Ottawa’s Fiscal Update: Revenue Side Story

Douglas Porter, Robert Kavcic and Benjamin Reitzes

December 14, 2021

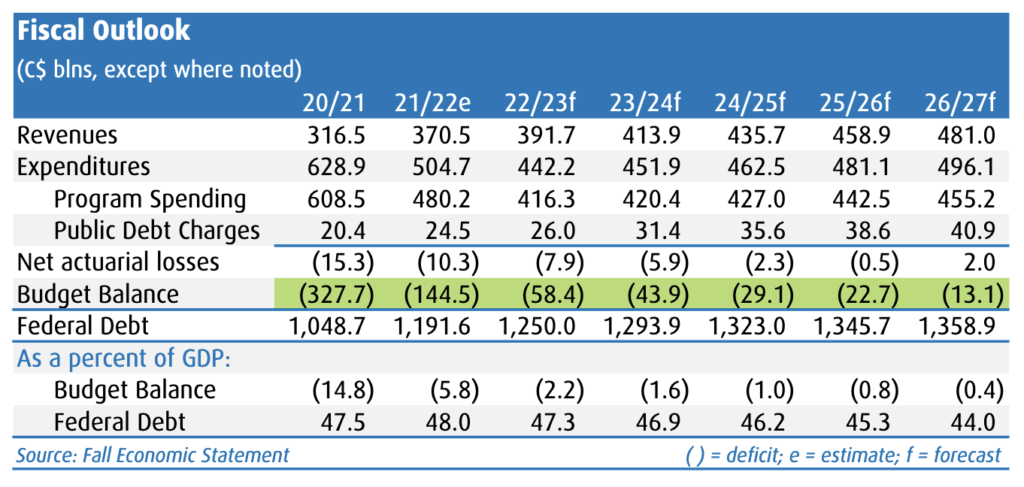

Ottawa’s fiscal update reveals a somewhat firmer budgetary picture, with a big upside surprise on revenues only partly offset by a variety of new spending measures. However, the broad brush remains the same, and this update is simply that—an update, with only a few moderate measures, and more significant fiscal steps still to come in next year’s budget. This year’s deficit is now expected to clock in at $144.5 billion (versus a Budget estimate of $154.7 billion), or 5.8 per cent of GDP. Last year’s gap is now officially pegged at a record $327.7 billion (14.8 per cent of GDP), lighter than the most recent official estimate of $354 billion, and down more than $50 billion from the peak estimate a year ago. In contrast to the provinces, there was no massive deficit drop on a revenue windfall, as new spending requirements have absorbed some of the upside. For example, today’s document set aside $4.5 billion to deal with Omicron, $5 billion for the B.C. floods, and $4 billion this year for First Nation child welfare. Even so, the fiscal outlook for the next few years is mildly reassuring, with the key debt/GDP ratio now expected to hold below 50 per cent throughout the forecast horizon.

Finance looks for the underlying deficit to narrow substantially in the coming fiscal year (starts April 1, 2022) to $58.4 billion, or 2.2 per cent of GDP, pending further support measures if new widespread restrictions prove necessary. Looking further afield, the shortfall is expected to moderate to $43.9 billion in the next year (1.6 per cent of GDP, versus a pre-virus trend of around 1 per cent of GDP). However, this relatively quick drop in the deficit does not factor in some more negative potential scenarios for the economy (under various levels of restrictions); Finance’s slower recovery forecast points to a deficit of just above $51 billion in FY23/24 (i.e., close to prior estimates).

