Seems Very Bullish… for Bonds

Douglas Porter

March 10, 2023

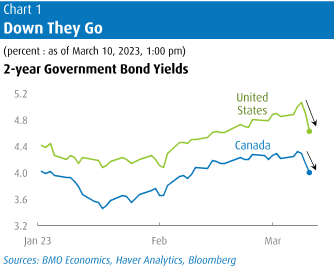

Had someone told you last Friday that this week would bring fire-breathing testimony from Jay Powell and a hefty 311,000 February payroll advance, your natural response probably would not have been to buy bonds. But, as it happens, that would have been precisely the correct response as the troubles at SVB Financial have overshadowed other fundamental factors. After pushing back above the 4% threshold earlier in the week on tough talk from the Fed Chair, 10-year Treasuries cascaded lower in the final two sessions, falling roughly 30 bps to around 3.7%. At the same time, the S&P 500 fell about 4%, and is now clinging to small gains for all of 2023, while the Dow is firmly in the red on a year-to-date basis.

Amid the rapid-fire rate hikes of the past year, many financial commentators were steadily looking for any cracks to emerge, as almost inevitably happens amid every serious monetary tightening cycle. Given the massive 450 bps of hikes in under a year, perhaps the big surprise was the near absence of such cracks—at least until now. The Silicon Valley Bank’s woes may not have been directly related to the ultra-aggressive rate hikes, but they are clearly a side effect. Arriving at the same time as the implosion of crypto lender Silvergate Bank, markets wasted little time in selling first and asking questions about broader ramifications later, with financial stocks especially hit hard this week.

And just like that, all the talk about a possible 50 bp hike by the Fed later this month, and/or a higher terminal rate of possibly 6% or more, have been brushed aside. Suddenly, our below-market call of just two additional 25 bp hikes by the Fed looks entirely realistic. To be clear, this much milder take on the Fed has nothing to do with this week’s slate of economic events. The February jobs report was generally solid, but the details weren’t quite as strong as the headline payroll gain. The companion household survey calmed to a 177,000 rise, and the unemployment rate edged up two ticks to 3.6%. Aggregate hours dipped, and average hourly earnings just nudged up 0.2% (and 4.6% y/y). On its own, the mixed jobs report likely would have made little net impact on Fed expectations.

The sudden turn in market pricing has also swept up the Bank of Canada. This week’s rate decision and commentary delivered no surprises, with the BoC becoming the first major central bank to move to the sidelines after a year-long rate hike campaign. However, the Bank reinforced its tightening bias, a message that was amplified in remarks by Senior Deputy Governor Rogers. And given Powell’s tough talk and a skidding Canadian dollar, markets were leaning heavily to the Bank restarting rate hikes later this year. That all vanished on Friday, even despite a surprisingly sturdy domestic jobs report, with markets now mostly back in line with our official call of no further hikes from the BoC in 2023.

The fast turn is notable, since the economic data are beginning to suggest the Bank was premature in its decision to pause. February’s job gain of 21,800 was unremarkable on its own, but is a show of strength in combination with the massive 150,000 advance in the prior month. And, unlike the U.S. report, there were flashes of heat in both wages and hours worked. The Bank specifically noted this week that wages were rising between 4% and 5%, but they perked up to a 5.4% y/y clip in February. Meantime, total hours worked, a rough proxy for GDP, rose 0.6% m/m and is headed for a 4% annualized rise for all of Q1. That compares with the BoC’s latest assumption of just 0.5% GDP growth in the quarter. January’s trade result also flashed strength, with export volumes popping 5%.

The fast turn is notable, since the economic data are beginning to suggest the Bank was premature in its decision to pause. February’s job gain of 21,800 was unremarkable on its own, but is a show of strength in combination with the massive 150,000 advance in the prior month. And, unlike the U.S. report, there were flashes of heat in both wages and hours worked. The Bank specifically noted this week that wages were rising between 4% and 5%, but they perked up to a 5.4% y/y clip in February. Meantime, total hours worked, a rough proxy for GDP, rose 0.6% m/m and is headed for a 4% annualized rise for all of Q1. That compares with the BoC’s latest assumption of just 0.5% GDP growth in the quarter. January’s trade result also flashed strength, with export volumes popping 5%.

While the Canadian data were busy running hot, the Canadian dollar turned ice cold. The loonie could not catch a major break this week, hit in succession by Powell’s stern remarks, the Bank’s hold, and then the broader market swoon on SVB. A pullback in oil and gas prices piled on. While the mix of jobs reports on Friday gave it a tiny reprieve (Canada solid, U.S. not overwhelmingly strong), the currency still ended the week down almost 1.5% at 72.5 cents (nearly $1.38/US$). That wasn’t quite the wallop that the Aussie dollar sustained (down more than 2% even with a 25 bp RBA rate hike), but was much weaker than the euro, pound, or yen, which all firmed slightly on net. Of course, the “currency” that was truly shellacked this week was bitcoin—deservedly so—with the crypto unit dropping by double digits to below $20,000.

Meanwhile, back on the economic front, attention will now quickly turn to next Tuesday’s U.S. CPI report for February. The stakes are high, as usual, with the sturdy January result having left everyone on edge. Unnervingly, our expectations are for almost an instant replay of the prior result, with headline and core prices expected to rise 0.4%. The overall figure is mild enough to cut the annual inflation rate at least a few ticks to just above 6%, but core will only nudge down to a still-concerning 5.5%. Almost as important will be retail sales the next day, to help judge whether the 3% spike in January was a statistical mirage, or a true burst of consumer strength; we suspect mostly the former, with sales expected to dip. Overall, this mixed bag of data and the news around SVB will likely keep the Fed on the milder side at the March decision, and we look for a 25 bp hike at that time.

The large U.S. banks found some support on Friday, even as the FDIC took control of SVB. Our U.S. bank analyst, James Fotheringham, deemed the bank’s woes as idiosyncratic in nature. He suggested that the deposit base and security holdings of SVB were not a typical characteristic of most other regional banks, although some may face pressures. Still, as Janet Yellen put it, in an understated fashion, it’s “a matter of concern” when banks face losses. We, and no doubt the Fed, will stay tuned.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.