What Do You Get When You Go on Pause?

Douglas Porter

February 10, 2023

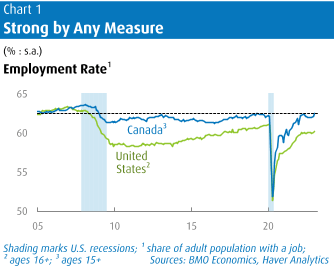

In a relatively quiet week for economic data, the Canadian jobs report landed with a resounding bang to end proceedings. Even out-doing its rollicking U.S. counterpart, employment zoomed 150,000 in January, which was a larger gain than anything seen in the pre-pandemic years. In percentage terms, the 0.75% surge blasted past those powerhouse gains of 0.33% in U.S. payrolls last month and 0.56% in the U.S. household survey. One way to capture the health of the jobs picture is the employment-to-population ratio (Chart 1). In a word, or ten, Canada’s employment rate of 62.5% matches the strongest reading since the days before the Global Financial Crisis.

Of course, any Canadian jobs report always comes with a sea of caveats, and analysts are well aware of the inherent volatility in the employment series. Plus, the reality is that the economy actually shed 125,000 positions last month in unadjusted terms—but that happens to be the smallest “raw” drop in January jobs on record. Last month didn’t so much see a hiring boom as firms holding on tightly to the workers that they already have on payroll.

Regardless of the precise explanation behind the relentless strength in the jobs market, a key takeaway is that the economy is a long way from recession at the moment. Accordingly, we are adjusting our economic forecast to reflect that rather loud reality, by pushing out the expected mild contraction by a quarter. We now look for GDP to post moderate growth in Q1, and then slip into slight declines in the next two quarters, before growth resumes in Q4. It’s a similar story for the U.S. economy, in light of a decent start to the year for most indicators. The effect of the firmer start to 2023 means that full-year GDP growth is now pegged at 0.7% in both countries (up from 0.5%). Full disclosure: that is exactly in line with the latest Blue Chip Consensus estimate for the U.S., while the Canadian call is a touch below the Bank of Canada’s recent estimate of 1.0%.

The robust result on Canada’s labour market lands just days after the Bank of Canada reinforced its “now on hold” message. In a speech in Quebec City on Tuesday, the Governor was extraordinarily clear that the bar is now very high for any further rate changes in the months ahead. While the rate pause is heavily billed as “conditional”, just by saying the word “pause” makes the bar for any additional move very high. Adding to the dovish tone, the inaugural Summary of Deliberations from the January meeting revealed that the Bank actively considered a hold at that time (versus the actual 25 bp hike). But while a rate hike at the coming meeting in March is highly unlikely, markets have been busily pricing in significant odds of one more increase later this year. Canadian two-year bond yields reclaimed the 4% mark this week, shooting 25 bps higher.

The sharp back-up in yields was partly an echo of the U.S. move, as 2-year Treasuries rose 20 bps to 4.5%, while 10s climbed almost as much to just above 3.7%. The headline event on the U.S. economic calendar this week was Fed Chair Powell’s remarks to the Economic Club in Washington. While markets initially seized on his reaffirmation that the disinflation process had begun, and a lack of pushback to easing financial conditions, the weight of his full remarks eventually won the day. As much as investors seem to want to listen only to dovish leans from the Fed, Powell & Co. have been quite consistent in saying that this is going to be a long battle. Stern messages from other speakers later in the week—notably from Williams and Waller—pounded home the point that the Fed is not for turning anytime soon.

We have long asserted that rate cuts are unlikely this year, and that they are most likely a 2024 story (a theme the Fed is completely on board with). And, the supersized job gains on both sides of the border in January simply solidify that view. Yet, ultimately, inflation will determine the path of rates in the year ahead. The one silver lining—from a central bank inflation perspective—in both the U.S. and Canadian jobs reports was that the wage measures eased. Again, aping the U.S. result, Canada’s average hourly wages surprisingly slipped to 4.5% y/y (from 4.8%). Some of the dip reflected a change in the composition of jobs—gains in lower wage sectors—but even adjusted for such shifts, wages cooled slightly. It remains to be seen if wages will stay so tame amid the incredibly taught job market, and with the federal public sector union looking for a double-digit increase in current negotiations.

After a relative U.S. data void, the big gun of CPI arrives on Valentine’s Day (Tuesday). While always a potential major market mover, this month’s effort may make fewer waves than normal. That’s because the disinflation story may take a bit of a pause of its own, as gasoline and used vehicle prices moved back up last month, potentially lifting prices 0.5% m/m. That would be enough to just trim the annual rate by a tenth or two, but it’s still likely to be north of 6%. It’s a broadly similar picture for core, where underlying prices are expected to rise about 0.4%, just enough to trim the annual rate a few tenths, but to a still-strong 5.5%. We look for a rough repeat in the Canadian data in the following week (Feb. 21).

Beyond that temporary lull in the disinflation story, headline inflation is expected to melt quickly in the ensuing months. Calmer energy prices, a more normal supply chain, and very easy comparisons with the huge gains a year ago are expected to drive inflation lower with purpose. But if inflation delivers even a fraction of the high-side surprise that employment has posted, the market won’t be talking about rate cuts in the second half of this year—it will be dealing with the possibility of yet further hikes.

Probably anyone who took piano lessons as a child is well acquainted with the Burt Bacharach canon, to which this week’s title is a painfully obvious nod. He and Dionne Warwick (the Rihanna of 50 years ago) teamed up with a string of instantly recognizable hits. Of course, his lasting appeal even won him cameos in two of the Austin Powers flicks. Now, the question is whether the Super Bowl’s half-time show will make a brief homage, en route to an inevitable Eagles victory?

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.