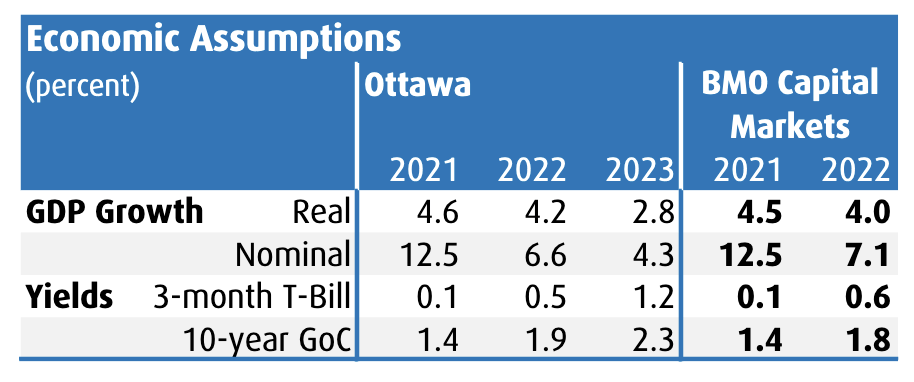

There are a few factors that may lift the underlying deficit. First, the economic scenario is generally reasonable, but seems a tad on the optimistic side for 2022, with the likelihood of a short-term dent to growth from new potential restrictions. Fiscal projections are based on an assumed 4.6 per cent rebound in GDP this year and then a 4.2 per cent advance next year; both of those are slightly above our latest call. Second, there is a high degree of uncertainty around this forecast, especially with the emergence of Omicron, and some potential additional spending requirements could weigh.

Combined with some measures announced since Budget 2021, there is $28.4 billion worth of new spending rolling out. The key takeaway is that almost all of the new spending is situational (i.e., pandemic and flood related), leaving policy and election-platform measures for Budget 2022.

Here are some of the largest items:

- Various COVID-related spending measures total $13.0 billion, with $3.3 billion of that total newly announced in this update. This includes items such as rapid tests, border

testing and operations, in addition to past program extensions. - Relief funding of $5 billion this fiscal year for British Columbia flooding.

- An additional $4.5 billion set aside to deal with Omicron.

- A total of $4 billion this fiscal year and beyond for First Nation support.

Economic Outlook

Ottawa is basing this fiscal update on 4.6 per cent real GDP growth this year, followed by 4.2 per cent growth in 2022 and a moderation to 2.8 per cent by 2023. That is a touch above our call of 4.5 per cent this year and 4.0 per cent next year, though we suspect momentum will hold somewhat firmer by 2023. Of course, nominal GDP has been the big factor helping to drive the upside in revenues, and this year’s 12.5 per cent surge is expected to gradually fade (though growth will remain strong, and we are above Ottawa’s call in nominal terms).

We would also note that since the spring, growth in both in Canada and much of the rest of the world has been a bit slower than widely expected. And part of that dimmer-than-expected outcome has been driven by supply chain issues, the drought, and various restrictions. Omicron uncertainty further clouds the outlook heading into the new year.

Medium-Term Fiscal Outlook

The medium-term fiscal outlook is also somewhat improved relative to the budget plan. While next year’s deficit is very close to the prior mark, FY23/24 and beyond now run roughly $7 billion per year smaller. Ottawa also outlines faster and slower growth scenarios, the most optimistic of which starts off with 5 per cent real GDP growth next year. In that scenario, the deficit tracks $6-to-$8 billion better than currently expected, but remains in the red by FY26/27. In other words, Ottawa does not see any scenario where balanced books come into view.

While discussion of fiscal anchors has now long been dropped, the debt-to-GDP ratio peaks this year at 48 per cent, before gradually falling to 44 per cent by the end of the forecast

horizon in FY26/27. As was the case pre-COVID, this might again be Ottawa’s guide, just at a much higher level than before the pandemic.

Debt Management Strategy Update

The Debt Management Strategy Update reflects the changes that have taken place in the Government of Canada bond auctions. Total financial requirements are projected to fall $35 bln, which cuts bond issuance by $31 bln (to $255 bln) and the treasury bills stock by $28 bln from level forecast in the Budget. Lower borrowing needs are in line with the cuts to auction sizes already put in place, with the drop coming across the curve (2-year through 30-year). Real return bonds, ultra-long bonds and green bonds sizes are unchanged. Notably, bond issuance remains skewed to the long end, accounting for 45 per cent of total issuance.

The Bottom Line: Ottawa’s fiscal update presents a slightly healthier picture, thanks to the strength in revenues flowing from robust income growth. Combined with strong nominal GDP growth, the debt/GDP ratio is now seen peaking in the current fiscal year at 48 per cent before gradually fading. Previously, this year’s budget had looked for this ratio to only just dip below the 50 per cent threshold by the five-year mark. However, the government apparently plans to stick to its election platform, so next year’s budget will provide a more complete measure of the medium-term fiscal landscape. At that point we will also have a much better bead on the impact of the latest variant, and just how sustained the current run of inflation has proven to be, and the extent to which the Bank of Canada will need to respond. So, while today’s fiscal news can be characterized as moderately positive, the main message is “stay tuned”.

Douglas Porter is chief economist, Robert Kavcic is a senior economist, and Benjamin Reitzes is director of Canadian Rates & Macro Strategist with BMO Financial Group.