The Economics and Politics of Canada’s Housing Supply Issue

Prime Minister Justin Trudeau and Quebec Premier François Legault announcing a federal-provincial agreement on the Housing Accelerator Fund, Nov. 9, 2023/Sean Fraser X

Prime Minister Justin Trudeau and Quebec Premier François Legault announcing a federal-provincial agreement on the Housing Accelerator Fund, Nov. 9, 2023/Sean Fraser X

By Matthew Mei

November 9, 2023

Canada is facing a significant housing shortage.

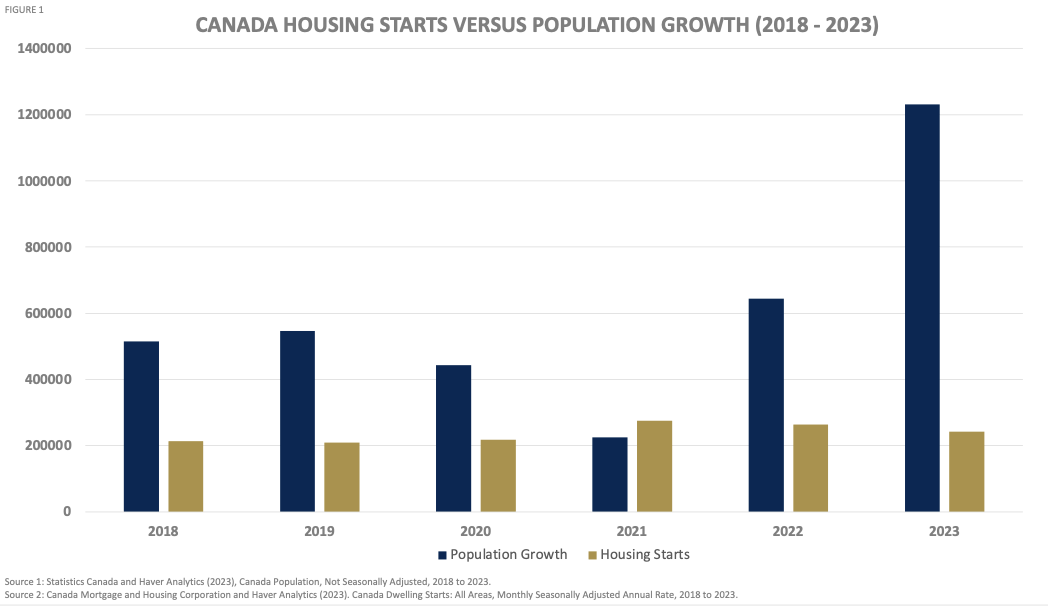

Our population has increasesd significantly, growing by an average of 600,000 people annually over the past five years, reaching 40 million in total. Home construction has struggled to keep pace with population growth, peaking at 320,000 new homes in 2022. We now have a medium to long-term supply shortage. Less housing means higher prices and an affordability challenge. We need to build. At the same time, investment in housing has fallen off in the face of rising interest rates and high construction costs, which have tempered short-term housing demand and construction.

Addressing this issue will likely be a policy focal point in the next two federal elections. The problem is too big and complex to go away soon. Governments at all levels and of all political stripes are engaged. There are cyclical and structural challenges. Fasten your seat belts and get ready for a long ride.

Given the size of the housing problem, the best policy medicine is to restore long-term balance in headline market indicators. This means reducing inflation and inflation expectations to the Bank of Canada target of 2 percent inflation. This will allow the Bank of Canada to lower the policy interest rate. Variable and fixed mortgage rates will fall. High inflation and high interest rates are hurting investment at a time when we need to build. Restoring market fundamentals is crucial for a sustainable housing situation.

Right or wrong, it is not surprising that many political leaders are distressed by the impacts of high interest rates and have waded into the policy space of the Bank of Canada. Economic and political fortunes are on the line.

At the federal level, all political parties want to address the housing issue. Good public policy increases supply and addresses affordability. Good public policy is good politics.

The (Liberal) government has launched multiple initiatives, including the Housing Accelerator Fund, subsidy supports, and the elimination of GST on all new rental construction. The Conservative Opposition proposes the Building Homes Not Bureaucracy Act . It calls for cities to boost annual home construction by 15 percent and offers bonus funding for the cities that surpass this target. Penalties for NIMBYism, removal of the gatekeepers at CMHC, removal of the GST of new homes with rental prices below market value are included. The NDP is calling for a parliamentary study to repurpose government properties into social housing.

