Inflection for Inflation

Douglas Porter

July 22, 2022

When it comes to inflation, no news is good news—sadly, we have a downpour of inflation news these days. Roughly three months ago we opined that the last thing a central banker wants to see is inflation as the top headline news item of the day. Let’s take that back. Even worse for said central banker is having to come on TV themselves to explain why inflation is so high and what they are doing about it, and that becoming news item number one. But that’s precisely what unfolded this week, as BoC Governor Macklem fielded questions on the latest four-decade high on Canada’s CPI of 8.1%, while President Lagarde explained the ECB’s first rate hike in 11 years amid the Euro Area’s 8.6% inflation rate. Australia is now probing into the RBA’s “embarrassing” forecast misfire on inflation, while Britain is top of the pops with a 9.4% headline rate and at clear and present danger of pushing into double-digit terrain.

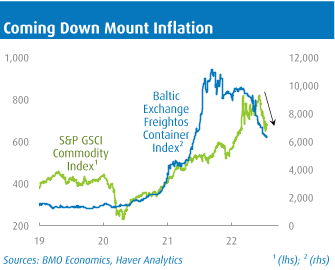

Yet, yet, there are a variety of encouraging signs that inflation may be at an inflection point, and that some of the initial underlying drivers are now backing off. Most obviously, commodity prices are simmering down broadly. A basket of key commodity prices has melted almost 20% in the past six weeks alone from the early June peak, and is now almost precisely right back to levels prevailing in the days prior to the invasion of Ukraine. Perhaps most notably is that even with a rebound on Friday, U.S. wholesale gasoline prices have dropped more than $1/gallon (or roughly 25%), reversing more than two-thirds of the post-invasion spike. As well, grain prices are backing down amid an improving outlook for the North American crop and a reported deal between Russia and Ukraine on getting food shipments through the Black Sea. Wheat futures are now a bit below pre-invasion levels, and down about 30% from the average levels reached in May.

Beyond those clear signals, there are a variety of more subtle signs that the tide may be turning. Previously feverish demand for all sorts of goods is now calming globally, reducing pressures on supply chains. Freight rates thus continue to climb down the mountain, with the Baltic Container Index now down from year-ago levels (it was up more than 100% y/y just three months ago). Retail inventories are climbing, leading to discounting in some sectors. Meantime, the previously roaring housing market has turned from lion to kitty cat in a matter of months in both the U.S. and Canada, and is set to undercut price pressures after fueling them for the past year.

And just as inflation has grown—literally—like a weed in the past year, it is entirely possible that it can retreat almost as quickly. We have not seen inflation ramp up so rapidly as it has in 2022 since pre-Elvis days. Picking Canada as an example, the 8.1% June headline CPI result compares with a 3.0% pace in June/21. That 5.1 percentage point leap is the largest rise in inflation in a year since 1951. The only other episode that came remotely close to this kind of dramatic acceleration was in (gulp) the mid-1970s, when oil and grain prices were also on a rocket ride. However, the good news, such as it is, is that even in that high-inflation environment, the headline rate did retreat heavily after firing higher.

Even with this mildly encouraging backdrop, the arithmetic remains challenging, if not ugly, for the next six months. While Governor Macklem sought to assure Canadians that current high inflation readings would not last long, he also allowed that it could maintain a “7 handle” through the rest of this year. Barring a deep dive in commodities, we would fully concur. If anything, after a lull in next month’s release, inflation may climb a second peak later this year before relenting in earnest in 2023. Note that even with a slightly more moderate monthly rise in June, both the 3- and 6-month annualized trends in seasonally adjusted prices are running much hotter than the headline pace at a towering 10.6% and 10.3%, respectively. But it’s always darkest before the dawn, right?

Financial markets are certainly becoming believers that the worst is over for inflation, if not this minute then at least in the very near future. Bond yields came down across the board this week, and remained heavily inverted in the 2s10s space. Ten-year Treasuries dropped 14 bps to below 2.8% after testing the 3.5% threshold as recently as mid-June—unsurprisingly, around the time commodities were peaking. While some of this steep drop in yields reflects mounting concerns over the global growth outlook, equities generally thrived this week amid solid earnings. Both the S&P 500 and TSX rose more than 3%, with the former punching back above its 50-day moving average.

The solid week for financial markets was in spite of prospects for another meaty 75 bp Fed rate hike next week and Thursday’s 50 bp step by the ECB. It’s probably impolite to point out that the last three ECB rate-hike cycles have been into the teeth of crises—the euro crisis (2011), the GFC (2008), and the tech wreck (2000).

We’ll just end by noting that all of these central banks are playing catch-up to none other than the Bank of Canada, which has both: a) hiked by more than any other major central bank so far (a cumulative 225 bps) and, b) to the highest overnight rate (along with the RBNZ at 2.50%). And this is despite the fact that Canada’s lofty inflation rate is actually less lofty than any of the U.S., Britain, or Euro Area. So, while the Bank of Canada is coming under some heat for woefully underestimating inflation, it has been positively proactive compared to its major counterparts.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.