The Dark Side of the Boom

Douglas Porter

March 24, 2023

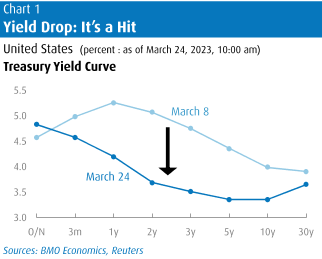

Markets are on the backfoot again amid ongoing contagion concerns from the rapidly morphing banking sector stresses. The focus returned to Europe on Friday, with the big German banks coming under the spotlight of sellers. While broader equities are struggling to find direction, bond yields are having no such doubts as they drive relentlessly lower. In little more than the short span of just two weeks, two-year Treasury yields have cascaded down by almost 150 bps. To put such a move in perspective, there have only been two times in the past 35 years that yields have dropped as much as 100 bps in a few weeks—after 9/11 and in the early days of the pandemic—and this episode has gone well beyond those two historic events.

The latest typhoon whipped up soon after each of the Fed, the Swiss National Bank, and the Bank of England were comfortable enough with conditions to proceed with as-expected rate hikes this week. Markets now seriously doubt central banks will remain so brave for long; along with Chair Powell’s mixed remarks at this week’s press conference and milder forward guidance in the statement, the latest flare-up has the market attaching very low odds to any further Fed rate hikes, and is pricing in an aggressive 100 bps of cuts in the second half of the year. We will simply reiterate that the bar for rate cuts is exceptionally high this time—what’s different is that the starting point for inflation is 6% in the U.S., 8.5% for the ECB, 5.2% for the BoC, and a towering 10.4% for the BoE.

Whether the central banks blink and then pivot all comes down to how the economy responds to the recent series of events. This week’s Focus Feature delves more deeply into that subject, but to this point we suspect the resulting damage isn’t enough to drive rate cuts anytime soon. Rough estimates of how much the financial stress translates to Fed tightening run the gamut from 25 bps to more than 100 bps. It’s notable that the FOMC’s dot plot was almost unchanged from December, suggesting members viewed the coming credit tightening as precisely enough to offset the previously believed upside risks, at least prior to the latest brush fire.

With everyone now looking at history for a guide, and perhaps too much focus on 2008, we’ll look even further back. This month marks the 50th anniversary of “The Dark Side of the Moon”; in honour of that landmark release, we’ll let Pink Floyd analyze the events of the past three weeks. In the order of the songs:

Speak to Me: Fed Chair Jay Powell was breathing fire at his Senate testimony on Tuesday March 7, warning that rates may need to go significantly higher to corral inflation. His remarks sparked plenty of talk that fed funds could be headed above 6%. Amid the barrage of questions, none were on banking sector stability.

Breathe: The fire-breathing was a bit less intense at the House testimony on March 8, but yields nevertheless rose further on what may well mark the peak for this cycle for maturities from 3 months to 3 years. The Bank of Canada decided that same day to pause for breath by becoming the first major central bank to move to the sidelines. It now looks like the stay will be long.

On the Run: Soon thereafter, the run on deposits on SVB began and gathered momentum rapidly. Even with another surprisingly strong rise in employment, yields began their historic tumble.

Time: Barely hours after the deep woes at SVB fully came to light, the FDIC was taking over the institution, the second-largest bank failure in U.S. history.

The Great Gig in the Sky: Signature Bank soon became the third-biggest U.S. bank failure, reinforcing market concerns that others could be at risk of expiring.

Money: Treasury, the Fed and the FDIC rapidly rolled out the extensive support package, including the Bank Term Funding Program. The BTFP was tapped for $41.7 billion in the latest week, and in the past two weeks the Fed has lent a total of $339 billion to the banking system. While this may ultimately lift the money supply, at least temporarily, Chair Powell asserted that the latest moves are not QE, since they aren’t aimed at stimulating the economy—and borrowers are paying full freight for the funds.

Us and Them: Concerns were not contained to the U.S., with Switzerland hastily pushing Credit Suisse into the arms of UBS this past weekend. While the markets were generally relieved by the shotgun wedding, the (surprisingly harsh) treatment of AT1 bondholders rattled some corners of the market. Equities retained some value while AT1s were knocked down to zero, prompting regulators almost everywhere to state that would definitely not be a pattern elsewhere.

Any Colour You Like: Green, red, black… many markets cannot decide what to do with the mix of banking sector stress but a much tamer profile for future Fed rate hikes. As an example, the S&P 500 is down by less than 1% since the day yields peaked on March 8th, while the Nasdaq is up 4%, and bitcoin and gold have thrived. Meantime, energy is in retreat on prospects of weaker growth, with oil down more than 10%, and the TSX has thus dropped almost 5%.

Brain Damage: Amid the turmoil, some are deeply questioning the wisdom of central banks marching ahead with rate hikes. In perhaps the greatest show of bravery, after probably the most traumatic week ever for the Swiss banking sector, the SNB still pressed ahead with a (rare) 50 bp hike to 1.50% on Thursday. Recall, that key rate had been negative as recently as last summer, as it had been since early 2015. And, in a bit of cognitive dissonance, the Swiss franc has managed to strengthen in the past two weeks, in a true flight-to-safety move.

Eclipse: The question for central bankers, for analysts, for markets—even after the latest series of rate hikes—is still whether the turmoil will eclipse the need to fight inflation for policymakers. St. Louis Fed President Bullard may have put it best: “While markets are obsessed by the banking stress, the Fed is obsessed with inflation”.

One statistic that may have been somewhat overshadowed this week by events, but is crucial for the long-run outlook, was the latest quarterly population estimate in Canada. In the most recent quarter, the population rose by 0.7% to 39.6 million. In the past year, that marks an astonishing record rise of 1 million (or up 2.7%). In recent years, the growth rate has been skewed by the stop-start of COVID, and the spike in the past year clearly exaggerates the underlying trend. Still, over the past three years, which would look through the pandemic distortions, Canada’s population has grown at a 1.44% annual rate, exactly matching the robust pace in the three years prior to 2020.

A few points on these strong increases: First, the rapid growth is headed in precisely the opposite direction of the U.S., where the population has grown at a 0.5% annual pace over the past three years, or nearly a full point below Canada. Second, all of Canada’s economic stats have to be considered in a somewhat different light amid such strong population trends. For example, employment needs to grow by almost 25,000 per month just to keep it rising in line with population trends. And, last year’s 2.1% Q4/Q4 rise in real GDP suddenly looks quite soft stacked up against a 2.7% rise in population (i.e., negative in per capita terms). Finally, we have long pushed back against the assertion that the root of Canada’s housing squeeze was a supply issue—but if the population keeps growing at anywhere close to 1 million per year, yes you are indeed going to have a shortage of supply, because we just can’t build units that fast.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.