Warm Winter, Cooling Costs

Douglas Porter

January 6, 2023

Following an exceedingly challenging 2022, markets began the new year in a cautious mood, with equities mixed and long-term yields falling amid lingering concerns on the global economic outlook and some signs that underlying inflation pressures are easing. Still, the facts on the ground—the latest batch of economic data—mostly suggest that the North American economy continued to chug along at the tail end of last year. While markets focused on a relatively mild wage reading in the U.S. December payroll report and a dip in the services ISM to below 50, the bigger picture was that job gains remain solid (+223,000) and the unemployment rate is as tight as ever (down a tick to 3.5%). This followed a three-month low in weekly jobless claims and a surprisingly sturdy 10.5 million job openings result for November. Even so, Treasuries rallied hard in the opening week, with 10-year yields falling more than 30 bps to below 3.6%, and 2s dipping 15 bps to below 4.3%.

The bond rally was supported by a heavy-duty retreat in energy costs, with both oil and natural gas prices falling heavily to open the year. After powering back above $80 at the end of last year, oil was clipped 7% this week, partly on concerns around China’s abrupt reopening. As this week’s Focus Feature explains, the reopening is a bit of a mixed blessing for commodity markets and the global economy. The sudden surge in China’s virus cases and the travel restrictions imposed by many countries may actually blunt growth initially, before giving way to firmer activity later this year.

Meantime, natural gas prices have also been cut down to size by extraordinarily mild winter weather in both Europe and North America, with U.S. prices plunging below $4 and down from a year ago. While highlighting the impact of climate change, the reality is that the freakishly warm weather and falling energy prices are a gift for Europe’s beleaguered 2023 economic outlook. An earlier easing in energy costs helped cut the Euro Area’s headline inflation rate to 9.2% in December, well below expectations and down from a peak of 10.6% in October.

Also supportive of the drop in yields were further indications that supply chain pressures are moving into the rearview mirror. The factory ISM reported the lowest level of supplier delivery delays last month in the past 30 years (aside from only March 2009). That’s an incredible about-face from 40-year highs in delays reached in 2021. The New York Fed’s measure of supply pressures also dipped last month, and is now a fraction of the record level hit at the end of 2021, even as China’s struggles have introduced new snarls. Part of the broader relief in supply pressure reflects a significant cooling in the demand for goods, with factory orders sagging 1.8% in November.

But we would pound home the message that inflation is no longer an issue for goods, but is now primarily a services story. To that point, note the extreme divergence between the ISM prices paid measures in manufacturing and services. The former saw prices paid careen lower to just 39.4—aside from the 2020 pandemic extremes, that’s the lowest since oil prices crashed in 2015. At the same time, services reported only a modest dip to 67.6. The gap between price measures last month is the largest in the 25 years of records. (Prior to the past year, there was no statistical difference between the two over time.)

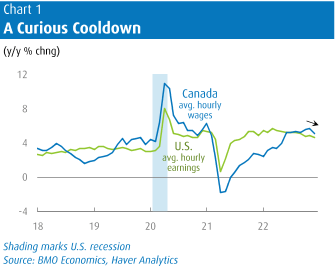

And, ultimately, services inflation is determined and potentially propelled by wage costs. That helps explain why the Treasury market was so encouraged by the latest jobs data, as average hourly earnings rose a moderate 0.3% m/m in December, clipping the annual rate to 4.6%. The prior month was revised lower by three ticks to 4.8%, and the latest result is a full point below the peak hit last March and is the mildest since the summer of 2021 (Chart 1). From the Fed’s point of view, that’s a clear step in the right direction. But before assuming that the battle is over, a few points to consider:

- Wages will eventually need to cool even further to be consistent with underlying inflation moving closer to the Fed’s 2% goal. Even accounting for some productivity gains, and a wee bit of catch-up for inflation sins of the past, earnings growth will need to cool to below 4%.

- The tightness in the job market is simply not consistent with a further chill in wage increases—quite the opposite judging from vacancies and the still-low unemployment rate. And, keep in mind that the monthly earnings figures are highly susceptible to large revisions.

- Almost all other measures of wages are running hotter than average hourly earnings. While a bit more dated, wages in the employment cost index were up 5.1% y/y in Q3, while the Atlanta Fed’s wage tracker is running above 6%.

The bond rally was so pervasive that even Canadian yields fell to end the week, despite another blow-out domestic jobs report. Mocking expectations of a slowdown, employment surged 104,000 in December, helping trim the jobless rate to 5.0%. The gains were broad-based by both sector and region, although the result was likely flattered by the mild weather (construction was up 35,000). As well, a high level of absent workers due to illness (8.1% of workers versus a more normal December level of 6.9%) may be driving a bit more hiring than normal. Consistent with that point is that total hours worked only nudged up 0.1% in the month. And, similar to the U.S. results, the main wage measure backed off to 5.1% y/y from 5.6% the prior month.

Even as the Canadian job figures were no doubt astonishingly sturdy, they found little or no echo in other economic indicators. To wit, home sales remain frosted over, with early results from the large cities pointing to a 40% drop from year-ago levels and a further sag in prices. Auto sales capped off a soggy 2022 with a so-so December, but still fell 9% for the full year. Merchandise trade is back in the red as energy sales have been chopped by lower prices, while overall export volumes are flat versus a year ago. And, similar to almost every other major economy, the PMI for manufacturing sagged further below the key 50 line last month. The only way this squares with massive job gains is to again highlight the much less impressive rise in hours worked, and to note that employment is often the last shoe to drop when conditions change.

While job markets remain very tight in both economies, there is little doubt that broader inflation pressures are relenting, and the debate is now more one of degree and not direction. We continue to believe that underlying inflation will remain stickier than expected, even with this week’s admittedly encouraging developments on a number of fronts. And we suspect that the central banks will see it that way as well. Accordingly, look for further rate increases at upcoming meetings by both the Bank of Canada and the Fed, with the debate on 25 or 50 bps likely to be decided by the next CPI reports (Jan 12 stateside and Jan 17 in Canada). Mark your brand new calendars.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.