Markets Sense Pivot After First-Half Divot

Douglas Porter

July 29, 2022

Does it sometimes seem like the laws of economic gravity have been repealed since 2020? In that period, we have seen record budget deficits coincide with record low bond yields, negative oil prices suddenly morph into record fuel costs, the Canadian dollar and other commodity currencies weakening in the face of record resource prices, unemployment rates hit both multi-decade highs and lows, and the ECB clinging to negative interest rates even as inflation punched above 8%. The fun-house mirror effect remained in full force this week, as virtually everyone downplayed talk of a recession despite the Q2 drop in U.S. GDP. In fact, financial markets rallied strongly in the face of another meaty 75 bp Fed rate hike and the second quarterly decline in GDP—it’s safe to say that in days of yore (i.e., 2019) these developments would not normally have been greeted warmly by investors.

The reason for the buoyant market performance in the face of ostensibly bad news is that hope springs eternal that much slower activity will cause inflation to crack, and soon. And, in turn, this combination of weak growth and calmer inflation will prompt a Fed pivot. While Chair Powell duly delivered all the obligatory messages about the inflation fight being paramount during his press conference, all the market heard is that the Fed is now fully data dependent and that there may be a case for smaller rate hikes ahead. Markets took this morsel and ran with it, slashing the amount of further Fed rate hikes in 2022 and building in even larger cuts in 2023, driving down yields across the board.

Just as one example, 5-year Treasury yields peaked above 3.6% in mid-June and then promptly cascaded lower by almost 100 bps (with half the drop just since the middle of last week) before stabilizing around 2.7% on Friday. The big bond rally, and just the sense that the Fed may be somewhat less aggressive—or even that peak Fed is approaching—triggered another week of robust equity market gains, led by the most speculative end of the spectrum. Generally decent earnings from the tech giants contributed to the bounce. The S&P 500 was headed for almost a 4% rise on the week and 8% for all of July, while the Nasdaq was on course for a hefty 11% rebound for the month—both marking the best monthly gains since 2020, after an exceptionally sour first half to the year.

We have no major quarrel with market pricing on the Fed through the remainder of this year—our year-end terminal rate call of 3.50%-to-3.75% (i.e., 125 bps further to go) is now just a tad above the market’s view of roughly another 100 bps of rate hikes. Where we are much less convinced is on the quick turnaround to hefty rate cuts in 2023; market pricing is looking at more than 50 bps of cuts. No doubt, growth will be struggling mightily next year, with the 0.9% dip in Q2 GDP perhaps just a taste of what’s to come. Alas, that provides zero guarantee that inflation will go quietly into the night. While we wrote at length about a possible inflection point for inflation last week, the issue is that while inflation may soon top out, it could remain uncomfortably high for an extended period.

And even as markets were rallying on the possibility of a Fed pivot, there were some unsettling developments on the inflation front. First, energy prices rebounded broadly this week, largely reversing a brief respite. By Friday, WTI had pushed back above US$100/barrel, while wholesale gasoline prices popped 12%, taking them right back to levels prevailing at the end of June. It was almost an identical picture for wheat futures, which bounced 10% amid intense skepticism that Russia will abide by the recent deal on shipments through the Black Sea.

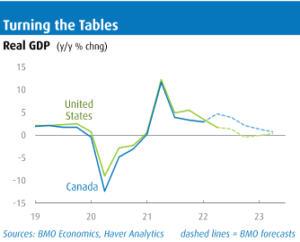

The comparison between flailing U.S. GDP and solid Canadian growth could not be starker over the first half of the year. While the U.S. fell at a 1.25% pace in H1, Canada rose at an average clip of roughly 3.75%, a 5 percentage point gap. This huge divergence mostly reflects a catch-up phase for Canada amid a much-delayed reopening.

Beyond today’s commodity prices, there is also the small matter that most measures of core inflation continue to print large. For example, the core PCE (Core Personal Consumption Expenditure Price Index) deflator—the Fed’s favoured metric—broke higher in June at +0.6% m/m, nudging up the yearly rate to 4.8%. The three-month trend is even a bit higher at 5.1% annualized, pointing to no quick backing down of underlying inflation. The employment cost index, arguably the best wage measure, rose a meaty 1.3% in Q2, lifting it 5.0% above year-ago levels. For perspective, this index was reliably in the 2%-to-3% range in the years before the pandemic.

Finally, on the GDP data, while almost all of the attention was trained on the weak real outcome, nominal GDP was quietly surging at a 7.8% a.r. in Q2 and is now up a whopping 9.3% y/y. To be clear, nominal GDP measures the increase in actual dollars spent across the entire economy, and this is what drives incomes, government revenues, and corporate earnings. True, the bulk of the annual rise is due to piping hot inflation—the GDP deflator has surged 7.5% y/y. But while bond markets are busily slashing yields back below 3%, we’ll just note that over the past half century there has been a long-standing close relationship between the level of interest rates and the growth of nominal GDP—indeed, over the past 50 years, U.S. nominal GDP growth has averaged 6.1%, and 10-year Treasury yields have averaged—wait for it—6.1%. Suffice it to say, today’s bond yields are baking in a massive slowdown in both inflation and real growth. Not to put too fine a point on it, but we’ll take the “over” on Fed pricing for 2023.

The comparison between flailing U.S. GDP and solid Canadian growth could not be starker over the first half of the year. While the U.S. fell at a 1.25% pace in H1, Canada rose at an average clip of roughly 3.75%, a 5 percentage point gap. This huge divergence mostly reflects a catch-up phase for Canada amid a much-delayed reopening. (It’s a similar story for the Euro Area, which managed to surprise with a solid 2.8% Q2 GDP advance, even with raging energy costs, thanks to a recovery in tourism.) As the chart indicates, Q2 will likely mark the first time since pre-pandemic days that Canadian GDP growth will pull ahead of the U.S. on a yearly basis. We look for the deep divergence to narrow over the second half of the year, as the reopening bounce is now mostly built back in, and rising rates and lofty inflation will clip growth almost everywhere. After an average growth rate of 3.4% this year, we look for Canadian GDP to cool to just 1.0% in 2023.

To complete the circle on the laws of economic gravity, one big reason for the pronounced weakness of U.S. growth in the first half was inventories. Slower inventory accumulation alone chopped 2 percentage points from Q2 GDP, after shaving it by 0.4 ppts in Q1. But how to square this big slice with mounting warnings from large retailers that inventories are growing uncomfortably large? Well, the shorthand is that it’s the change in the change in inventories that matters, and after managing to rebuild the shelves in the second half of last year, cooling spending for goods prompted U.S. firms to suddenly slow that rebuilding effort through the spring. That process was later to develop across the Canadian economy, but may begin to weigh in the months ahead.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.