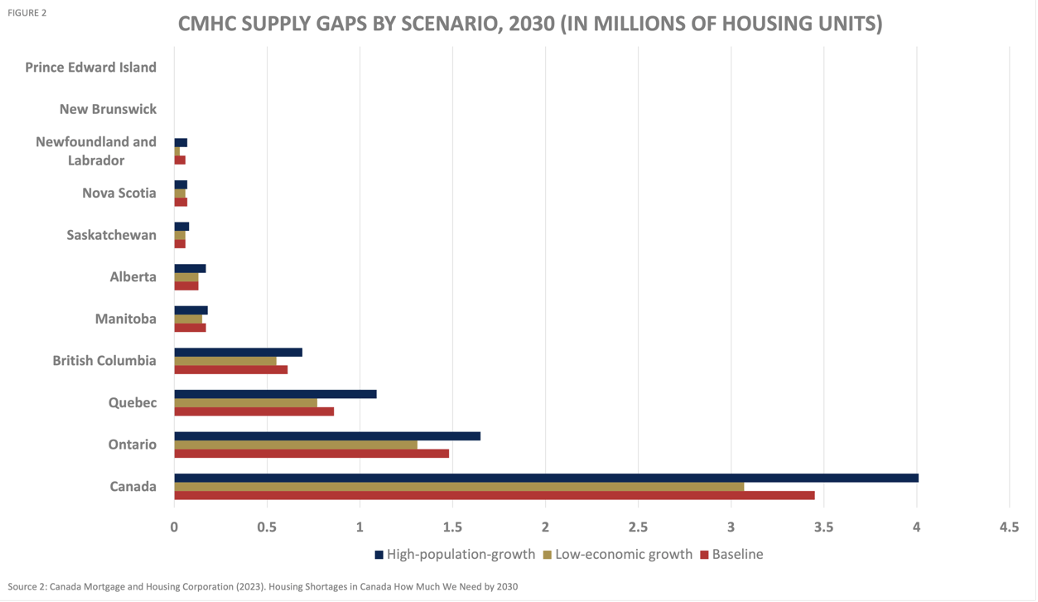

A recent Canadian Mortgage and Housing Corporation (CMHC) report suggests that Canada is on track for a 3-to-4-million housing unit shortfall by 2030, with fundamental factors such as high interest rates and production costs contributing to the problem. The same report has two housing gap scenarios based on different economic growth projections. In the high-economic growth scenario, the housing gap would increase from a 3.5 to 4-million-unit gap if current immigration trends are maintained until 2030. In the low-economic-growth scenario where economic growth is weaker and current immigration policies end, the housing supply gap is anticipated to decrease from 3.5 to 3.1 million units.

Higher immigration is driving recent population growth, which in turn fuels the demand for housing. Recently, Immigration Minister Marc Miller tabled new immigration targets for the next three years in Parliament, with about 500,000 new permanent residents per year until 2026. With restoration of macro fundamentals, these historically high immigration levels will push up demand and drive up housing prices and rental rates across the country.

One of the most pressing policy issues exacerbating the housing crisis and prospects for economic stability is the real estate bubble that afflicted large metropolitian areas including Toronto and Vancouver. The trilemma combination of low interest rates, speculative investment and foreign investment drove up real estate prices to exorbitant and unsustainable levels. The bubble still exists notwithstanding recent price dampening caused by higher interest rates.

Whether the air will be let out of the bubble slowly is a major question mark on the Canadian economic outlook. The carry costs of a mortgage in Canada (i.e., mortgage payments divided by disposable income) are trending steeply and quickly upwards. In the ongoing recession outlook debate, the difference between a soft landing and hard landing will likely be decided in the housing sector.

The current state of Canada’s housing sector has the potential to hurt short term economic stability, medium term political fortunes and long term quality of life. As a policy issue it demands full political attention and has staying power.

Matthew Mei is a fourth-year economics student at the University of Ottawa. He is taking a research course at the Institute of Fiscal Studies and Democracy (IFSD).