Fifty Shades of 50 bps

Douglas Porter

February 17, 2023

The crucial U.S. economic releases of this week spoke with one voice—higher for longer. Hopes for a fast melt in inflation were dashed by hot core readings in both the CPI and PPI. Thoughts of a meaningful economic cooldown were banished by a fierce snapback in January retail sales. Dreams of an imminent end to Fed rate hikes were washed away by hawkish Fedspeak. The latter included musings by at least two regional Fed Presidents (admittedly both non-voters this year) that they favoured 50 bp hikes. In a symbolic addition to the hawkish mix, Fed Vice-Chair Lael Brainard—the FOMC’s lonesome dove—will be taking her leave before the next meeting to lead the President’s National Economic Council.

The net impact was to drive the interest rate complex higher across the board, to reignite the U.S. dollar, and to undercut the fledging rally in equities. Since the Fed last met little more than two weeks ago and decided to slow the pace of tightening to a 25 bp cadence, 10-year Treasuries have leapt 50 bps to above 3.8%, while 2s have surged almost 60 bps to above 4.6%. The market and analysts are busily ratcheting up the odds of an extra 25 bps from the Fed, on top of the expected such moves in March and May—whether through a third 25 bp hike in June, or one of the earlier moves upsized to a 50 bp hike. The point being that many are now leaning to a terminal rate of 5.25%-to-5.50%, and the market has almost completely given up on the possibility of rate cuts in the second half of this year.

There is little mystery behind why sentiment has shifted so abruptly. The market has been drilled by high-side surprises in each of arguably the three most important economic indicators in rapid-fire succession. First it was half a million new jobs in January, then a meaty 0.4% rise in core CPI (with revisions to the seasonal factors in earlier months leaving the three-month trend at 4.6%), and then a 3% snapback in retail sales. Some secondary indicators have also chirped in with strength for the month, including the services ISM, auto sales, and manufacturing production.

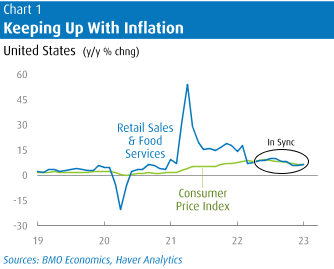

No doubt, many of the indicators were supported by a generally mild winter, and in many cases the strength just offset pronounced weakness in December. For example, the big rebound in retail sales may be partially a statistical illusion that simply offset the reported 1% declines in the last two months of 2022. The seasonal adjustment factors, which are huge around the turn of the year, may be struggling to keep up with shifting spending patterns, the weirdness of the past three years, and the odd weather. Note that retail sales were up 6.4% from year-ago levels in January, precisely matching the rise in consumer prices (Chart 1). Coincidence? Methinks not. But the bigger picture is that the economy is holding up remarkably well in the face of the harsh tightening of the past year. The Atlanta Fed’s GDP Nowcast is now pegging Q1 growth at a solid 2.5%, only the slightest of cooldowns from the 2.9% growth in Q4.

The consensus is cottoning on to the improving growth backdrop. After a mostly weak December, which saw many economists marking down their forecasts, the strong start to 2023 has prompted many to revise up growth expectations. The most recent consensus (conducted just this week) for U.S. GDP growth this year was marked up four-tenths from last month to 0.7% (which just so happens to match our latest call; accidents happen). Meantime, the outlook for average CPI inflation this year stalled at 3.7%, after steadily descending in prior months—and we remain above consensus, as per usual, at 4.4%.

The consensus is cottoning on to the improving growth backdrop. After a mostly weak December, which saw many economists marking down their forecasts, the strong start to 2023 has prompted many to revise up growth expectations. The most recent consensus (conducted just this week) for U.S. GDP growth this year was marked up four-tenths from last month to 0.7% (which just so happens to match our latest call; accidents happen). Meantime, the outlook for average CPI inflation this year stalled at 3.7%, after steadily descending in prior months—and we remain above consensus, as per usual, at 4.4%.

While most of the major economic news this week was from the U.S., the overall theme globally has been a better-than-expected growth backdrop so far this year. The Euro Area’s GDP was confirmed at a modest advance in Q4, and the big comedown in energy prices on the continent has quieted talk of recession. European natural gas prices are now back in line with oil prices (on an energy equivalence basis) for the first time since 2021, courtesy of the mild winter. Similar to stateside, the consensus call on Euro Area GDP has been boosted four ticks in the past month from no growth to 0.4% (we’re 0.6%). In contrast to the U.S., the inflation forecast has also been chopped by four ticks in the past month (on energy), to a still-lofty 5.5% pace for the year.

The U.K. and Japan are partial outliers, with the former still expected to post an outright decline in GDP this year (consensus is now -0.8%, albeit getting less negative), while the latter’s outlook has actually been fading a bit (consensus is now 1.1%, albeit the best in the G7). But the large upgrades to the U.S. and Europe, as well as the bump to China’s growth outlook from the abrupt reopening, have boosted our global growth estimate a few ticks for this year to 2.5%. Notably, the usually cautious IMF is calling for a decent 2.9% advance. Even that relatively upbeat call is still well below a “normal” year of 3.25%-to-3.50%, but the trend is heading in the right direction and moving away from recession terrain (anything below 2% for the world economy). The obvious downside to this good growth news is that it simply means that central banks will need to gird for an even longer, potentially tougher, fight to ultimately quell inflation.

Canada’s data calendar may have played a quiet second fiddle to the headline U.S. events this week, but the local bond market fully participated in the sell-off. After touching bottom in mid-January, the 10-year GoC yield has bounced more than 50 bps to its highest level in three months at nearly 3.3%. Canada’s curve remains even more deeply inverted than its Treasury cousin, with 2-year yields almost 85 bps above 10s. The big rise in rates reflects the growing view that the Bank of Canada may not be done hiking rates after all—a view that gathered momentum in the wake of Canada’s own January jobs jamboree. The market cooled its hawkish leanings a shade or two after Governor Macklem reinforced the point that the Bank is on pause in testimony to Senate. At the same time, Deputy Governor Beaudry not-so-subtly suggested that Canada could “follow a slightly different path to inflation normalization than our counterparts.” BoC Decoder: Just because the Fed is still hiking doesn’t mean we have to still be hiking.

Despite that guidance, the market still sees a strong chance of one more hike later this year. Our take on market pricing is that there is almost a 50% chance of an additional 50 bps of rate hikes this year, and slightly more than 50% odds of no further moves. (That is, it’s highly doubtful the Bank would see the need for one solitary 25 bp move—what’s the point of that?) Our view continues to be that the Bank is most likely to stay on hold for the rest of this year, with some upside risk. Much as the Governor suggested, the Canadian consumer and the housing market are still absorbing the rate shock of the past year, and we need to be patient for the tough medicine to work.

For a starter, we should at least await Canada’s January CPI before making any big changes in the BoC view. For the record, we expect Tuesday’s report to echo the U.S. result, with gasoline prices juicing a 0.7% m/m rise (a few ticks lower in s.a. terms), which will barely clip the annual rate (to 6.1%), and core inflation staying sticky at around 5%. The consensus on Canada’s average inflation rate for this year was also held steady at 3.7% this month (we’re at 4.0%), while the GDP call was upped two ticks to 0.6% (BMO is now 0.7%). Better, but not good.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.