Whither the Economy Now?

November 18, 2022

Douglas Porter

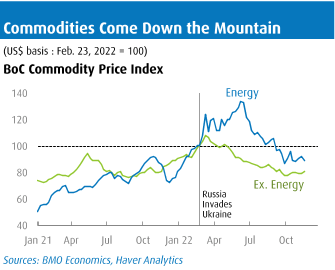

A steady stream of Fed speakers rained on the market parade this week, drumming home the message that policy will need to tighten further and remain there for longer. The head rainmaker was St. Louis Fed President Bullard, who sealed his reputation as lead hawk by warning that the appropriate terminal funds rate should be above 5%, at a minimum. The hawk talk landed just as oil prices spent the week careening lower to under $80, taking the commodity complex further below its pre-Ukraine invasion levels (see chart). In a week that saw most major markets largely moving sideways, this combination of tough Fedspeak and sagging oil prices inverted the Treasury yield curve even more deeply. Ten-year yields dipped below the mid-point of the Fed’s target range (3.875%), and the 2s10s spread was at -70 bps by Friday morning, the deepest inversion in 40 years.

While various points on the Treasury curve have been inverted for months, the fact that long-term yields have fallen even below the overnight rate is a much more important marker and signals pronounced economic weakness ahead. Meantime, Canadian 10-year yields also dipped this week, and are nearly 70 bps south of like-dated U.S. yields, taking Canada-US spreads close to all-time wide differentials. (The record negative spread of -92 bps was hit in late 2015 when oil prices had been crushed.) And Canada’s overnight rate of 3.75% is far above the 10-year yield of barely 3.1%, with the inversion first arriving in early September. If anything, this paints an even more challenging picture for Canada’s 2023 growth outlook. And, like the U.S., we are expecting zero GDP growth next year.

Yet, despite the dour outlook for 2023, it now looks like Canadian GDP advanced by a solid 3.3% this year. That is well above the nation’s 20-year trend of 1.8% average growth, and would rank it in the upper half of the G7. (Strangely, the U.K. will lead the pack with 4.2% growth, as the early-year reopening outweighed the recent tumult.) Canada’s gain will also clock in well above the expected U.S. outcome of just under 2%. In retrospect, Canada had two big relative advantages this year in the growth sweepstakes:

The reopening bounce. Having been locked down much more deeply and longer than the U.S., there was simply more room to rebound this year. Some of the outperformance in 2022 was simply a catch-up for a major underperformance in 2020/21. (Aside: At the start of last year, we were aggressively looking for a 6% snapback in both the U.S. and Canada. Initially, the growth rates were instead reported at 5.7% and 4.5% respectively. Well, presto, now the statistical wizards tell us that the U.S. economy did indeed grow nearly 6% last year, while early indications from the provincial data suggest Canada was north of 5%. Combined, North America grew 5.9% last year. Consider this a small victory lap of vindication.)

The commodity boost. The early-year run-up in commodity prices gave Canada a big lift in its terms of trade, raising nominal incomes and swelling government revenues. As well, in contrast to much of the rest of the world, the Prairies had a solid grain crop this year, reversing the terrible drought of 2021, which alone cut overall GDP by roughly half a point last year.

Unfortunately, both of these relative advantages are now fading. Either they are a spent force (reopening), or are now actually going into reverse (commodity prices). Meanwhile, there is also one significant relative disadvantage for Canada’s economy, which is moving to the forefront—the outsized share of the housing sector. The combination of new home building, renovation activity, and real estate agent commissions—i.e., the components of residential investment—now totals 7.1% of real GDP in Canada. While that’s well down from the record high of 8.6% in early 2021, it’s more than double the current 3.1% share in the U.S. economy (which itself is down from last year’s nearby high of 3.8%).

Thus, when housing is going into reverse, as it now most clearly is, that’s a much bigger drag on Canada’s economy than the U.S. and most other major economies. (Even Australia at around 5% of GDP and New Zealand at about 6% aren’t up there with the heft of Canada’s housing sector.) This week brought fresh evidence that housing is retreating fast from the wildness of the past two years, with existing home sales falling 36% y/y, and national prices now down by a precise 10% from their February peak.

Home building typically is the last shoe to drop when activity stalls and starts remained sturdy last month at 267,000 units. That’s right in line with the solid average of the past year, which remains 40% above the 30-year trend of closer to 190,000 units. Note also that there are now 328,000 units under construction, easily an all-time record, and suggesting that activity will remain at a high level for some time yet. We would also note that the economy was able to expand almost 5% in the past year even as real residential construction as a whole fell almost 12%.

Bottom Line: A housing retreat will cut Canada’s relative growth advantage. Even so, this is likely to just bring Canada closer in line with the U.S growth trend over the next year. Both are still expected to face a shallow downturn, before stabilizing late in the year. We are officially looking for a moderate drop in GDP in the first half of 2023, but would allow that the resiliency in consumer spending and the relief from lower oil prices may nudge the start date of that downturn a bit later in the year. But we have learned to heed the message of the yield curve, and that message is crystal clear.

Trivia quiz: In the 40 years since we last experienced real inflation, which North American pro sports team has won the most championships? Okay, if you guessed the LA Lakers (9 victories), you win a free trial subscription to Focus. But here comes the hard one, and this is for a one-year subscription—which team has won the second most? (Cue the Jeopardy! theme tune, as the wheels turn.) The answer is the Toronto Argonauts with 7. With much of the world focused on the start of the World Cup this weekend, spare a moment for the 109th Grey Cup on Sunday, when the Argos will be going for number 8 since 1982. True, they will have to overcome the prohibitive favourites in the Winnipeg Blue Bombers, but the Argos seem to have more than their share of luck despite a reputation akin to a certain other sports franchise in the city.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.