Rumours of Growth’s Demise…

December 2, 2022

Douglas Porter

…Have Been Greatly Exaggerated.

After spending much of the week firmly locked in rally mode in the wake of Chair Powell’s latest musings, markets received a bit of a rude surprise from an upstart U.S. payrolls report on Friday. Ignoring the bond bulls’ script of fading growth and ebbing inflation, jobs instead posted a hearty 263,000 advance in November, coupled with a sturdy 5.1% y/y average hourly earnings gain. Both landed squarely on the strong side of expectations, and briefly cut short what had been a fast and furious Treasury rally. Still, after the dust settled, U.S. yields ended the week moderately lower, while the S&P 500 eked out a modest gain even with a late-week pullback.

In fairness, the solid payroll gain ran against the grain of generally softening U.S. economic data, which did indeed mostly point to a cooling growth backdrop. To cite a few highlights from a busy week, the manufacturing ISM fell to 49.0 in November, the first foray below the 50 waterline since the pandemic depths in 2020. What really caught the eye in that release was the prices paid index of just 43.0, or half its level this past March. As well, consumer confidence receded in November, auto sales pulled back after a nice October bounce, the trade deficit swelled again, job openings eased, and home sales continued southbound. The cooling was by no means universal, however, as jobless claims calmed back down to 225,000 last week and spending and income remained firm in October.

As a result of these mixed messages, we have nudged up our forecast for U.S. Q4 GDP growth to 1.5% a.r. (from 1.0%), after the three-tick upward revision to the Q3 actual to 2.9%. The call for this quarter happens to line up well with current tracking for total hours worked. We mentioned last week that the combination of calmer commodity prices and surprising late-year economic resiliency were casting at least some doubt on the (shallow) recession call for 2023. Naturally, oil prices promptly rebounded 6% to around $81, in anticipation of this weekend’s OPEC+ meeting, highlighting the ongoing risks from the energy complex. Even so, we would not quarrel with Powell’s suggestion this week that there still is a possible path for a soft landing for the economy—we just happen to believe that the chances of finding that friendly path are about 25%.

What really got the market going was Powell’s comment that the pace of rate hikes would soon slow, possibly—i.e., most probably—at the mid-December FOMC meeting. While that had long been baked in the cake by market pricing, and in our official call of a 50 bp hike, it nevertheless unleashed the latest buying frenzy for both bonds and stocks. Apparently learning little from the ill-fated late summer rally, 10-year Treasuries plunged from a midweek high of almost 3.8% to a low of 3.5% just prior to the jobs data. Some Fed speakers attempted to calm the fires just ahead of the blackout period, but yields remain a hefty 70 bps below their October highs.

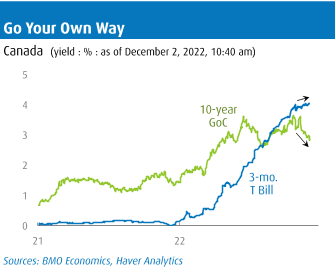

Canadian 10-year GoC yields also ended the week lower. At around 2.85%, they are down a towering 80 bps from their October peak, and back to levels they first visited this cycle way back in late April. At that time, the Bank of Canada’s overnight target rate was a mere 1.0%, compared with its current 3.75%—and rising—level. While GoC yields also briefly rebounded after the U.S. jobs data, the domestic employment report hit the consensus bullseye with a small gain of 10,100. Still, the details were solid, as big gains were posted in full-time and private sector positions, wages stayed firm at 5.6% y/y, and the unemployment rate surprisingly dipped a tick to just 5.1%. Note that Quebec’s jobless rate plunged to a nation-wide low of 3.8%—the first time any province outside of the Prairies has been below a 4% unemployment rate… ever.

Canadian 10-year GoC yields also ended the week lower. At around 2.85%, they are down a towering 80 bps from their October peak, and back to levels they first visited this cycle way back in late April. At that time, the Bank of Canada’s overnight target rate was a mere 1.0%, compared with its current 3.75%—and rising—level. While GoC yields also briefly rebounded after the U.S. jobs data, the domestic employment report hit the consensus bullseye with a small gain of 10,100. Still, the details were solid, as big gains were posted in full-time and private sector positions, wages stayed firm at 5.6% y/y, and the unemployment rate surprisingly dipped a tick to just 5.1%. Note that Quebec’s jobless rate plunged to a nation-wide low of 3.8%—the first time any province outside of the Prairies has been below a 4% unemployment rate… ever.

Prior to the jobs data, we learned earlier this week that the Canadian economy expanded much faster than expected in Q3 at 2.9% (weirdly matching the U.S. GDP pace to the decimal place). Many were quick to downplay the result, pointing to an outright decline in final domestic demand and nominal GDP in the quarter, and an early flat reading for October activity. Countering that, note that final sales were solid at 2.7% (exports popped in Q3), and the flash monthly GDP reports have consistently understated actual growth in the past five months.

Taking these factors into account, we also nudged up our estimate for Canadian Q4 GDP, albeit to a mild 0.6% annualized pace (from nil). Total hours worked are currently on pace to advance at more than a 1.5% clip in the quarter, so the risk is for a further upward revision. This hasn’t significantly altered our view on next year’s outlook, but—similar to the U.S. theme—the chances of the economy managing to avoid an outright downturn have edged up in light of the late-year resiliency.

The jobs and GDP data complete the Bank of Canada’s naughty and nice list ahead of next week’s final rate decision of 2022. After a string of surprises this year—the Bank defied the consensus three times in seven meetings—the market and analysts are again split, guaranteeing at least another modest surprise on Wednesday. To wit, the C.D. Howe’s Monetary Policy Council was precisely cleaved on their opinion, with six members calling for a 50 bp hike and six others calling for a milder 25 bp move. Markets are similarly torn, albeit with perhaps a tiny bias to door number two. We lean to the 50 bp option, but readily admit that there is a decent case for a slower pace of hikes.

Where we more firmly disagree with others is on the endpoint for rates (we’re higher than most at 4.50%). Simply put, our core view remains steadfast that underlying price pressures are going to prove more challenging to wring out of the system, and that the risk is thus that rates will need to go higher than the consensus expects. Bringing it back to the meat of Powell’s message this week, rates are going to need to stay higher for longer, and that likely applies to Canada as well.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.