The Future of Money

Of all the innovations of the Fourth Industrial Revolution, cryptocurrency is arguably among the most controversial. As society processes more clearly the costs and benefits of digitization from social media to normalized surveillance to disinformation, the adoption of virtual money as central bank digital currency looms as a likelihood. Former Parliamentary Budget Officer and current president of the Institute of Fiscal Studies and Democracy Kevin Page says it’s not a matter of ‘if’ but of ‘when’.

Kevin Page

Randy Newman, the American songwriter, released a song in 1988 called “It’s Money That Matters”. In our turbulent world, we are spending a lot of time talking about money. Inflation rates are rising. Economists say this happens when too much money is chasing too few goods. Interest rates, the cost of using someone else’s money, are rising. In response to rising inflation and interest rates, Finance Minister Chrystia Freeland delivered a speech June 16th on affordability. Household budgets are being stretched. We need more money.

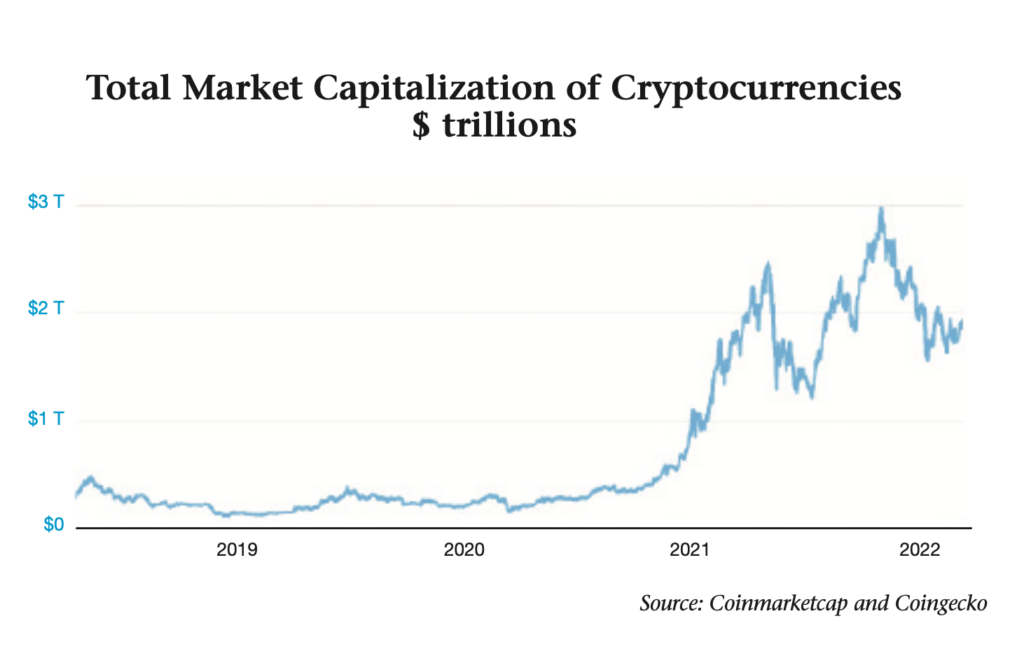

Equity and crypto markets are in a tailspin. People are losing money – savings and investments. Global losses in recent months are in the trillions of dollars. These markets do not do well in periods of great uncertainty which is generated in large part by concerns that it will take a recession to break inflation expectations. Large declines in the value of cryptocurrencies such as Bitcoin are raising existential questions about the future of digital money and assets.

Fortunately, a historical perspective would suggest that bear markets, large percentage declines in the value of assets, are temporary. They come and go. Policy makers and markets adjust because it is in their interests to do so. Bear markets are followed by bull markets. Patience is a virtue that can pay dividends.

Lost in the fog of market turbulence is the question about the future of money. Market societies depend on monetary systems for the free exchange of goods and services. We need a medium of exchange, a unit of account, and a store of value.

