Who Wants to be a Central Banker?

Douglas Porter

July 8, 2022

Suffice it to say that it’s a confusing time for economy-watchers. On the one side, there is mounting chatter around the possibility of a recession, perhaps next year, perhaps in the second half, or perhaps right now, depending on your source. But at the same time, we have a four-alarm fire raging on the inflation front, with next week’s showpiece U.S. June CPI report likely flagging a headline print of close to 9%. While there are some signs that inflation may (finally) be close to peaking—we dig into that very debate in this week’s Focus Feature—that level of scorching hot inflation leaves central banks no option but to keep the firehose pumping. To recycle an old quote by former BoC Governor Poloz when central banks were slashing rates: “A firefighter has never been criticized for using too much water.” (Unless of course it’s an electrical fire, but that’s another story.) Curiously, many now are in fact pouring on the criticism—both from those blaming overly loose policies for today’s inflation, and from those already scolding that tightening policies risk recession.

The June jobs data for North America simply complicated the task at hand. For the Fed, the message was relatively straightforward at least, with payrolls cruising well above expectations at +372,000, the jobless rate holding fast at a tight 3.6%, and earnings strong but stable at 5.1% y/y. Even as some bears are gleefully pointing to the very real potential for a second consecutive decline in reported GDP in Q2, total hours worked rose at a solid 2.7% annual rate in Q2 (after a 3.5% rise in Q1), or approximately 100 miles away from recession territory. There is little doubt that U.S. growth is losing steam, especially after last year’s blast-off, but it’s not clear if the rocket is levelling off after dropping the boosters, or about to fall back to earth. The steady payroll gains, as well as the firm but fading ISMs (of 53.0 for manufacturing, 55.3 for services) suggest the former. Accordingly, we continue to expect a follow-up 75 bp rate hike late this month, with Fed speakers mostly guiding in that direction as well.

Canada’s jobs figures were much messier, but arguably delivered an even clearer message. Yes, headline employment fell 43,200, the first drop since the Omicron shutdowns in January. But note that the U.S. household survey, which is what Canada’s LFS most closely resembles, also reported a loss in June (of 315,000), and precisely no one of sound judgement would deem the U.S. jobs report weak. The entire jobs drop was in the self-employed category, almost all of which were part-time positions. Aside from that, the report all but screamed “we are at maximum employment!”. At just 4.9%, the unemployment rate gripped the 4-handle for the first time since February 1970. (Not sure what this means, but top songs from that month included “Bridge Over Troubled Water”, “Raindrops Keep Fallin’ on My Head” and “Who’ll Stop the Rain”, with the water theme staying strong.) To cite but one example of how the world has changed, the province of Newfoundland and Labrador reported a single-digit jobless rate for the first time on record in June (okay, it was 9.9%).

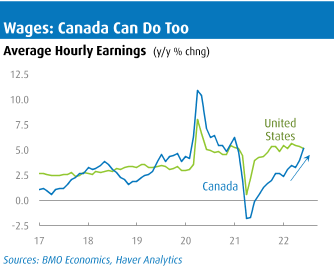

In turn, that tightening of the job market has begun to push up wages in earnest. After a year of remarkable calm, pay increases are now rising quickly amid a drum-tight market and strong headline inflation. Average hourly wages jumped 5.2% from year-ago levels last month, a big step-up from the 3.2% average pace in the first five months of the year. And while this series can be quirky, note that the competing payroll survey also posted a sudden upswing in the fixed-weight wage measure in the latest month to 6.2% y/y (versus a prior trend of below 3%). On both metrics, Canadian trends have suddenly caught up with the U.S. (see Chart), albeit the series don’t match precisely.

With the economy essentially at full employment, wages starting to stir meaningfully, and headline inflation poised to test 8% in this month’s CPI report, the Bank of Canada’s task is clear at next week’s decision. We fully expect a 75 bp rate hike, with the Fed’s like-sized move last month paving the way for others to become more aggressive. In fact, there is a reasonable case to be made for a 100 bp step—such a hike would take the overnight rate to 2.50%, immediately moving to the middle of the Bank’s range for neutral rates. It could also be justified by the wild inflation overshoot. However, we still lean 75 bps, as Bank officials have clearly stated that they want to be a source of stability and predictability, and the market is nearly 100% priced for a 2.25% rate by next week.

Yet, even this step looks like it will be too much for some. The housing market is flashing deeper signs of strain, with sales falling fast, and prices poised to follow in many regions. And, recession calls have become mainstream for the broader economy—albeit the most high-profile example from this week didn’t see the downturn beginning until mid-2023. But those rising risks simply can not and will not sway the Bank from soldiering on; the risk of recession has to be a secondary consideration to the reality of red-hot inflation. Moreover, as one wise person noted, a 10% jobless rate negatively affects 10% of the population, while a 10% inflation rate negatively affects 100% of the population. Yes, it is extremely unfortunate that the inflation fight will come with some pain, but letting inflation continue to run amok now will only lead to even greater pain later on—arguably the biggest lesson to take away from the great inflation of the 1970s.

Even as recession concerns widened much more broadly, financial markets went off in their own direction this week. Following a deep slide in Treasury yields at the end of June, rates backed up markedly across the curve, with the solid payroll report piling on. The 2s10s curve inverted early and mostly stayed there as 2-year yields jumped 27 bps, while 10s were up a more pedestrian 21 bps but also pushed well back above 3%. Canada’s curve was a bit less dramatic, with a more moderate back-up, and 10s holding just a snick above 2s, both close to 3.3%. Stocks rebounded, led by the beaten-down tech sector, and even crypto seemingly found some stability. Tying some of these strings together was another weekly setback in oil prices to around $104, well below the $120 level of a month ago, with growth concerns weighing on the demand outlook. However, even there, the picture is complicated, as prices spent the second half of the week rebounding from a sharp slide to well below $100 earlier on. Apparently, all financial markets are also struggling mightily to find their bearings amid today’s extremely complex economic environment.

Douglas Porter is chief economist and managing director, BMO Financial Group. His weekly Talking Points memo is published by Policy Online with permission from BMO.