Macro Forecasting in Turbulent Times

While the COVID-19 pandemic, inflation, supply chain snarls and a counterintuitive labour shortage snappily tagged the ‘Great Resignation’ have made the job of economic forecasting dodgier than it has been since the great forecasting fail of 2008, we’re not quite yet in a William Goldman economy in which nobody knows anything. With some extreme forecasting pro tips and a scenic detour into the horse manure crisis of 1898, here are Kevin Lynch and Paul Deegan.

Kevin Lynch and Paul Deegan

“Prediction is very difficult, especially if it’s about the future.” So said both Niels Bohr, the Danish Nobel laureate in physics, and Yankees legend Yogi Berra. These days, when it comes to forecasting, economists are making the weatherman look good.

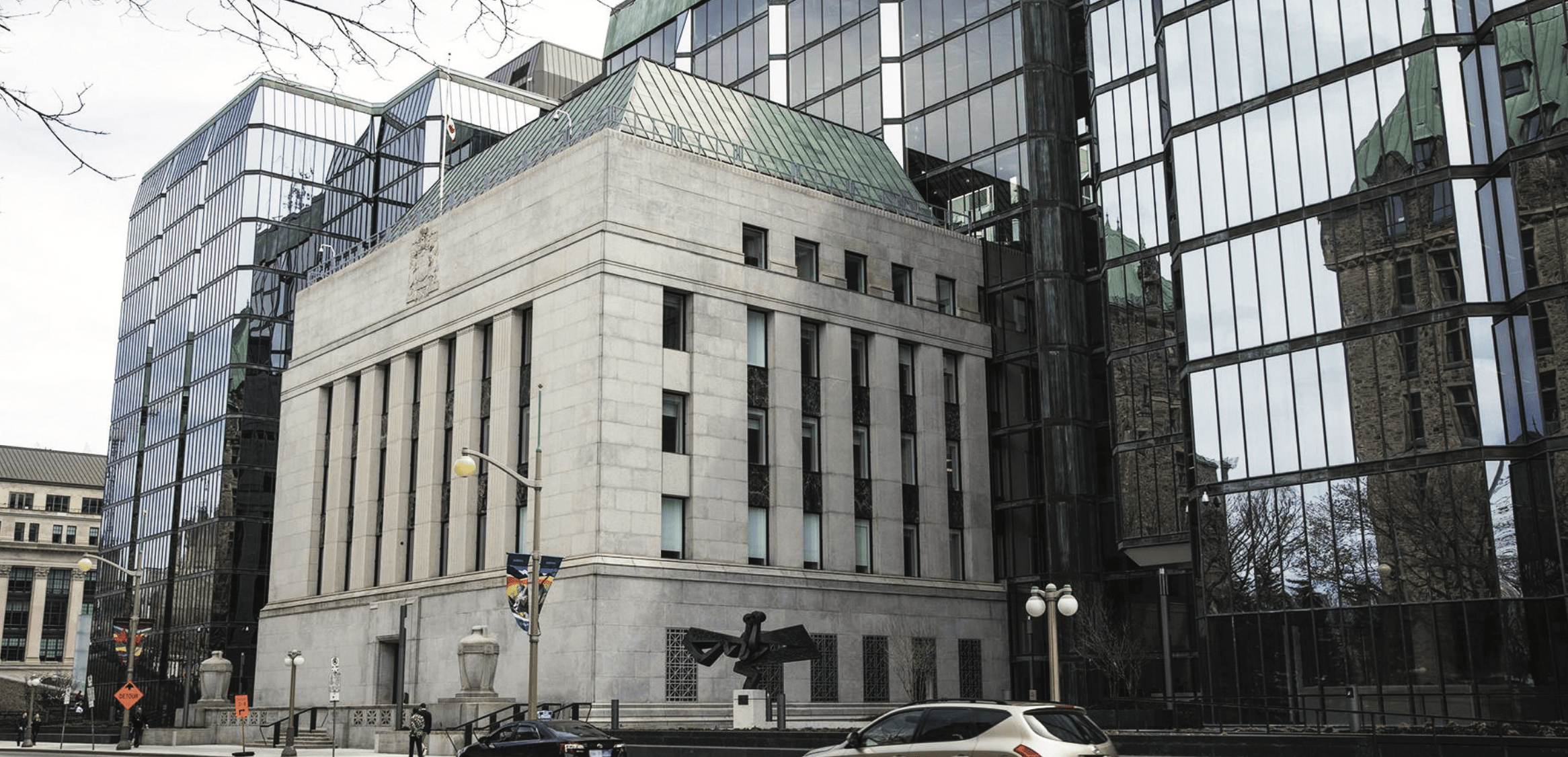

In late January, the International Monetary Fund (IMF) chopped its 2022 growth forecasts, citing rising inflation, supply chain disruptions, and the Omicron COVID-19 variant as the reasons. This view was corroborated by the Bank of Canada as it updated its forecast and policy guidance, and then amplified by the Federal Reserve, which threw a penalty flag on inflation and drove financial markets into a tizzy at the prospect of rising interest rates. What is most striking in the recent release of projections by central banks and international financial institutions, however, is not the revisions to their forecast numbers but the reversals in their policy analyses in less than six months.

