GDP: Grossly Distorted Picture

Douglas Porter

January 27, 2023

The primary theme in financial markets so far in 2023 is a rising hope of a coveted soft landing for the advanced economies. Firming equities, narrowing credit spreads, fading bond yields and a softer U.S. dollar are all part of the package associated with inflation receding without the messy business of an outright recession. Calmer energy and food prices, along with an improving supply chain and moderating wage growth, are the ingredients that could help smooth the way forward.

But while investors are busily climbing on the soft-landing express, the economic data are not fully aboard. The recent narrative has been mostly about how resilient economies have proven to be, but there are plenty of signs that growth is indeed grinding slower in most major economies while inflation remains uncomfortably lofty. And, thus, it’s far too soon to conclude that a soft landing is at hand.

This week’s key economic data point fuelled the optimism, as U.S. real GDP surprised to the high side with a 2.9% advance in Q4, even as the core PCE deflator eased to a 4.4% y/y pace in December. But quarterly GDP is akin to an economist’s Rorschach test, with both bulls and bears always able to find something in the data to support their slant. And the bears were all over the fact that final sales to domestic private purchasers almost stalled in the quarter (0.2% a.r.), as consumer spending and business investment chilled while housing fell heavily again.

Suffice it to say that GDP was not a terribly helpful guide to how the U.S. economy was truly faring in 2022. Almost no one believed that things were nearly as weak as the reported two-quarter drop at the start of the year—i.e., precisely zero reputable analysts deemed the economy to be in recession at that point. But, by the same token, the average growth of just above 3% in the second half likely wildly overstated the strength of the economy. As it turns out, the full-year average growth rate of 2.1% was probably fairly close to the underlying reality, and just happens to be in line with the 20-year average growth rate. And sorting through the ample noise from the monthly data, we continue to expect a grind down in coming quarters under the heavy weight of the rapid rise in borrowing costs.

Yet, despite that coming reality, we are nudging up our full-year estimate for 2023 U.S. GDP growth half a point, from zero to 0.5%. Some of that reflects a stronger starting point, courtesy of the solid Q4, but some also is due to more favourable financial conditions and energy prices. While oil prices have backed up to around $80, natural gas prices are careening lower to below $3, or less than a third of last summer’s peak. But, make no mistake, a 0.5% rise in real GDP is a very soft outcome—only four of the past 40 years have seen growth weaker than that: 2020, 2008-09 and 1991. Even the tech wreck recession in 2001 saw GDP rise roughly 1%. And our call continues to look for two quarters of GDP decline, so just meeting the short-hand definition of recession.

For broadly similar reasons, we are upgrading our call on Canadian GDP growth by the same tally, from nil to 0.5% for 2023. While the official Q4 data won’t be available for another month, we suspect that next week’s flash reading will point to growth just over 1% (the BoC estimated 1.3% in its latest MPR), above our earlier estimate of 0.6%. While preliminary results suggest overall activity struggled in December, most indicators point to a milder decline than previously expected heading into 2023—especially the powerhouse job gains late last year. Still, it’s notable that job vacancies have begun to recede, and layoff notices are mounting by the day. So, we remain comfortable with our core view that the Canadian economy is still headed for a shallow recession this year.

The Bank of Canada appears to share at least some of that caution. While the Bank’s growth forecast was actually revised slightly higher for this year (at 1.0%, a half-point above our new call), Governor Macklem did not shy away from discussing the R-word in his press conference. And, the major revelation from this week’s rate announcement was the clarity of the shift to “pause” after the as-expected 25 bp hike. While a lengthy pause happens to fit our expectation to a T, it’s mildly surprising that the Bank didn’t leave itself a tad more optionality given the volatile inflation backdrop.

The Bank of Canada appears to share at least some of that caution. While the Bank’s growth forecast was actually revised slightly higher for this year (at 1.0%, a half-point above our new call), Governor Macklem did not shy away from discussing the R-word in his press conference. And, the major revelation from this week’s rate announcement was the clarity of the shift to “pause” after the as-expected 25 bp hike. While a lengthy pause happens to fit our expectation to a T, it’s mildly surprising that the Bank didn’t leave itself a tad more optionality given the volatile inflation backdrop.

Look for the Fed to also downshift to a 25 bp hike at next week’s FOMC, but to very much keep the door open to further such steps. After all, the prior set of dot plots looked for another 50 bps on top of the presumed hike next week (to a terminal rate of 5.00%-to-5.25%). Our view is that the gratifying moderation in headline and core inflation in recent months, along with fading growth, will be enough to convince the Fed to pull up just short of their earlier view on rates. Notably, the three-month trend on the core PCE deflator dipped to a 2.9% annualized rate, easing into the comfort zone of 1%-to-3% for the first time since the start of 2021 (i.e., even before transitory became a dirty word). Curiously, the University of Michigan survey finds that consumer expectations of five-year inflation also just happens to be 2.9%.

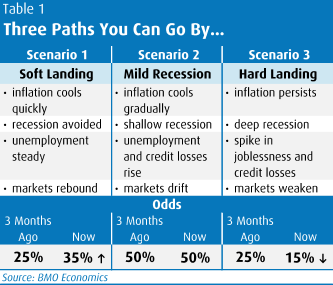

Pulling the strands together—markets, growth, inflation, and the rate outlook—what are the prospects for a soft landing? The attached table is a stylized (or simplified) look at the potential major scenarios for the economy in 2023, with a rough sense of the probabilities. The overriding point is that we continue to view the shallow recession scenario as the most likely outcome, with roughly 50% odds. However, the other main point is that the odds of a very bad outcome have receded, alongside a better inflation backdrop and calmer energy prices (especially in Europe), while the soft landing odds have risen. And, although providing only a glimmer of optimism, that shift may indeed be enough to have largely justified the moderate market recovery since the start of the year following an exceedingly tough 2022.

They say inflation is melting. As a counterpoint, we submit: Justin Bieber selling his song catalogue for US$200 million. For sure, Yummy is alone worth at least $10 mm, but for a grand total of 290 songs up to the end of 2021, that works out to almost $700k per pop. One does wonder about the staying power of classics such as Eenie Meenie, etc. A bit more seriously, the rally in many asset prices and valuations early this year—perhaps most famously for Bitcoin—does raise questions over whether central banks have done enough to truly quell inflation. Let’s just say that we may be just one energy/food price spike away from finding the answer is “no”.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.