Bill Gates, the American businessman and philanthropist, once said, “We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next 10.” Notwithstanding recent declines in crypto markets, cryptocurrencies (or assets) have experienced significant growth over the past decade. Central banks around the world are moving forward with projects on digital currencies. While it is still early going, the stage is being set for monetary digital transformation.

In ten years, it is a fair bet that private market capitalization for cryptocurrencies (or assets) will be multiplied manyfold. The vision and economic case for growth is strong. Similarly, it is a fair bet that most central banks in advanced economies will have digital currencies in operation at both the retail (consumer) and wholesale (financial sector) levels. Households and businesses will demand the efficiencies provided by digitalization.

Yes, it is a fair bet that private and public digital monies will continue to co-exist and grow. It is a monkey wrench for central bank policymakers. Quantitative easing or restricting (changes in the central bank balance sheet) may be less easy and effective in a world with more private crypto transactions. Administration and regulation of modern financial systems, including the role played by commercial banks, will face change. Technological innovation and competition are good but disruptive.

Your wallet will likely become digital. In the years ahead, if you want to e-transfer money to charge up your electric vehicle or buy a pizza, it is likely that money will be withdrawn directly from your account at the Bank of Canada (yes, our central bank and not the commercial bank on the street corner).

If your company wants to do business with a new overseas supplier, you will have a choice in the increasingly digital world: A traditional path using your commercial bank – a financial intermediary; another path using private cryptocurrencies – with little to no financial intermediation. Either way, the time to complete the transaction will be digital time – fast.

The principal advantages of digital money, both future central bank digital currency (CBDC) or private market cryptocurrencies like Bitcoin (the most popular) are related to speed, payment tracking transparency and lower transaction costs. Proponents of crypto currencies using blockchain technologies will play up additional advantages related to accessibility, peer-to-peer transactions (no intermediaries), and protection agains fraud (personal information not shared).

The principal disadvantages of digital money relate to security (beware of hackers) and uncertainty (innovation). Critics of cryptocurrencies would add the lack of regulation (important for trust), value volatility (decentralized markets), and potential use by criminal elements (money laundering and funding illegal activities).

The principal disadvantages of digital money relate to security (beware of hackers) and uncertainty (innovation). Critics of cryptocurrencies would add the lack of regulation (important for trust), value volatility (decentralized markets), and potential use by criminal elements (money laundering and funding illegal activities).

While private market cryptocurrencies (or assets) will crowd into financial markets, it would be a bad bet to assume central banks will have a diminished role in a digital money world. Private decentralized markets will not be able to compete with independent central banks when it comes to tradition and trust. We need central banks to control inflation and stabilize unstable economies.

Conservative leadership candidate Pierre Poilievre made news when he advocated for private market cryptocurrency as a hedge against inflation. News alert: market capitalization of cryptocurrency has tumbled, down more than a third from recent highs in 2021. While the crypto market may become more stable as the size of the market grows, it is still too small and volatile to be a confident hedge against price inflation.