Last year, according to these same institutions, the inflation surge was “transitory”, related to temporary factors which would quickly unwind, and did not pose a major risk to the economy. Supply chain disruptions, one of those temporary factors, are now viewed as a more intractable and structural problem. Scarcity of workers — the “great resignation” phenomenon — is another temporary factor that turns out to be much more complex and possibly long-lasting. Omicron is not the first COVID variant, but forecasters became surprisingly sanguine about the possibility of another variant capable of disrupting economic activity. And debt, which was downplayed as either a constraint or a risk for governments, is now a flashing yellow light with higher interest rates on the immediate horizon.

The real question these revised forecasts highlight is not how much lower GDP growth may be in 2022, or how long higher inflation will be with us, but whether the economy is fundamentally less predictable than these sophisticated forecast models suggest. There are echoes here of the global financial crisis, where “black swan events” were trotted out to explain why policy analysts and forecasters, who tend to predict near the consensus, completely missed the systemic risk of a massive accumulation of collateralized debt instruments.

In a disruptive and changing world – one characterized by turbulence, uncertainty, novelty, and ambiguity – conventional forecasting may have more limits than normal, with all this implies for government policy and business planning. A period of rampant technological change; societal shifts in equality and cohesion; seismic changes in geopolitical power and competition; or the emergence of a global pandemic would all be consistent with these disruptive conditions. They also describe rather well our world today.

So, what is to be done to avoid these unsettling forecast flip-flops? When disruptive conditions are prevalent, researchers at the IMF (Behar and Hlatshwayo, 2021) suggest complementing traditional macro forecasting, whose forecast models typically revert to past behaviours and relationships, with “strategic foresight”, which they define as the systematic exploration of alternative assumptions to better inform present decisions.

In practice, strategic foresight is complex. It can range from paying more attention to the micro assumptions underlying key aspects of traditional forecast models, to examining longer term megatrends and their possible short-term impacts on behaviours and expectations, to horizon scanning, which attempts to connect seemingly unconnected developments, to scenario exercises that test prevailing assumptions and wisdom by articulating various plausible futures, or to more esoteric game theory simulations.

The payoff is a better understanding of the implicit risks of “known unknowns” embedded in the public forecasts of governments and central banks as well as the identification of future “unknown unknowns” that deserve greater attention today.

The lack of strategic foresight to assist forecasting and decision making is a shortcoming of long standing. The Harvard Business Review (“Why Business Leaders Need to Read More Science Fiction”, 2017) cites the case of an international conference of urban planners in New York City in 1898 to tackle the greatest urban problem of the day: horse manure.

Various incremental solutions were put forward, none of which could deal with the problem’s scale and stench, but no one considered the new technology of horseless carriages. And yet, by 1912, cars and trucks outnumbered horses on the streets of New York, and the problem was being solved by a novel invention which had been hiding in plain sight.

Back to the updated IMF forecast for the global economy and why it changed. World economic growth was revised significantly downwards to 4.4 percent in 2022 (4.1 percent for Canada), largely because of sharp cuts to the outlook for the United States and China.

The culprits were unanticipated pandemic-related supply disruptions in both countries; inflation proving to be anything but temporary in the US, and debt sustainability weighing down the critical property development sector in China. Labour is constraining growth in the US, Canada, and other advanced economies, not because of lack of demand – job openings are plentiful – but due to a lack of supply.

Workers are scarce, but are we missing a clear micro understanding of why or to what extent work will itself change, with workers shifting to hybrid models including permanent remote work? Supply chains are intensely global, heavily concentrated in China for durable goods and parts, less resilient to shocks like the pandemic than anyone imagined and susceptible to zero COVID policies in China and worker shortages in North America and Europe.

The clear take-away is that forecasts, whether from the IMF, central banks or governments, will be inherently less reliable until we get a better handle on these and other emerging issues.

For Canada, we need senior officials to get out of the “Ottawa bubble” and develop a hands-on feel for the real economy, talking to people where they work, about what they do, and how their sector can be made more competitive and resilient. We need to invest in the analytic capacity, the data, and the agility in the government to analyze complex micro issues as they emerge and to undertake sophisticated strategic foresight studies. And, government needs to be willing to transparently share this analysis with the public to encourage rigorous debate and common understanding. If not, in these disruptive times, forecast updates driven by policy reversals may soon be accompanied by the Britney Spears song, “Oops!… I did it again.”

Contributing Writer Kevin Lynch was Clerk of the Privy Council and vice chair of BMO Financial Group.

Paul Deegan was Deputy Executive Director of the National Economic Council at the Clinton White House, and is a former BMO and CN Rail executive.