Nord-Storm

Douglas Porter

March 3, 2023

And on the ninth meeting, the Bank rested. Following a year-long blast, which saw interest rates hiked in eight consecutive meetings by a cumulative 425 basis points, markets fully expect the Bank of Canada to hold steady at next week’s decision. While this Governing Council has shown little concern about crossing markets in the past, it’s not going to dump its conditional pause before the first gate. It’s true that the global economy has had a strong run of data since the decision to go on pause, but Canada’s domestic story has been a bit more two-sided. Market pricing still leans towards the possibility of additional hiking, but no longer has another full rate increase built in for later this year. And our view remains that overnight rates will stay on hold through the rest of 2023—albeit with the risk to the upside.

Within a few weeks of publicly announcing a move to the sidelines, the Bank was promptly greeted with one of the hottest employment reports on record, followed by a series of surprisingly strong retail, wholesale and manufacturing sales reports for January. Coming on top of rollicking U.S. results for the same month, and it suddenly looked like the Bank had been woefully premature in pausing. However, January can often be a wonky month for economic data, since it is so heavily adjusted for seasonality, and especially when the season itself is wonky (i.e., an extraordinarily warm month). We always said: “Wait for February”. The Bank won’t have the benefit of either of the North American jobs reports for next week’s meeting, but the real decisions will be made in the following meetings in any event.

The cause for pause has found some support in more recent developments. First, in contrast to stronger-than-expected inflation readings in the U.S. and Europe to start the year, Canada’s CPI was milder than expected. Some core measures have even seen the three-month trend approach 3%. Next, the Q4 GDP report was staggeringly below expectations at flat—whereas the Bank was expecting 1.3% annualized growth, and consensus was even higher (no doubt swayed by StatCan’s flash estimate of 1.6%). True, the preliminary estimate for January pointed to a 0.3% rise in monthly GDP, but that followed a 0.1% dip in December, and was probably weather-aided. Finally, there are growing signs that the consumer may be struggling under the weight of past rate hikes.

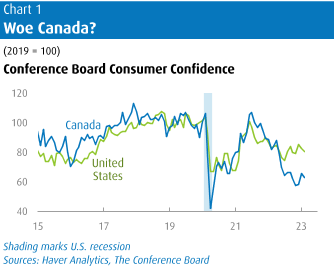

One of the rare parts of the Canadian economy that remained relatively firm late last year was the consumer. Even as headline growth was flat, real consumption churned out a decent 2.0% advance in Q4, and was up 4.8% after inflation for all of last year (following a 5.1% snapback in 2021). A massive increase in government transfer payments in Q4 provided support for disposable income, helping boost the savings rate a percentage point to 6.0%. But still-strong inflation and the weight of higher interest rates may now be finally taking its toll. After a bounce at the start of the year, consumer confidence retreated again in February, and is at levels normally reserved for recessionary times (Chart 1). Auto sales were up 5% from year-ago levels last month, but they still marked the second-lowest February in the past 10 years. Consumer insolvencies rose 33% y/y in January (although they’re still 20% below Jan/20). And then there was the abrupt announcement that Nordstrom is closing its 13 Canadian stores, with a loss of 2,500 jobs. While this may say more about the particulars of the tough Canadian retail market, rather than the health of the consumer, it nevertheless added to the sense of a chillier economy.

On balance, one can quibble with the wisdom of the Bank being so public about its decision to pause when there are so many deep uncertainties about both the inflation and growth outlook. And, there is the risk that the pause could act as a loud all-clear signal for the housing market, even when the risks are definitely not all cleared. The very early readings from the largest cities suggest that home sales picked up in seasonally adjusted terms in February (albeit from very low levels). But the reality is that a lengthy pause is likely a prudent path at this point, to more fully assess the impact of the massive tightening of the past year. After all, every economics student knows that it takes 12-18 months for rate hikes to fully affect the economy, and this week marks the one-year anniversary of rate hike #1.

On balance, one can quibble with the wisdom of the Bank being so public about its decision to pause when there are so many deep uncertainties about both the inflation and growth outlook. And, there is the risk that the pause could act as a loud all-clear signal for the housing market, even when the risks are definitely not all cleared. The very early readings from the largest cities suggest that home sales picked up in seasonally adjusted terms in February (albeit from very low levels). But the reality is that a lengthy pause is likely a prudent path at this point, to more fully assess the impact of the massive tightening of the past year. After all, every economics student knows that it takes 12-18 months for rate hikes to fully affect the economy, and this week marks the one-year anniversary of rate hike #1.

Rare is the week that a Euro Area data point stands above all others. But the region’s preliminary estimate for February CPI was not what the doctor ordered. Coming in three ticks above expectations, the meaty 0.8% m/m rise left the annual rate at 8.5%, down just one tick from the prior month. Expectations for all economies were that headline inflation rates would fall heavily in the first half of 2023 as the large gains of a year ago dropped out of the calculation. Well, the direction is right, but the descent is proving tedious. More unnerving was that core CPI rose three ticks to 5.6%, matching the U.S. January pace. If the latter dips even a tick in February (data due March 14), this would leave the Euro Area with higher core inflation than stateside for the first time in more than a decade.

The high-side inflation surprise in Europe is an issue for the rest of the world for at least two reasons. First, it may be a signal for others that inflation pressures generally remain stubborn, which may well be reflected in coming February CPI data elsewhere. But it also keeps the flame squarely on the ECB to keep going aggressively—and 50 bp hikes look likely at the next two meetings, at least. In turn, this puts renewed pressure on global yields, which saw the 10-year Treasury drive above 4% this week, while like-dated GoCs moved above 3.4%, up more than 60 bps just since the Bank paused. To paraphrase Trotsky, the Bank may not be interested in moving rates, but moving rates are interesting to the Bank.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.