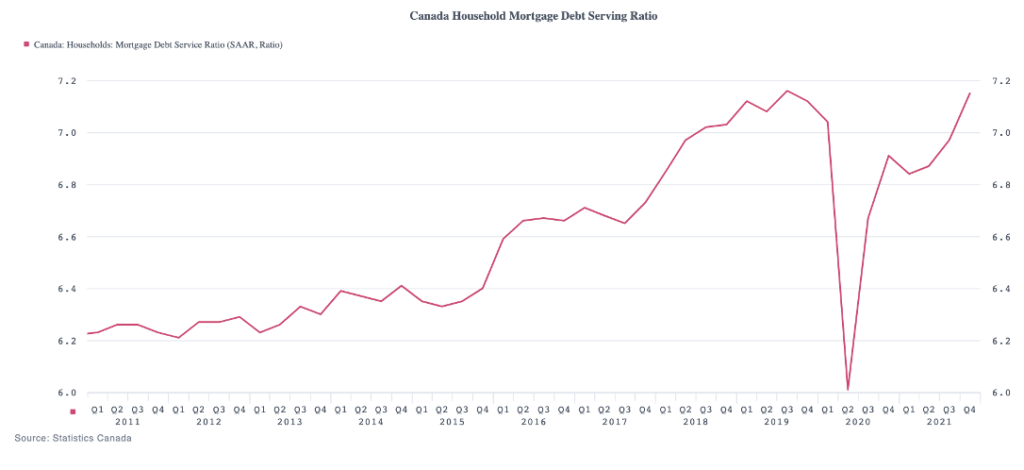

A key concern about the resiliency of the recovery and the potential for a soft (non-recessionary) landing remains the impact of a sharp rise in interest rates on the debt servicing costs for households and businesses. Outstanding debt relative to income for non-financial corporations and households is high relative to historical standards. Years of relatively low inflation and low interest rates encouraged borrowing and boosted asset prices, including house prices.

Rising mortgage rates represent a dark cloud for the household sector and the economic outlook. The household sector is becoming increasingly vulnerable. Real personal disposable incomes are trending down as price inflation outpaces wage inflation. Debt servicing costs for mortgages are trending up and this trend is not about to break with policy interest rates rising.

With respect to Horace, the Roman poet, he also said that “Adversity reveals genius, prosperity conceals it.” Perhaps a more hopeful sentiment for this time of steep paths.

Kevin Page is the President of the Institute of Fiscal Studies and Democracy at the University of Ottawa, former Parliamentary Budget Officer and a contributing writer for Policy Magazine.