If We Could Read Jay’s Mind…

Douglas Porter

May 5, 2023

Markets took a step back this week amid a renewed flare-up in regional bank selling and a dramatic tightening in the timeline for the debt ceiling. These twin ghosts overshadowed the two heavyweight economic developments of the FOMC decision and the April jobs report. The Fed made few ripples, hiking 25 bps as widely anticipated and hinting strongly at a pause, albeit certainly keeping the door open to the possibility of further hikes. And that possibility is still very much alive, with payroll gains landing yet again on the high side of expectations at 253,000, the jobless rate back at a cycle low of 3.4%, and wages accelerating to 4.4% y/y. Even with this show of strength, 10-year Treasuries ended the week almost where they began at a bit below 3.5%, and 2s were down 10 bps to below 4% on the earlier bank/debt limit concerns.

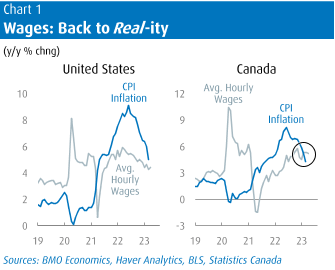

This week’s back-and-forth market move on the conflicting forces of a surprisingly resilient economy and financial instability was a microcosm of 2023. But unless and until the financial stresses spill over into the economy, the Fed will remain focused on the still-sturdy growth trends and well-above-target inflation. Next week brings the U.S. CPI for April, and it’s likely to reveal that headline inflation held steady at 5.0% y/y, while core will simmer down only slightly to 5.4%. While we do look for both measures to calm further to below a 4% pace by late this year, that will still be out of the Fed’s comfort zone. The latest still-solid trend in average hourly earnings points to some underlying persistence in core inflation pressures (Chart 1). Accordingly, we are maintaining our view that Fed rate hikes are now finished, but that rate cuts are unlikely until 2024.

The outlook is essentially the same for the Bank of Canada, with the overnight rate expected to hold steady at 4.5% until early next year. Governor Macklem offered a bit for both the hawks and doves at a fireside chat on Thursday. For the sharp-talon crew, he restated that inflation is simply far too hot for the Bank’s liking, and that the goal is 2% (not something mushy below 3%). For the milder crowd, he bluntly noted that if the U.S. banking strains spilled into tighter credit conditions, “we would need to take this into consideration as we set the policy rate”. Assisting the Bank’s inflation-fighting efforts a bit this week was a recovery in the Canadian dollar to well back above 74 cents (or $1.341/US$), up more than 1% even as oil prices fell 7% to the low-$70 range. The unusual combination of both a step back in energy costs and a firmer loonie is about as favourable as it gets for the inflation outlook. And, after a brief lull in the headline inflation reading for April (broadly similar to the U.S. story), Canada’s CPI is poised to tumble anew next month to the low-3% zone.

The outlook is essentially the same for the Bank of Canada, with the overnight rate expected to hold steady at 4.5% until early next year. Governor Macklem offered a bit for both the hawks and doves at a fireside chat on Thursday. For the sharp-talon crew, he restated that inflation is simply far too hot for the Bank’s liking, and that the goal is 2% (not something mushy below 3%). For the milder crowd, he bluntly noted that if the U.S. banking strains spilled into tighter credit conditions, “we would need to take this into consideration as we set the policy rate”. Assisting the Bank’s inflation-fighting efforts a bit this week was a recovery in the Canadian dollar to well back above 74 cents (or $1.341/US$), up more than 1% even as oil prices fell 7% to the low-$70 range. The unusual combination of both a step back in energy costs and a firmer loonie is about as favourable as it gets for the inflation outlook. And, after a brief lull in the headline inflation reading for April (broadly similar to the U.S. story), Canada’s CPI is poised to tumble anew next month to the low-3% zone.

That’s the good news for Canada’s inflation backdrop. The less good news is that the economy continues to roll along, the job market remains extraordinarily tight, and wage pressures remain strong. While the details of April’s jobs report were less sparkly than the 41,400 headline advance, with part-time positions accounting for the entire rise, the reality is that the unemployment rate is locked in at just 5.0%. The gaudy job tallies are no doubt being boosted by very strong population growth, but even the share of those aged 15-64 with a job (i.e., the employment rate) is now at an all-time high of nearly 76%. A common query we field is: “Where did all the workers go?” Answer: they are working.

The Bank has often fretted that the combination of wage gains in the 4%-to-5% zone, coupled with no productivity growth, is inconsistent with returning inflation to the 2% target. Well, how about average hourly wage increases of more than 5% (they were 5.2% y/y in April) coupled with negative productivity (as reported in the U.S. for Q1 and almost certainly to be echoed in Canada for the quarter)? With inflation receding, wage gains have turned positive again in real terms in Canada (Chart 1), a trend that the recent public sector agreement will do little to reverse.

But above and beyond a surprisingly resilient labour market is perhaps an even bigger potential surprise—a revival in the housing market. We suggested a week ago that close attention should be paid to the April home sales data for “any indications that things are turning higher”. Turning higher… how quaint. It seems that activity came roaring back, with the Toronto region looking to have posted one of its largest seasonally adjusted monthly sales increases on record, and prices bouncing higher as well. While perhaps not quite as torrid elsewhere, that general trend was repeated in most major cities. Prices are still well down from the year-ago highs, but sales/new listings are now pointing due north.

It is still very much an open debate whether this is just a spring blip for housing, which will eventually succumb to the delayed reality of the massive rate hikes, or if this is the start of (yet another) upward climb. Our official view is mostly in the middle of those extremes, but the risks are leaning to the stronger side of things at the moment. A hot job market, robust income growth, rollicking population increases, a tight rental market, some clarity on the rate front—all roads point to revival. But of course, the real estate sector has to be very careful on what it wishes for: a housing rebound could ultimately prompt the Bank back into rate-hiking mode. As we have said many times before, if the most interest-rate sensitive sector of the economy is holding up well, then are interest rates nearly high enough yet? To ask the question is to answer it.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.