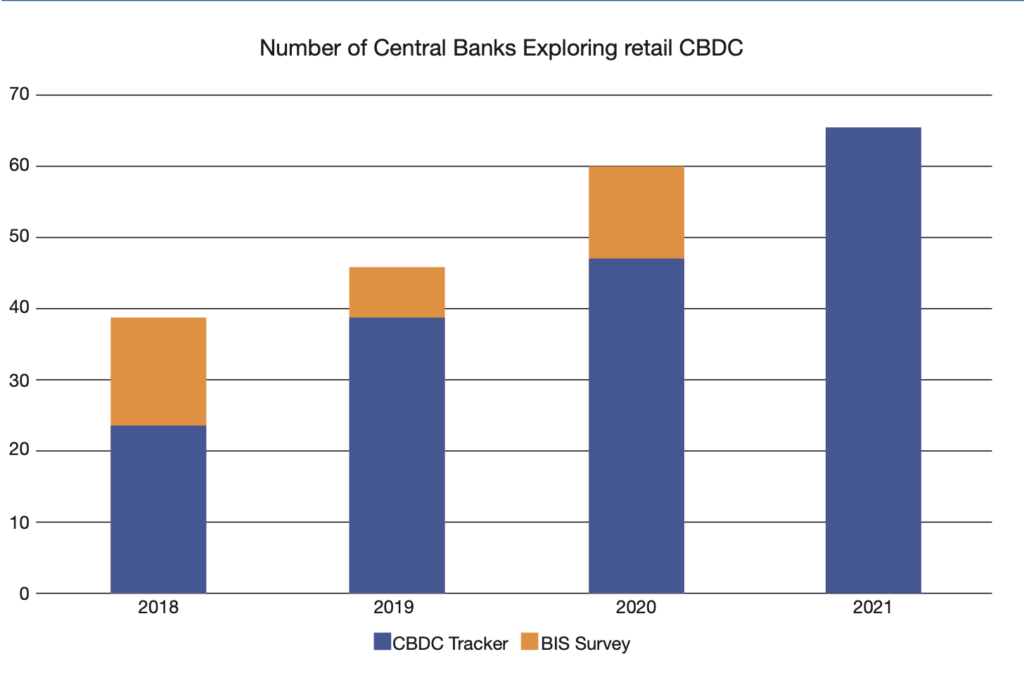

Poilievre also made news when he argued that he would not be a proponent of a Bank of Canada digital currency (CBDC). This just in: More than 60 central banks around the world are exploring the development of digital currencies. The genie is out of the bottle. The Bank of Canada is in good company.

One of the major reasons for the development of digital currencies is the foundational technology known as blockchain. The technology sits on top of the internet. It was developed in large part for Bitcoin – its first application was a crypto currency. It is relatively new, launched in 2009.

Blockchain is a distributed database. Communication occurs directly between peers (clients). There is no central node (user). No intermediators. Each user on a blockchain has a long (30 character plus) address. Transactions are between blockchain addresses. Records cannot be altered. It is fast. Blockchain transactions can be programmed (which opens up possibilities for development).

Internet protocols, developed in the early 1970s, took decades before households and businesses could fully exploit opportunities (e.g., Amazon, Zoom, etc.). Technology experts believe it will take many years and lots of experimentation for technologies like blockchain to become transformative (from bitcoin payments to private online ledgers to self-executing contracts). The future of digital currencies will rest on technology development and adoption.

The vision of crypto currencies like Bitcoin is compelling and transformative. A virtual currency. A payments system outside the control of an external entity (no intermediators). Bought and sold on exchanges. Total quantities (Bitcoin – 21 million coins) on exchanges are known and fixed. There are opportunities to tie the value of a crypto to a fiat currency like the US dollar. Encrypted with blockchain – data is stored in the blocks and verified by validators called miners.

The vision of crypto currencies like Bitcoin is compelling and transformative. A virtual currency. A payments system outside the control of an external entity (no intermediators). Bought and sold on exchanges. Total quantities (Bitcoin – 21 million coins) on exchanges are known and fixed. There are opportunities to tie the value of a crypto to a fiat currency like the US dollar. Encrypted with blockchain – data is stored in the blocks and verified by validators called miners.

It is estimated by Earthweb that there are about 300 million people using crypto world-wide in 2022. There are thousands of currencies and a few hundred exchanges. The top 10 cryptocurrencies make up more than 85 percent of total market value. These are both big and small numbers. Big because there has been enormous development since 2009. Small relative to global financial markets. Development continues.

In 2021, Benoît Cœuré, head of the Bank of International Settlements (BIS) Innovation Hub, said “The financial system is shifting under our feet”. Cryptocurrencies will challenge the business model of commercial banks. He said that CBDCs must preserve the best of the current system (e.g., safety, liquidity, integrity) while allowing for innovation. The Bank of Canada is working with other central banks on this mission. It is a good bet that Bill Gates is right and we will underestimate the change that will occur in the next 10 years. Change is coming.

Kevin Page is the President of the Institute of Fiscal Studies and Democracy at the University of Ottawa, former Parliamentary Budget Officer and a contributing writer for Policy Magazine